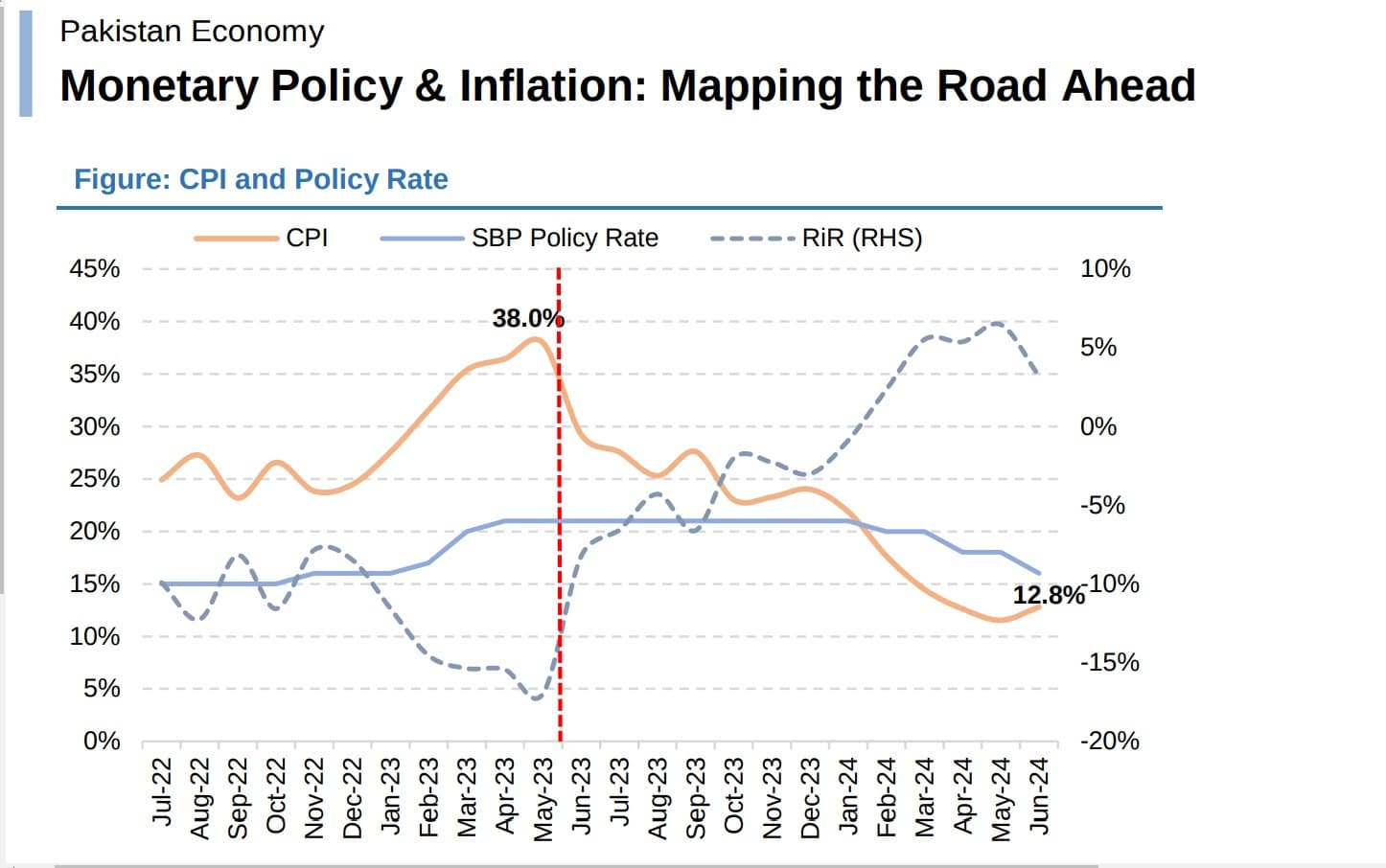

According to the latest report by Arif Habib Ltd (AHL), inflation is predicted to come down in upcoming months to 0.99 percent MoM average by December 2023 and float somewhere between 23-29 percent between June and December.

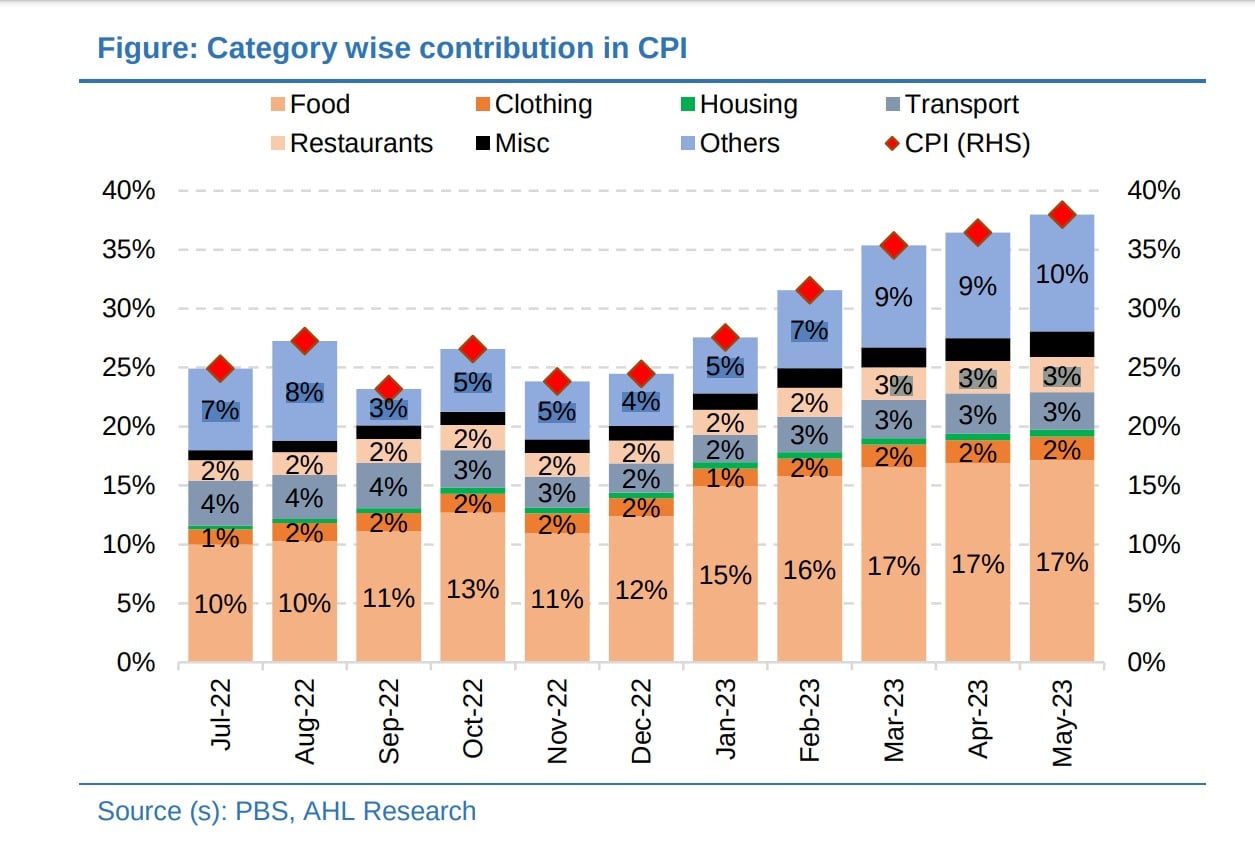

The retreat is likely to be due to high base effects with real interest rates expected to turn positive in the second half of the FY24 with a possible reduction of 400-500 basis points in the policy rate. Past year floods, higher taxes, removing subsidies, and exchange rate depreciation have brought headline inflation at 38%, but the report states that further increasing interest will not do any good and a holistic approach is needed to address the fundamentals.

Economic Outlook

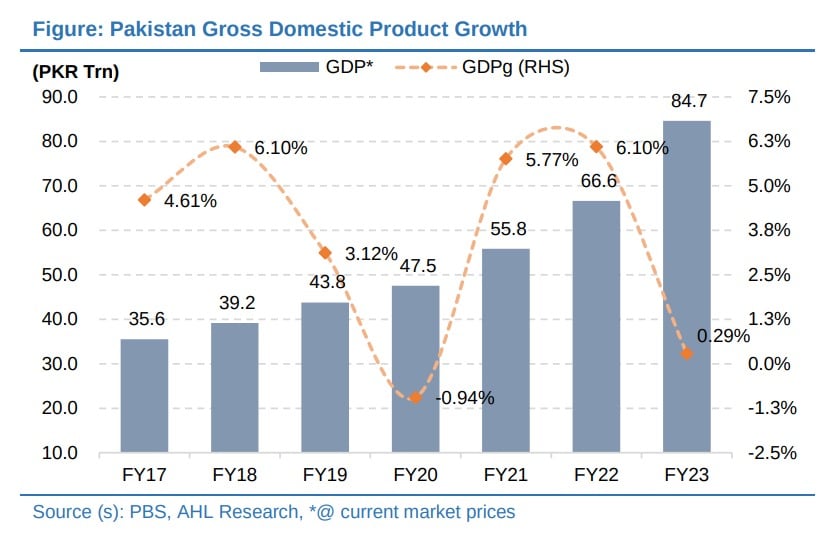

The Monetary Policy Committee (MPC) is expected to meet on 12th June to lay out the future economic direction of the country. The report recommends against a further increase in policy rates pointing out the harmful impact of a monetary squeeze with provisional GDP of 0.29 and industrial negative growth of 2.94 percent.

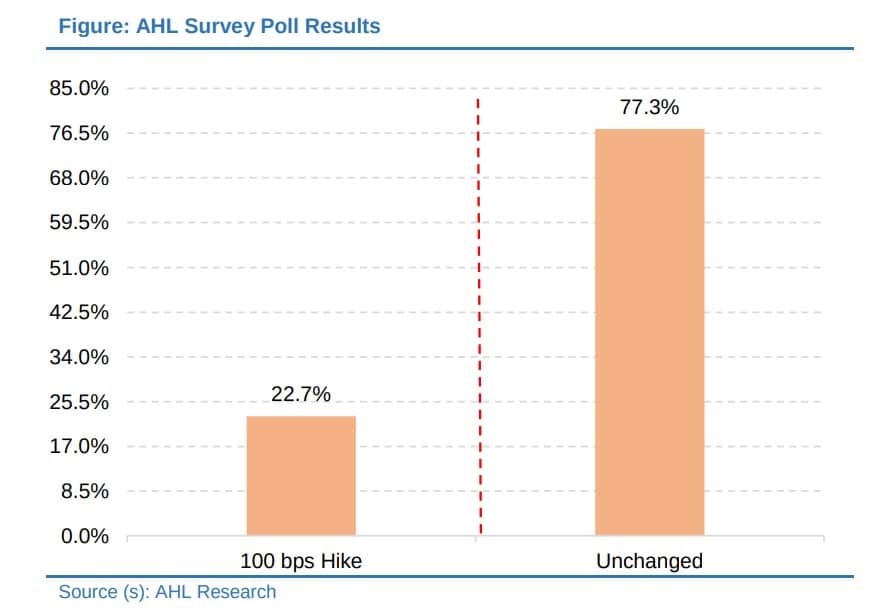

The report states that the economy has come to a near halt with the rising cost of business due to rising interest rates and any more monetary tightening will add to the existing economic woes of the country. AHL surveyed Banks, AMCs, Insurance, and DFIs, Non-Financial Services/Manufacturing: E&Ps, Cement, Fertilizers, Steel, Textiles, and Pharmaceuticals for feedback on the expected monetary decision next week.

According to results, 22.7% of the total respondents expect a 100 points increase in policy rate while 77.3% forecast that it will remain unchanged at 21.0%.

Markup on Domestic Debt to Cross Rs. 7.8 Trillion

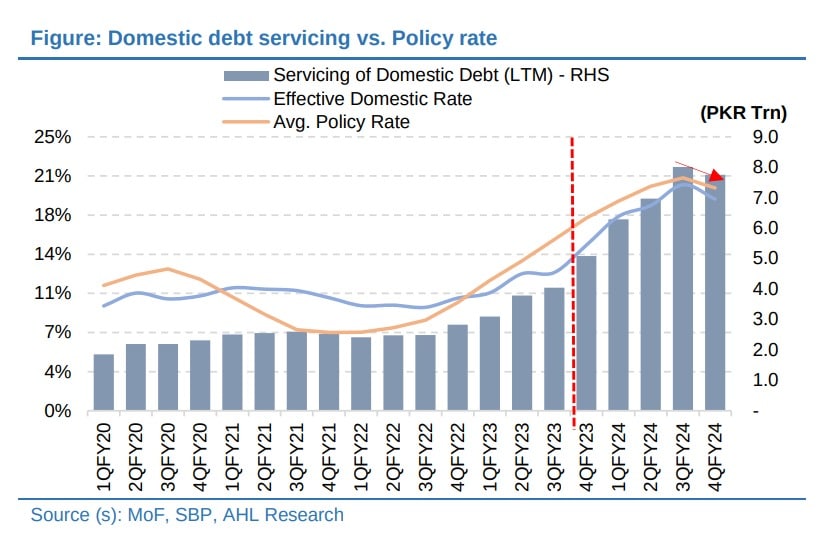

Analyzing the fiscal situation, the report states that nearly 84% of deposits in domestic banks have been extended to the government while the domestic debt servicing has increased by 69 percent till Mar ‘23 to 3.6 trillion primarily due to jacking up policy rate by 725 basis points to current 21 percent.

The cost of markup on domestic debt is expected to be over Rs. 7.8 trillion, estimated at 85 percent of the expected Rs. 9.2 trillion of FRB revenue in FY24. It also makes the case against a further hike in interest rates as it will only worsen the state of affairs, so reports ask the officials to tread carefully during these challenging times.

Investors in “Wait and See” Mode

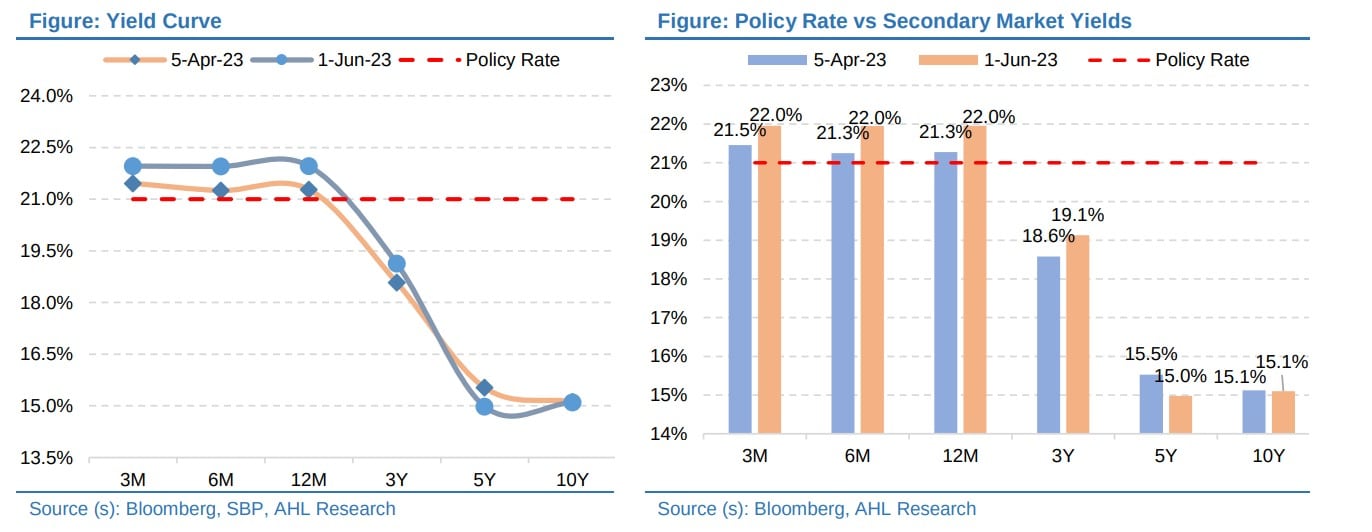

Reports state that the primary yield market has remained unchanged overall since the monetary policy of April ‘23 with cut-off yields of short-tenor instruments ranging from 21-22 percent and yields of all three tenor treasury bills are historically high. It also outlines a yield curve inversion in markets with yields on long-term bonds falling below those of shorter-term bonds.

Investors are waiting for the monetary policy landscape to unfold and are not making any significant changes in investment portfolios with yield curve inversion suggesting that stakeholders expect uncertain economic scenarios despite the expected policy rate cuts.

Only one reason election preparation

Agreed.

i think we can do it as a test call as well. However there is a demnd push inflation..but with such a high interest rates scenario and shortage of fccy has already killed the demand…ao lets halt the steep rise and see the impact