- Log into FBR IRIS

- Complete your Income Tax Return

- Revise your Income Tax Return

- Record keeping for Income Tax Return

- Determine whether you qualify for Income Tax Return

- Credits, rebates and exceptions

- Privacy upholding and personal information guarantee

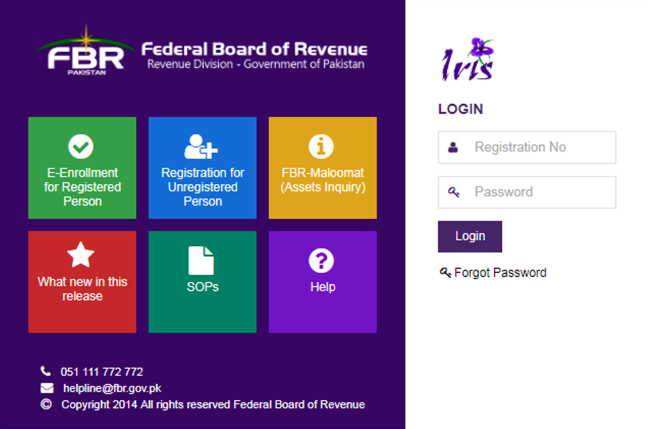

What Is FBR IRIS?

FBR Iris is an online portal specifically designed for filing income tax returns.

If it is your first time filing an income tax return, registration on the portal is compulsory. That being said, follow this link and register. After registration, log on and file your Income Tax Return. According to our country’s statute of limitations, those having obtained a National Tax Number (NTN) or Registration Number – but not the credentials to log into FBR IRIS – can get access by clicking on the top-left green square labelled E-enrolment for Registered Person.

E-enrolment with FBR provides you with an NTN or Registration Number, and a password. You can login to IRIS by entering your NTN – or Registration Number – and the new password.

Note: If you have forgotten your password, just tap ‘Forgot Password’ below the Login icon and follow instructions.

The next step is an important one. This is where you file your income tax return.

To complete this step, you have to fill the Return of Income and Wealth Statement forms. For your facilitation, the FBR IRIS portal provides step by step instructions and video-illustrative guides on completing the forms.

Important Point: Your submissions of Income Tax Return and Wealth Statement forms in IRIS are confirmed when both are moved from the Draft Folder to Completed Task.

Income Tax Return For Salaried Person – How To

If you’re a salary-man who qualifies for filing Income Tax, the FBR IRIS portal provides a Declaration Form labelled 114(I). You will be prompted to fill it before resuming with filing for income tax.

Revising Your Income Tax Return

An Income Tax Return can be revised within 5 years of being originally filed – this gives you an option to correct any omission or wrong statement discovered later on. However, you have to apply/file for revision on IRIS. After getting approval within the next 36 business hours, you can file a revised Income Tax Return.

Revising Your Wealth Statement

You can revise your Wealth Statement – which is a statement of assets and liabilities – on IRIS before receipt of the notice under sub-section (9) of section 122 of the Income Tax Ordinance 2001.

Simply put, you don’t need to file an application seeking approval for revision. If you’re not violating any law pertaining to tax evasion, revise your wealth statement without any delays.

Filing Income Tax Return After Federal Deadline

If you have missed the due date for standard online Income Tax Return, the procedure for filing outside given deadline is the same. Just follow instructions in IRIS and complete your application.

Record Keeping For Income Tax Return

If you have a taxable income, you are obligated to keep Income Tax Return records for at least 6 years. Check the Federal Board’s official website for further information.

Note (For Salaried Individuals): If you have an income threshold that complements FBR’s tax laws, you might be obligated to file Income Tax Return.

Credits | Rebates | Exemptions – For Income Tax Return

You can avail tax credits, rebates and exemptions only if you are an Active Taxpayer. Say, if your son/daughter studies at NUST, and the semester fee includes a refundable amount subject to initial payment, you may apply for a rebate. Before the turn of the next FY, you’ll be refunded with the amount you paid last year.

Privacy Of Personal Information

If you have a taxable income and, for some reason, you don’t file your Income Tax Return, you might be subject to legal proceedings under provisions of Income Tax Ordinance 2001. But you can rest assured that your personal information will not be disclosed to anyone except tax officials.

So, this is all there is to FBR IRIS and its feature-set. Go through it, and make sure whether you qualify for filing Income Tax Returns or not. For more queries, drop a comment. Now let’s discuss how our income tax returns look like.

Just joking! Take care and watch this space!