How To Get An HBL Credit Card:

- You are an HBL account holder

- The Account is well-versed and shows a good credit history

- You are in need of a Credit Card

- Call the HBL helpline 111-111-425

- Navigate through options and locate Credit Card Application

- The operator asks for your personal details and cross-checks credit history

- A bank-rep visits you at your designated address and continues with the procedure

- You may also apply through the HBL Banking Application on mobile phones – if you fulfil exclusive terms and conditions

- You receive your credit card within a month

HBL’s World Of Possibilities

When you’re applying for your first credit card, you’re essentially asking the bank to take a chance on you.

HBL Credit Card is here to make everything more rewarding and benefitting. Accepted by millions of accredited merchants worldwide, HBL Credit Card is packed with amazing benefits, exclusive offers and exciting rewards for everyone.

How To Apply For A HBL Credit Card

Option-1: Applicable to all

If you’re a regular HBL account holder with sufficient funds pertaining to your financial requirements, you may apply for a credit card by calling on HBL’s helpline: 111-111-425.

A select-representative of the bank branch nearest to your location will visit you at your designated place of rendezvous or – if you’re busy – call on you at your workplace. Upon meeting the guy, you’ll be asked a standard set of questions – just to maintain a certain level of transparency – and provided with a form to fill.

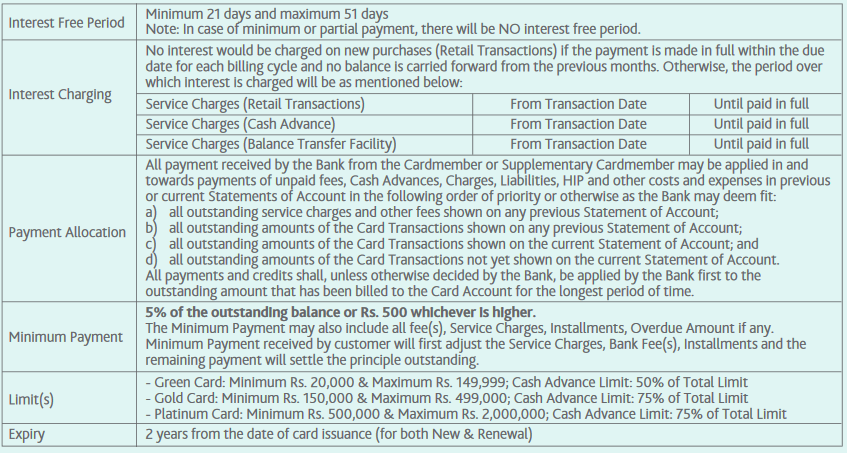

In addition to the account opening form – if you’re new – a ‘Basic Information and Charges Sheet’ is also presented. You have to fill it accordingly; the form clearly identifies the primary charges/fees applicable, and also explains essential terms of usage such as minimum payments, interest payment and payment allocation.

After this little meetup, you say goodbye and await further instructions. Over the course of the next few business days, HBL representatives – to confirm your details – officially call at your workplace to confirm your occupation. They may converse with your colleagues and ask simple questions to confirm your designation – and a few teensy details.

In the next couple of weeks, your application is processed, and you typically receive your credit card within a month.

Option-2: Exclusive HBL Customers Only

I’m excluding the typical storytelling schematic here. Just read the following, and if you think you qualify, go for it!

Easy to understand, right? Here’s a little tip for you: Honestly speaking, this offer is for people who have a ‘goldmine’ in their account. You might not be applicable for it, so instead go with option 1 and feel free to enquire further by calling on HBL’s helpline: 111-111-425.

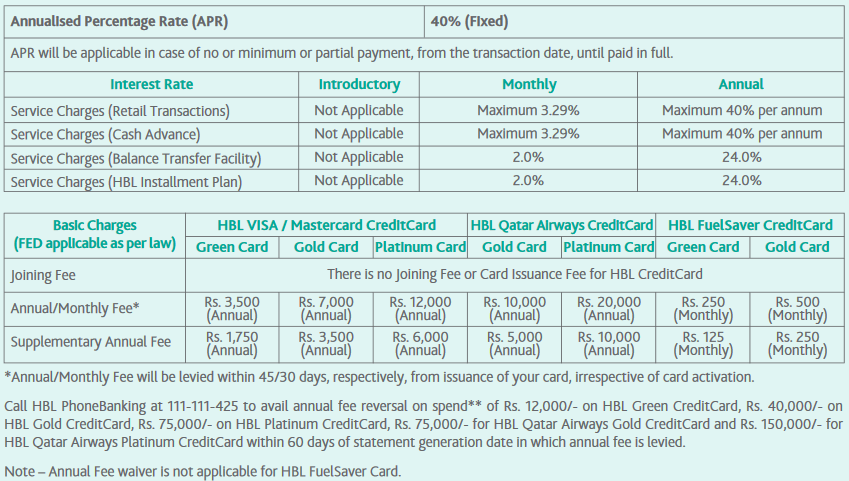

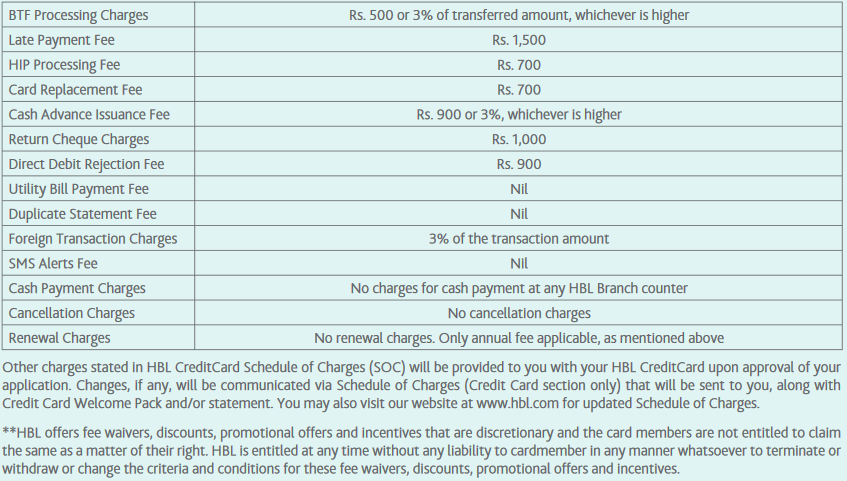

HBL Credit Card Charges & Relative Conditions For Payments

The following gives a brief – yet accurate – list of HBL credit cards and associated charges.

For existing HBL Customers, Direct Debit Instructions are mandatory to avail a spend-based annual fee waiver. For NTB – New To Bank – customers, this condition is invalid.

Other information pertaining to side-benefits:

Regarding Insurance, the following plans are offered through HBL Credit Cards.

The rest is pretty much standard; you know who to call, and what to expect. For future references, HBL has officially notified customers regarding information updates. For Credit Card hopefuls in particular, the information given in the credit card application forms may be subject to an update in the Banking records associated with respective HBL deposit account number – mentioned for Direct Debit Instructions.

For existing HBL Credit Card holders, HBL will update through bank records associated with existing HBL Credit Cards – after the credit card facilities get approved.

You may find the last part pretty boring and dull. You may choose to ignore it right now, but don’t forget to check back – after getting your credit card.

If you found this article useful, leave us a comment and tell us what you think!