Nearly a decade ago, people would physically gain access to financial services by visiting a bank. Transactions were a stark procedure, and long queues till the end of banking hours bothered everyone. Today however, the situation has shifted 180 degrees, and in a good way. Smartphones, banking apps, quick online access to financial instruments, and customer engagement platforms have changed the way we think money. What comes next? With technical changes running laps around a potential digital evolution, where do we stand in terms of digital security? Here’s how to protect your digital banking details.

Get Relief On Bank Loans From Pakistani Banks

Related: Protect Your JazzCash & Easypaisa Accounts

As we all know, online banking has many benefits. However, it is possible for threats to arise from hackers and fraudsters without you realizing it.

Hackers try to get cosy between parties that exchange information. When breached, they steal your info and abuse it in order to break into your account. This puts your money at high risk, and things could take a pretty hard left turn from here on out.

So, what are the best practices that help ensure the safety of your online banking experience?

The following info provides succinct steps to ensure a safe online presence in the banking sector. Get in!

Basic Foundation | How Strong Is Your Password?

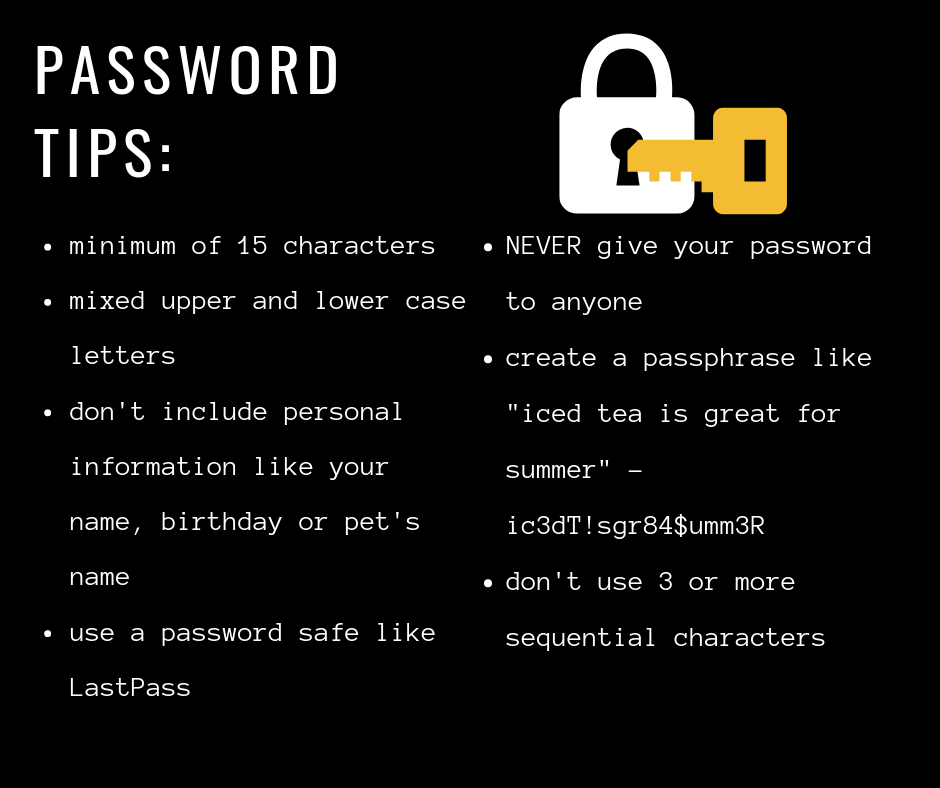

This one’s a little too obvious, we understand. Your choice of password can create an opening for hackers, even if you don’t realize it.

Some of the most common mistakes people make with online banking passwords include:

- Using personal information (name, address, date of birth)

- Choosing short passwords

- Relying on common words or weak number combinations

- Using the same password for multiple logins (something 83% of online banking customers do)

- Not updating passwords regularly

Following the aforementioned steps definitely makes remembering passwords easier, but the risk factor still remains. Here are a few tips for setting stronger passwords for banking applications:

- Choose longer passwords, such as a phrase rather than a single word

- Use a mix of upper and lowercase letters

- Include numbers and special characters

- Avoid common sequences, such as “1234”

- Avoid using personal information, such as your name, pets’ names, date of birth, etc.

- Don’t store your login details in your online banking or mobile app

Update your banking passwords regularly. It makes life more difficult for scam artists or hackers who want nothing more than making life difficult for you.

Two-Step Verification | How To Protect Your Digital Banking Details

Your security game is taken to a whole other level if your bank offers a multi-factor verification sequence.

A multi-layered authentication process allows you to add extra layers of security before safely logging into your account. For instance, when frequenting your preferred online banking platform, you initially enter a login name and password. Then, a second security test appears that helps verify if it’s really you trying to sign in.

For example, HBL Konnect offers customers the option to get a special code – or OTP – on their phones when logging in. This makes it harder for hackers or identity thieves to unlock your account!

Note: Banks in Pakistan offer two-step verification options if requested. Check with your account-holding bank for further information.

Check with your bank to see if multi-factor authentication is an option. If it is, you may just need to download a free authentication app to get your account set up. For confirmed info, please refer to our official page.

Say “NO” To Public WiFi

Public WiFi is convenient when you need to stay connected on the go, but you can’t rely on its security.

Regarding public WiFi, some of the biggest security risks include:

- Man-in-the-middle attacks, whereby the hackers are able to electronically “eavesdrop” on your banking and other online activity

- Data transmissions over unencrypted networks

- Malicious hotspots

- Malware and spyware

How to steer clear of such problems? | How To Protect Your Digital Banking Details

- Set up a virtual private network (VPN) for your phone. Best VPNs include Hotspot Shield, and Norton

- Do NOT log into your banking profile when connected to a public WiFi

- Disable public file sharing and stick to sites that are encrypted

The best way to check for encryption is to look for ‘https’ in the site URL. This triggers the lock icon on the left side of the URL bubble.

- Sign up for banking alerts

Banking alerts and notifications are one of the easiest ways to stay on top of your banking activity and to monitor security.

Depending on how your bank operates, you may be able to opt for email or text alerts to receive notifications.

Last Word | Control Your Financial Life

Online banking gives you control over your financial life at the touch of a button, but, as with anything else online, there are risks when it comes to security.

Keep up with basic security housekeeping duties for all your devices. Install firewall security if you haven’t done it yet!

For all devices, keep your operating systems updated. By being proactive with managing security risks, you can help decrease the odds of your online banking information ending up in the wrong hands.

Well, there you have it guys! This was all about how to protect your digital banking details. If you have any questions, feel free to leave a comment in the section provided below.

Good luck and stay safe!