Though the government announced the reduction in GST for various sectors from 22.5% and 19.5% GST to level sales tax at 16 percent, but telecom sector isn’t included in this relief.

Announcing the reduction in GST for various sector, finance bill 2012-13 said:

Removing aberrations in rates of sales tax @ 22% and 19.5% to standard rate of 16% through rescinding of SRO 644(I)/2007 dated 27-06-2007 vide SRO 594(I)/2012, dated 01.06.2012, effective from the 02.06.2012.

Since, the 19.5 percent tax that telecom customers pay is not GST (instead it is FED) along with the fact that telecom sector’s tax wasn’t increased with above mentioned SRO (i.e, SRO 644(I)/2007), hence order for leveling of GST at 16 percent will not apply for telecom sector.

For reference, you can download:

- Finance bill 2012-13 (PDF File – 397 KB)

- Sales Tax and Federal Excise Budgetary measures for 2012-13 (PDF File – 121 KB)

- SRO 644(I)/2007 (PDF File – 40KB)

The situation resulted into a misunderstanding in telecom sector (just like we had in 2010-11) as media, telecom officials and customers considered this leveling of general sales tax valid for telecom sector as well.

However, Federal Board of Revenue officials confirmed ProPakistani that telecom sector will keep paying 19.5 percent tax, which is termed as Federal Excise Duty.

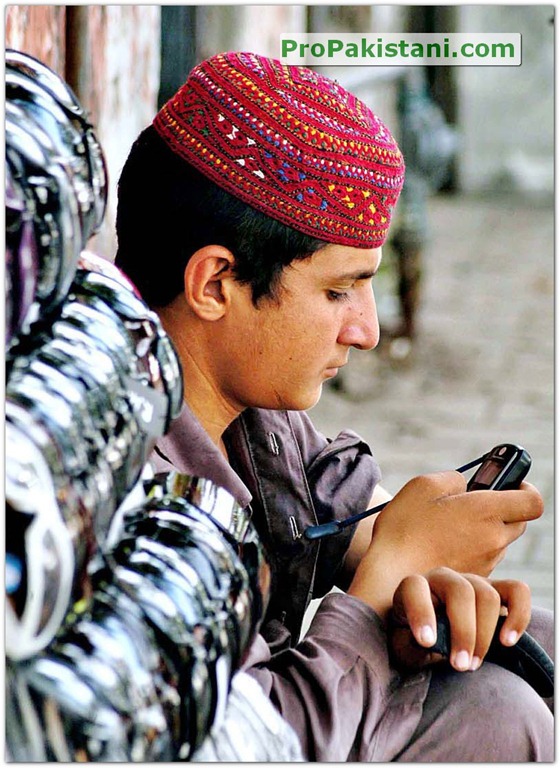

It maybe recalled that telecom sector has repeatedly urged the government to rationalize taxes on the sector, which is among the most competitive markets in the world with one of the lowest call charges in the world but still telecom sector remains highest taxed in the region and third in the world.

Cellular customers pay 19.5 percent FED, 10 percent advance withholding tax in addition to 7 percent service charges that is deducted by telecom operators.

Put in simpler words, a telecom subscriber has to pay Rs. 34.55 out of every Rs. 100 as taxes and service charges.

It maybe recalled that telecom sector recently become biggest utility services consumed by customers as they paid Rs 39.828 billion on the account of taxes on telephony services in the first half of financial year 2011-12.

telecom tax should be increased further to cope with budget deficit. In advanced countries, call rates are not decreased to such a level just like in Pakistan to be misused. They are not concerned with unnecessary call, sms or internet packages. We are not able to get energy resources, jobs n basic necessities of life and debate on 3G release. Be mature…

Pagal hai yeh banda.

Sahi keh raha hai yeh banda… tum muftay ho aur har waqt rotay rehtay ho

itnay CHAMCHAY hai telecom company kay yahan is forum par.

Yeh wahi log hai jin ka $ bahir raka hua hai aur har waqt taxes lagao taxes lagao aur $ ka account full hota chala jae ga.

Jab tim aie ga tu foran Pakistan say lungi uta kar BAG jaen gay.

Pathar Shb: itnay taxes laga kar koe quality main improve aie NAHI na phr taxes kis chez kay.

1000% agree with you Saeed bhai.

Agreed…

I dont agree with Imran. and i can defend well but i am not in a mod of doing that but just very briefly:

yeh kom pehly hi bari taqleefoun main hay… ager call rates low hain to achi baat hay.. shuker hay kaheen to is kon ko relief mila hua hay.. tax barhanay say kia faida ho ga.. zardari aur gillani ki jaib main aur paisay aa jay ga.. F**K that!

200% Agreed!

@Imran: Come on Man, the amount of taxes we are paying is well enough, we are paying tax on each and every thing but the facilities against these taxes are Zero.

+1

zardari sahab se apeal hai k please budget main se 1000 arab 4G service kelye alag karden hame pakistan k kone kone main suprem quality 4G service chaye jis ka setup japanese company lagay.

O Bhai uth ja, Lahore aa gaya hai.

Na pani ha na bijli ha na gas kahan se karen aesh.. Mulk ko kuton ne loot liya ha.. Jo haal is mulk ka ho chuka ha aur agay bhi hone wala ha wo kitabon me likha jaega… Zardari koi kanjar aur uske sathi kanjar ki aulad hn bare…

On every easy load or on a card recharge we pay a lot. Taking example on every Rs.100 recharge card we pay more 16Rs as tax. Now suppose if 50,000 people daily recharges a 100Rs card they are paying 50,000×16=Rs.8 lac. So 8 lac tax. Atleast we deserve 3G for what we are paying. Our government isn’t serious on this issue. Our country is bankrupt but our politicians are traveling to abroads with 80 people and spending millions on shopping. But this all is our mistake. We choose people on linguistic basis. This is the time to choose people not for you but for your country.

Ye jitne bhi log taxes aur mufta khanay ki batain karte hain ye saray students hote hain. Jin k uper responsibilities nahi hote just enjoy karna chahtay hain. Jab ap logon k uper responsibilities ajayein gi phir aap log bhi kahain ge taxes zyada lagne chahye taake usage kam ho jaye aur aap k bache parhayi ki taraf dheean de. 3G/4G k uper debate na kare sirf kaam ki batain karein jin se puray pakistan ko faida ho.. Ye abhi bachay hain

Dear Imran!

the amount we are paying as a tax, it is going directly into the pockets of politicians.

when they are exempted from tax so why they are imposing taxes on us.Can u tell me any development project in pakistan on which they are spending this tax. We are not blind. One thing more, We are all Muslims , We all are Equal..

Firstly stand against ur corrupt Government ..stop them.. Then blame someone else.

Sales tax on telecom falls under provincial chapter after 18th constitution amendment (incorporating recommendation of 7th NFC award & within Sindh province levies @ 19.5% through 2nd Schedule of Sindh Sales Tax on Services Act 2011.

Federal Govt cannot change the sales tax rate on telecom services in federal budget but in the respective provincial budgets.