Guide said that authority has remained firm in directing telecom companies for providing accurate information to consumers regarding tariffs and to avoid misleading advertisements, however, in an effort acquire further customers telecom companies kept complicating the tariff plans.

PTA said that this awareness guide is aimed at providing retail customers, essential information for making well informed decision regarding choice of tariff package, informing them of their and the operator’s rights with regards to tariff packages, and conveying the ways of seeking remedy should they feel the operator has not fulfilled its responsibility.

PTA’s tariff guide clarifies that there will be no cut in GST rate for telecom sector, which many had believed would be the case following the FY13 federal budget announcement.

Selecting Your Package:

Do not make a hasty decision that you may regret later on. Seek all the information associated with the service you are interested in. Every consumer has different need and a

package available in the market may or may not suit your needs.

For example if you talk almost equally on all networks then opt for package with low call rate on all networks. If you peak very little outside your own network then you are better off with a package that offers cheaper on-net rates. Therefore, before making a decision on which tariff package to opt for, you should be very clear about your needs.

Ask yourself the following questions for each package under consideration. If you think you

have answers to all of these questions, only then consider these packages for comparison, otherwise seek further information.

-

What is the price of this package? (Pay attention to nuances such as Peak, Off Peak, Per Minute or Per Second call-charging features. Calculate the effective per minute

price for better comparison) -

What is the on-net and off-net call price?

-

Is this package a bundle offer that combines several services (e.g. voice, SMS, data)that cannot be separated?

-

Is there any recurring charge (daily/monthly deductions, line rent)?

-

Is there any security deposit? If yes, how much?

-

What are the terms of payment (in arrears or in advance)? Is there any late payment penalty or other payment aspects that you must know?

-

What are applicable other terms and conditions? (validity, downgrade charge package conversion charge, usage detail charges, balance inquiry fee. Such details are often written in fine print, so pay close attention to details)

-

Does the package/promotion talk about “free minutes” or “free balance”? Bear in mind that “free minutes” are not the same as “free balance”. Free balance can be used on services other than voice calls as well.

-

Does the package include an “unlimited” service? The word “unlimited” generally does not mean literally unlimited. “Unlimited” plans/offers tend to have a fair usage policy/non-abuse limit. Find out what it is.

-

Do you know the cost of ancillary services? (help line charges, credit recharge

charges, fee for usage detail etc.) -

Whether the prices quoted are exclusive or inclusive of taxes?

Cellular Tariff Plans:

-

Cellular Tariffs (Postpaid) – Excel File – 33 KB

-

Cellular Tariffs (Pre-paid) – Excel File – 30 KB

-

PTCL Tariffs – Basic Package – PDF File – 42 KB

Taxes on Telecom Services:

All telecom services (except internet) are subject to various Government taxes. These taxes are either charged upfront (for example Withholding Tax is deducted as soon as you recharge your pre-paid account) or are deducted on usage basis (for example Federal Excise Duty (FED) is charged on per call basis).

The current rates of Withholding Tax and FED on telecom services are 10% and 19.5% respectively. However, these rates keep changing and therefore you should find out the latest applicable tax rates.

Tariffs advertised by the operators normally tend to exclude tax rates. Therefore, any calculation of effective out of pocket expense to a consumer must also take into account all applicable taxes.

Calculating Taxes:

As mentioned above, WHT of 10 percent is deducted as soon as you will recharge your account. Hence, 10 percent of whatever amount you will recharge will be deducted.

Example: If you recharge Rs. 100 then Rs. 10 will be deducted as With Holding Tax. In case if you recharge Rs. 35 then Rs. 3.5 will be deducted as WHT in advance.

FED is charged on per call/SMS or any revenue generating transaction.

Example: If you make a call that is charged at Rs. 1 per minute and you make a three minutes call then taxes (FED at 19.5%) will be as following:

-

Airtime Charges: Rs. 1 x 3 (minutes) = Rs. 3

-

FED = 3 x 19.5/100 = 0.585

-

Total Charges: Airtime Charges + FED = Rs. 3 + Rs. 0.585 = Rs. 3.585

Service Charges on Scratch Cards and Easyloads:

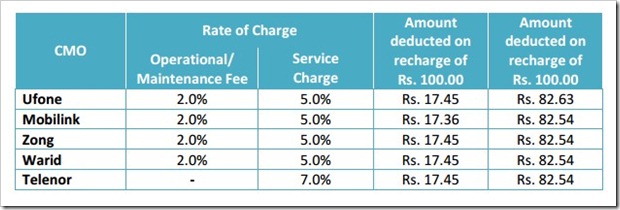

Mobile operators and several Fixed Wireless Local Loop operators levy additional service charges on reload of pre-paid accounts through scratch cards and easy-loads. The following charges are currently being charged mobile operators on pre-paid accounts:

All mobile operators except Telenor levy 5% service charges on the face value of all recharges (through top-up / Jazz load/ easy load/ money load and scratch cards). This charge is 7.0% in case of Telenor.

In addition to the above service charges, the following cellular mobile operators (CMOs) also deduct the following fees/charges on the face value of all recharges (through top-up / Jazz load/ easy load/ money load and scratch cards).

-

Ufone Account Maintenance Charge: 2.0%

-

Mobilink Operational Fee: 2.0%

-

Zong Operational Charge: 2.0%

-

Warid Maintenance Charge: 2.0%

In simpler words, all operators charge 7 percent of your scratch card or easyload as service/maintenance/operational charges.

Check below table to know better about your balance after loading Rs. 100 card:

Help Line Charges:

Following are the help line/directory assistance charges of major operators (in Pak Rupees excluding taxes). These charges apply when you connect to customer service representatives through helpline.

The charges may be lower if you only connect to the interactive voice response (IVR) and do not talk to the customer service representative. Furthermore, these charges are deducted on per call basis i.e. they are not dependent on call duration.

Registering Complaints:

In case of any complaints, the first point of contact should be the operator concerned. If the operator does not resolve the issue, or you remain unsatisfied with the operator’s response, you can lodge a complaint with PTA at its Headquarters in Islamabad or with any of its Zonal Offices.

The contact details for lodging complaints through email, postal mail, telephone, email or online at PTA website are given below.

- Telephone Numbers:

- 0800-55055 (Toll Free Number)

- 051-9225325

- 051-9225329-30 (Ext-155) PTA Exchange

- FAX. 051-2878127

- E-Mail. [email protected]

- On-line. http://www.pta.gov.pk > Consumer Support > Complaints > Complain Form

- Postal Mail/ Consumer Protection Directorate, PTA Headquarters,

You can download complete tariff awareness guide by clicking this link (PDF File – 285KB)

you have not posted the file link for pre paid .

( it post paid in both instances )

Thanks, updated.

Prepaid tariff link is wrong, you have linked to postpaid tariff twice.

is main bht is mistake hain like GPRS Charges 18rs hain telenor kay not 15

telenor ney postpaid main help line charges lagai hoye hain jo kisi company ney nahi lagai.i hate telenor. lootarey hain.

Jab aik baar 100 k card pay tax deduct ho jata hai. To phr her call pay kuen tax lagta ha.

Jese ager aik Roti ka tax kaat liya jae to phr hr niwalay pay kuen tax thori na kaaty ga.

+1

Recharge pay jo tax deduct hota hai wo With-Holding tax hai. and agar ap Tax return submit krtay hain to us mein claim kr sktay hain wo. jab k call/sms pay jo deduct hota hai wo FED hai (like sale tax). this is not double taxation

“All telecom services (except internet) are subject to various Government taxes.” Does it mean that using GPRS is free of all taxes? If so, what if a person loads rs100 and uses all the available amount (after the deduction of service/mentenence fee) for internet usage? I think you would be charged WHT. If i remember correctly, when i was in Pakistan, Waridtell and Zong deducted both WHT and FED from my account on GPRS/internet usage.

Yes, they used to deduct taxes on internet services earlier, but now EDGE/GPRS is not taxed.

* Kindly UPDATE as per Following Link >>

https://propakistani.pk/2012/03/10/ufone-to-charge-additional-2-maintenance-fee-on-every-reload/

** As per the TiCKER on Ufone.Com **

*Attention Customers:

As notified through press advertisements printed on March 10th, 2012 in Daily Khabrain and Express nationwide,

Ufone is implementing revised maintenance charges.

Effective May 30th 2012, maintenance charge of 2% +tax will be applicable on all prepaid recharges.

This is to provide utmost quality of service to our customers.

*Dear Customer,

Ufone has always provided U with impeccable services and affordable rates.

UAdvance/ULoan amount has been revised to Rs.15 at a service charge of Rs. 1.5+tax w.e.f 1st June, 2012.

Is It ALL About U -OR- Us ??

Hey please update how tax is calculated on Postpaid connection?

They should deduct WHT and FED separately. For example, for activity of Rs. 2 you’ll be charged 2.63 (Rs.2+FED+WHT) instead of first calculating WHT of Rs. 2 and then calculating FED of Rs. 2 and then adding all these. They firstly add 2+Fed and then WHT on whole i.e. tax on tax on postpaid.

I had subscribed UFONE post-paid service. Ufone only charged when calls are made. But things have changed drastically. Whether you make a call or not, Ufone will charge you. It is as if all companies like Ufone have decided that post paid services are not profitable, now they are charging all the time and saying it does not matter if one is making calls or not, one still has pay line rent. Something is seriously wrong somewhere.

Company Bill Actual Bill

Total Bill Consumed Rs 300 Total Bill Consumed Rs 300

FED Sales Tax 19.5% Rs 58.50 (On 300) FED Sales Tax 19.5% Rs 58.50 (On 300)

Advance Tax 12.5 Rs 44.81 (On 300+58.5) Advance Tax 12.5 Rs 37.50 (On 300)

Total Bill Rs 403.31 Total Bill Rs 396

Pleas can you explain me this phenomena for tax calculation

Company Bill

Total Bill Consumed Rs 300

FED Sales Tax 19.5% Rs 58.50 (On 300)

Advance Tax 12.5 Rs 44.81 (On 300+58.5)

Total Bill Rs 403.31

Actual Bill

Total Bill Consumed Rs 300

FED Sales Tax 19.5% Rs 58.50 (On 300)

Advance Tax 12.5 Rs 37.50 (On 300)

Total Bill Rs 396