Sindh Revenue Board (SRB) has issued a notification through which it has removed general sales tax on internet services with following conditions:

- For usage under Rs. 1,500 for 2MB connections

- For usage under Rs. 2,500 for more than 2MB and less than 4MB connections

So anyone with below 1,500 usage (with 2MB broadband speeds) or usage below Rs. 2,500 (for any broadband connection above 2MB and below 4MB) will be exempted from GST on internet services.

Previously the tax on internet services in Sindh was charged at 19.5%.

It is still unclear how 3G and 4G services are going to be exempted from internet taxes or not.

Alongside, through the same notification, SRB also reduced the General Sales Tax (GST) on telecom services from 19.5 percent to 19 percent.

According to the notification issued by Sindh Revenue Board (SRB)

The concessionary rate of 19% on the telecommunication services is available subject to the condition that the “persons providing telecommunication service shall pass on the full benefit of the reduced rate of tax to the service recipient and shall neither invoice/bill nor collect any extra charge/amount or surcharge on the value of the services.”

Persons not complying with this condition shall charge, collect and pay tax at that statutory rate of 19.5%.

At least one operator, Telenor Pakistan has announced to pass on the impact of 0.5% reduction of GST to its customers.

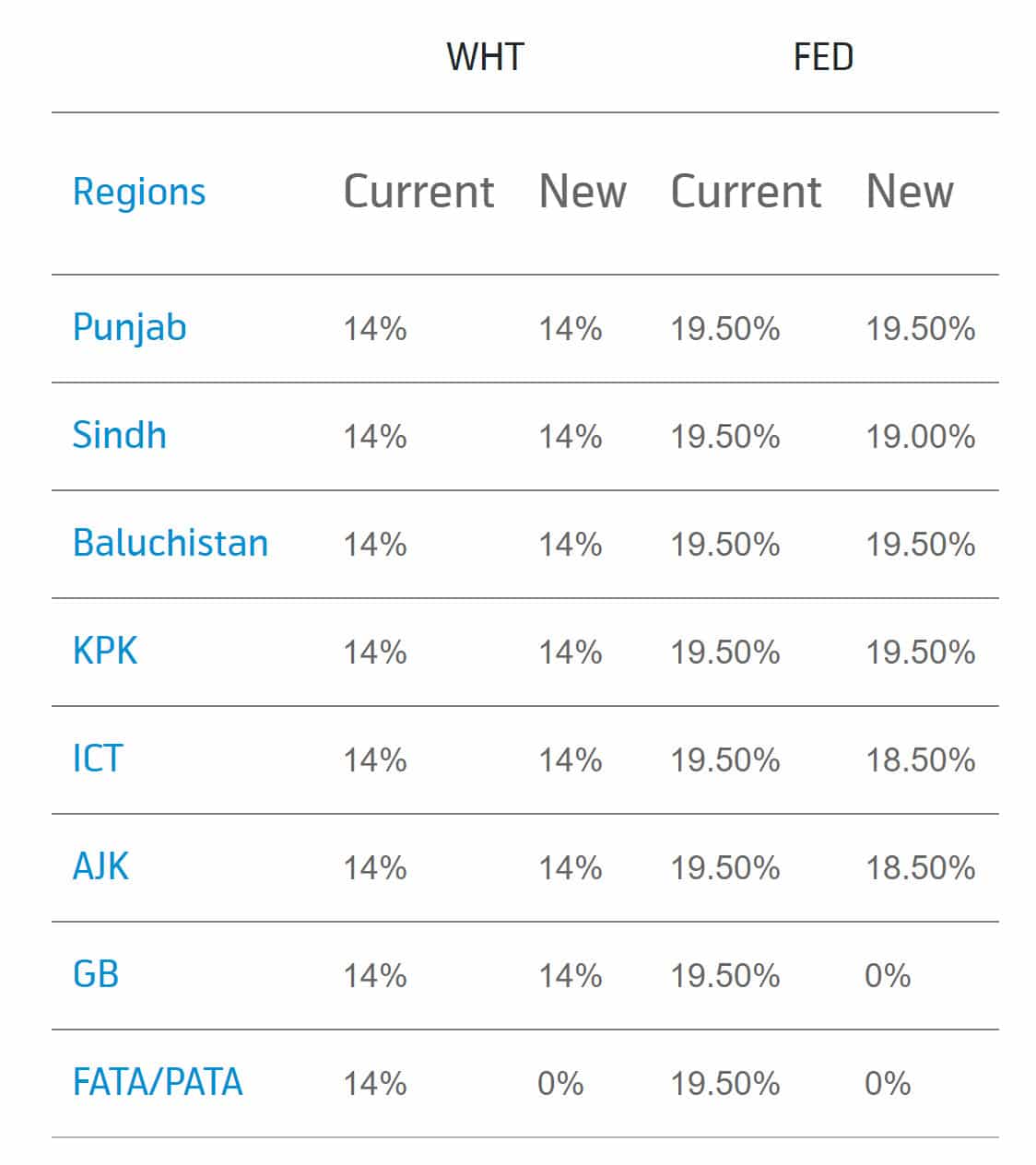

Telenor, unlike previously, will now charge different GST rates for its customers based on their location. Telenor’s GST on calls, SMS will be as following:

Other operators are likely to pass on the relief to their customers in Sindh as well. On the other hand, operators reluctant to pass on this benefit will continue to pay 19.5% GST to provincial revenue collection authority.

In the provincial budget of 2014-15, the Sindh Government had announced to reduce GST on telecom services from 19.5 percent to 18 percent but the decision was not approved by the provincial cabinet and continued to collect GST at the same rate (of 19.5%) from the telecom users residing in Sindh.

Exemption of Taxes on Internet Services

Sindh Revenue Board (SRB) announced to exempt taxes on internet broadband services on the monthly tariff of up to Rs. 1,500 for 2MB connections and up to Rs 2,500 for above 2MB and below 4MB speeds.

Billing beyond this limit will be charged with 19.5% GST.

SRB notification reads

“Internet services whether dial up or broadband, including email services and data communication network services of upto 2 mbps speed valued at not more than 1,500 rupees per month per service recipient and of more than 2 mbps speed but not more than 4 mbps speed valued at not more than 2,500 rupees per month per service recipient.”

Expemption of Taxes on International Leased Lines or Bandwidth Services

The revenue collection authority on the behalf of provincial government also waved off taxes on internet services used for commercial purposes.

But the tax exemption has been given to exporting IT companies only, according to the notification.

“Telecommunication Services involving charges payable on the international leased lines or bandwidth services used by software exporting firms registered with the Pakistan Software Exporting Board.”

Decision from Sindh government for removal of GST on internet services is now going to put pressure on KPK government, that has now become the only province that’s charges GST on internet services.

Not to mention, Balochistan and Punjab don’t charge any GST on internet services.

The decision to reduce and exempt taxes on telecom/internet lies in the hands of provincial lawmakers who can decide to give relief to the residents of their provinces.

Aj kal bohat c Good News a rahi hain! Nazar na lag jae Pakistan ko! :D

Election jo karib arahay hain. And this is not really something to be happy about. It’s reverse psychology. First raise taxes by a mile, then reduce it by a notch = happy simple minded citizens.

Oops! Didn’t think about that aspect of it! :P

What does this mean for PTCL 8MB connection?

yes, if monthly bill is below Rs. 2500

Aamir Bhai, yeh news main aur KMQ June main hi break kar chukay hain k budget main ailaan hua tha 4mb ya 2500 tak service tax exemption hai Sindh main. Hum ne cheekh cheekh kar kaha tha k yeh bohat bari news hai aap publish karien. Magar aapko September k aakhir main jakar khayal aya? Zabardast! Yeh June ki budget speech main hi announce hogaya tha. Aur July se implement ho chuka hai.

Read the comments above. It is not even a news. :)

No Aamir bhai. Please don’t mislead readers.

Taxes will NOT apply if

1. Bandwidth is <= 4mbps *and* 2. Price is = 2,500 (whichever comes first)

So in this case even if 8mbps connection is Rs 700 the tax will apply.

This is a misleading, poorly researched and outdated article in general.

This story is wrongly worded and completely

Misleading. Any bandwidth over 4mbps is not exempt even if below Rs 2500. This is a totally nonsensical by the SRB and Govt of Sindh because service providers will have no incentive to give more than 4mbps in less than Rs 2500

Compare point 1 to 2.

1. Sindh Revenue Board (SRB) has issued a notification through which it has removed general sales tax on internet services with following conditions:

For usage under Rs. 1,500 for 2MB connections

For usage under Rs. 2,500 for 4MB and above connections

2. SRB notification reads

“Internet services whether dial up or broadband, including email services and data communication network services of upto 2 mbps speed valued at not more than 1,500 rupees per month per service recipient and of more than 2 mbps speed but not more than 4 mbps speed valued at not more than 2,500 rupees per month per service recipient.”

Yes, you are right. There was problem in understanding. We have corrected that.

lol, now that i ditched them and opted for 4g in lower price, before was paying ,2500 for shiz 2mbps ptcl net

What if PTCL 4MB @ Rs. 1,750.

Still exempted from tax but the broadband should not extend from 4mb and not 2500.

Exempt. If you go for higher speed, or if your spending per month goes above 2,500 in this speed, then you are liable to pay Sindh sales tax @ 19%.

is me new kia hai

crap and outdated article. this exemption was provided in their finance act passed before June 30, 2016. Moreover, the tax rate has actually increased from 18% to 19%.

These are all dirty charges and denying the right to education and awareness despite the constitution of Pakistan approves these all facilities to the citizens.

THE HEADING IS NOT EVEN REMOTELY TRUE – TOTALLY MISLEADING:

The rate of Sindh sales tax (SST) on telecom services was 18%, which has been enhanced to 19% effective July 1, 2016. THE TAX RATE HAS NOT BEEN REDUCED.

Similarly, SINDH HAS NOT REMOVED TAX ON DATA. They have increased exemption threshold. Till June 30, internet with speed above 2 Mbps was fully taxable, with data speeds below that exempt till Rs. 1,500. Now, data speed above 4 Mbps are fully taxable, while two exemption threshold apply. So the current taxation rule is:

> If data speed is up to 2 Mbps, internet will be exempt up to Rs. 1,500 per month per user and fully taxable (including Rs. 1,500) after that.

> If data speed exceeds 2 Mbps, but stays up to 4 Mbps, internet services will be exempt up to Rs. 2,500 and fully taxable above it.

> For data speeds in excess of 4 Mbps, internet services are fully taxable with no exemption limit.

I highly recommend that articles on sensitive information like taxes should be based on authentic documents and not government press releases.

Is this megabits or megabytes ???!!!

Can someone cite the SRO or ORDER# or bill# where it’s passed ?