The number of Branchless Banking (BB) accounts has surged to 33 million by end of September 2017. The three month period from Jul to Sept, 2017 saw a record increase of 5.7 million accounts.

The rise in BB accounts is exhibiting a steeper trend since June 2016 due to the creation of an enabling environment by the central bank and vibrant role of BB players in facilitating account opening process through biometric devices at agent locations and remote account opening options.

Breakdown of BB Accounts

According to the State Bank of Pakistan (SBP), 25.6 million male and 7.3 million female accounts make up all the BB accounts.

Sindh represents the highest share of female BB accounts with 25%, followed by Punjab, Khyber Pakhtunkhwa and Gilgit Baltistan.

BB accounts witnessed a 29% increase in female accounts as compared to 19% increase in male accounts in the said quarter – a positive sign in gender inclusion. However, this phenomenon was mainly noticed in Punjab, whereas other provinces experienced higher growth in male accounts than female accounts.

ALSO READ

Ride Hailing Services Push Bank Car Financing to a Record Level

Cost Reduction

The cost reduction in customer verification from NADRA has also provided enough synergy to encourage banks to attract customers towards the branchless banking channels. However, only 47% of the total BB accounts are active.

The significant rise in BB accounts and limited share of active accounts exhibits the fact that the BB platform is attracting more people, however, it still needs to provide value-added services for generation of activity in the accounts.

It’s high time for the industry to offer innovative and tailor-made products for different segments of the society to generate activity in the accounts and to transform the existing cash-based payments streams to digital channel in order to pave a way for the establishment of a Cash-Lite society.

ALSO READ

House Financing is Improving in Pakistan but There’s Room for Improvement [Analysis]

Branchless Banking Agents Base

Amid rise in total agents, declining trend in active agents continues.

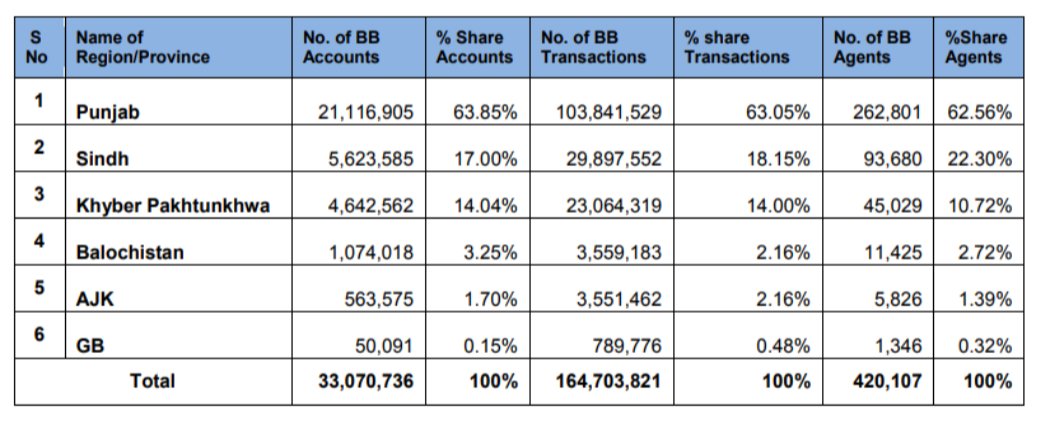

During the period of Jul to Sep, the agent network grew by 17,397, bringing the aggregate number of shared agents to 420,107. However, active agents declined by 3,920 in number, reaching 181,377 agents.

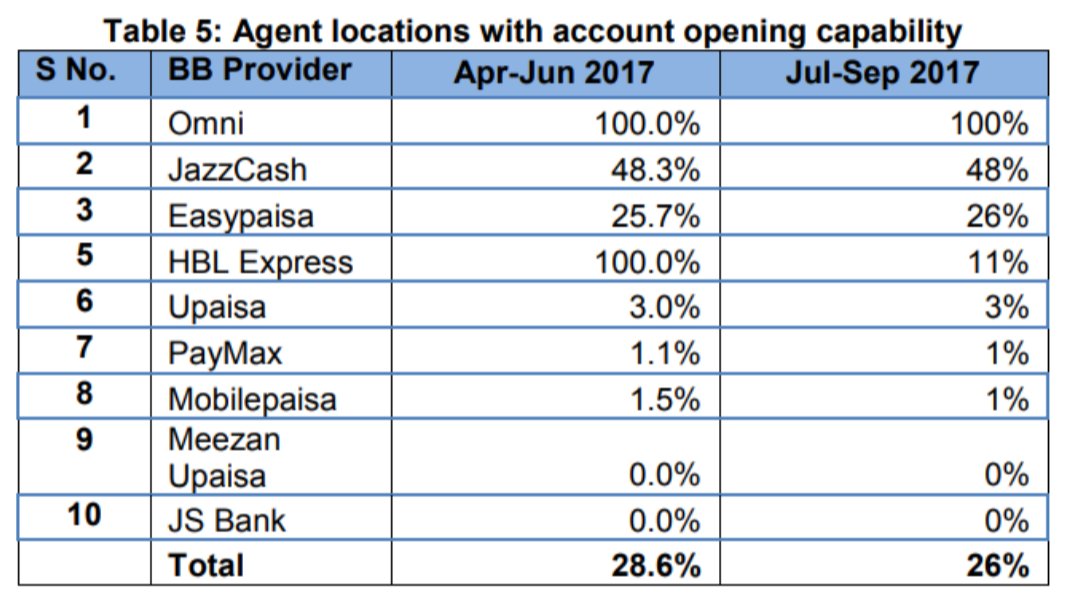

The account opening capability of the BB agents declined from 28.6% to 26%. On the other hand, the record growth in accounts supports the fact that the customers are more inclined towards self-assisted mode of opening accounts i.e. through the remote mode.

ALSO READ

Alert: Fake Currency Notes in Circulation Are Rising

Social Welfare Payments by BB

A total of Rs. 30.6 billion were disbursed through the branchless banking channels on account of social welfare payments. The social welfare payments were led by BISP (72%) with disbursements worth Rs. 22 billion, followed by EOBI pension and Pakistan Bait-ul-Maal payments worth Rs. 6 billion and 1.3 billion respectively.

The adjustment in social welfare payments also resulted in a decline in BB deposits, which decreased from Rs. 15.4 billion to Rs. 11.2 billion.

Total BB Transactions Decline

A total of 164.7 million transactions, worth Rs. 726.4 billion, were conducted during the Jul-Sep 2017 quarter.

The Customer Oriented transactions contributed 96.9% and 63.5% in volume and value of BB transactions respectively, whereas the remaining were agent transactions for liquidity purpose.

The customer oriented transactions are further divided into Over The counter-OTC and mobile-wallet transactions. The mobile-wallets transactions, in terms of volume and value, remained 104.8 million and Rs. 246.4 billion, contributing a share 65.7% and 55.4% respectively.

It may be noted that the BB transactions declined by 1.47% and 2.69% in number and value respectively from the previous quarter, due to decline in OTC transactions. SBP made it mandatory for the banks to conduct Person-to-Person transactions (also called CNIC to CNIC) through the Biometric Verification System (BVS) devices starting July 2017.

Since the installation of BVS devices is still underway at a number of agent locations, this led to a decline in OTC transactions, thus exhibiting a downfall in overall BB transactions.