The Privatization Commission of Pakistan extensively advertised and marketed sale of 26% shares of Pakistan Telecommunication Company Limited (PTCL) along with management control in 2004- 2005. In response, 18 parties submitted their Expressions of Interest. Of these, 12 parties submitted their Statement of Qualifications (SOQs) and 9 parties were pre-qualified for the bidding. Subsequently, three parties participated in the bidding process which was held on 18th June, 2005.

The consortium led by Etisalat emerged as the highest bidder with an offer far above the reference price of Rs. 62 per share approved by (CCoP) Competition Commission of Pakistan.

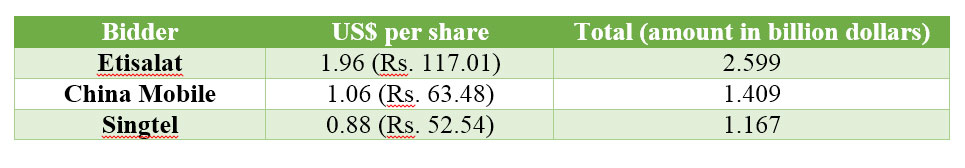

Details of offers are as under:

The CCoP approved the bid submitted by M/s Etisalat and a Sale Purchase Agreement (SPA) was signed in 2005 which was to mature in September 2005. However, EIP (Etisalat International Pakistan) requested certain modifications to the transaction structure and the SPA.

Key modifications made upon EIP’s requests were as under:

- Staggered Payments

- Cost of Voluntary Separation Scheme (VSS)

- 3248 Properties to be mutated in favor of PTCL with clean and clear titles

The CCoP on January 6, 2006 approved the above mentioned modification, after which a new SPA was signed on March 12, 2006. The Cabinet approved the revised terms and conditions of SPA in a meeting held on April 12, 2006.

Subsequently, upfront payment of US$ 1.4 billion was made by Etisalat on 12-04-2006 against total bid amount of US$ 2.598 billion.

Balance of US$ 1.2 billion was to be paid in 9 biannual installments starting from September 2006 and ending on September 2010.

However, Etisalat has so far paid three installments totaling US$ 400 million and the balance US$ 800 million is still outstanding. M/s Etisalat has not paid any installment since July 2007.

- Total sale price For sale of 1326,000,000 shares of PTCL @$1.96: USD 2.598 Billion

- Amount Received from Etisalat: $1.799 Billion

- Pending Payment: USD 799.3 Million

As per the Share Purchase Agreement, the payment of the balance USD 1.2 billion was contingent upon transfer of clean and clear titles of 100% properties by January 2008.

In case of failure, valuations of the properties not transferred till January 2008 will be carried out by both the Seller and the Purchaser separately and higher of the two valuations will be considered for deduction from the balance installments.

Status of Transfer of Properties

At the time of privatization of PTCL, there were a total of 3248 properties to be mutated in favor of PTCL. Of these, 3,215 have already been transferred till date leaving behind 33 outstanding properties.

Valuation of Non-Transferred Properties

Privatization Commission has had the properties assessed by three valuers at different times. Hamid Mukhtar & Co was first engaged in 2009. Subsequently, National Bank of Pakistan was tasked in 2011 and lastly by M/s Iqbal Nanjee & Co in 2013.

According to Pakistani authorities, at present, the valuation of 33 non-doable properties totals to approximately USD 87.89 million.

However, Etisalat is yet to disclose its valuation of the remaining properties.

Recent Developments

Etisalat International Pakistan (EIP), the purchaser of PTCL, is delaying further payments on the ground that all properties included in the Share Purchase Agreement have not been transferred in the name of PTCL. Privatization Commission is actively pursuing and facilitating the process of transfer of properties to PTCL of which 3215 (98.98%) have been transferred and 33 (1.1%) remain to be transferred due to various reasons, including, legal impediments.

Since January 2010, approximately 278 properties have been transferred in favor of PTCL. The Federal Government (Finance Division) has either paid or given guarantees to the respective Provincial Governments and the Departments for the payments relating to the transfer of these properties.

GoP has on multiple occasions requested M/s Etisalat to withhold approximately US$ 50-75 million and release the balance amount, after adjusting the proportionate amount equivalent to its holding of 26% of the value of 33 properties. However, despite all efforts of the GoP, M/s Etisalat has not released any further installment of US$ 133.333 million.

The Privatization Commission on its part is doing all it can to facilitate the transfer of properties. Finance Ministry is also aware of the situation and Finance Minister is personally pursuing this case; but with not much of results.

Investigations on PTCL Privatization

Independent investigations on the privatization of PTCL have been initiated and completed in the past by both, National Assembly Standing Committee on IT and National Accountability Bureau (NAB).

The same have recently been submitted to the Public Accounts Committee (PAC). Both the reports are available with the respective organizations.

Will this Money Ever be Recovered?

Technically speaking, as per sale purchase agreement, Government of Pakistan is bound to transfer all — cent percent — properties or Etisalat (again as per agreement) can set literally any value of remaining properties, even if its one property that isn’t transferred; which means, Etisalat can set USD 800 million as value of the last remaining property and never pay the remaining dues again.

This will mean that Government of Pakistan will have to transfer each and every property before claiming USD 800 million dollars. And if GoP fails to do so, Etisalat will have all the legal standing to hold the payment and get away with such hefty amount.

What Pakistan can do at best is to nab the people who signed agreement with Etisalat and see why they granted EIP such unprecedented rights and benefits.

Pervez Musharraf’s son, Bilal Musharraf, was consultant for Etisalat in their deliberation for PTCL purchase. When Etisalat saw that they had bid US$1.2 billion more than the 2nd highest bidder, they got cold feet and certainly outraged.

Had Mushi not soothed and pampered them with such outrageous favors, they would obviously have eaten his son alive. I laugh at those ostriches who claim that Mush was not corrupt.

it should also be mentioned ptcl pays 10 lakhs to arab worker and 40 thousand to local worker for doing same jobs.

I am not saying that we should not get the remaining USD 800m. But if you look at the bids, we are still better off than the second bid from China Mobile. So in a way, if this falls apart and if what Hegemony says about Musharraf and his son is true, I think Bilal Musharraf did a service by bringing in more money than was possible. And if the outstanding balance is paid, we will be richer than before. All leaders, at least in Pakistan, are corrupt and flawed. Musharraf was the best among the worst. Thats all.

Tum log best among the worst k chakar me mulk bera garak karwana parhy likhy jahilo

Kall ko tumhary ghar me 5 daaku ghusain or jo sab se kam maal uthae usko chor do gy k he was the best among worst

beep hy esa sochny walon per

It means Musharraf’s son ditched Etisalat.

(headbang)

wah kia baat hai etisalat ki .. they got the best deals and no one will sue them or catch them. WHy? because most of our politicians have bank accounts and properties in UAE. SO nothing will HAPPEN ……………..

Q ke jab in leaders ko mulk se nikala jana hai to inko oanah be uae walo ne he deni hai.. iss liye ye un se 800$ nai kete

Lafafa blogism

kitne paisay main?

In strictly accounting terms, if the value of 33 properties is $ 8 million (as per reality) and Etisalat values it $ 800 million (to rob PTCL) then PTCL will get worth $ 792 properties in its Balance sheet extra. And after audit it will be reduced by $ 792 (upon revaluation). Net effect zero. Result PTCL gets $ 800 cash. I think Etisalat has something else in mind for not paying the money.

Fateha parrh lo dosto qaum ke assets pe, PIA is next….