The Brooking’s 2016 edition of the Report on Financial and Digital Inclusion Project (FDIP) evaluates access and usage of affordable financial services for under-served people in 26 countries. The first FDIP report was released in August last year and since then, 5 new countries have been added and key changes over the past year have been documented.

The report analyses the financial services ecosystems in four different categories including country commitment, mobile capacity, regulatory environment, and adoption of selected traditional and digital financial services.

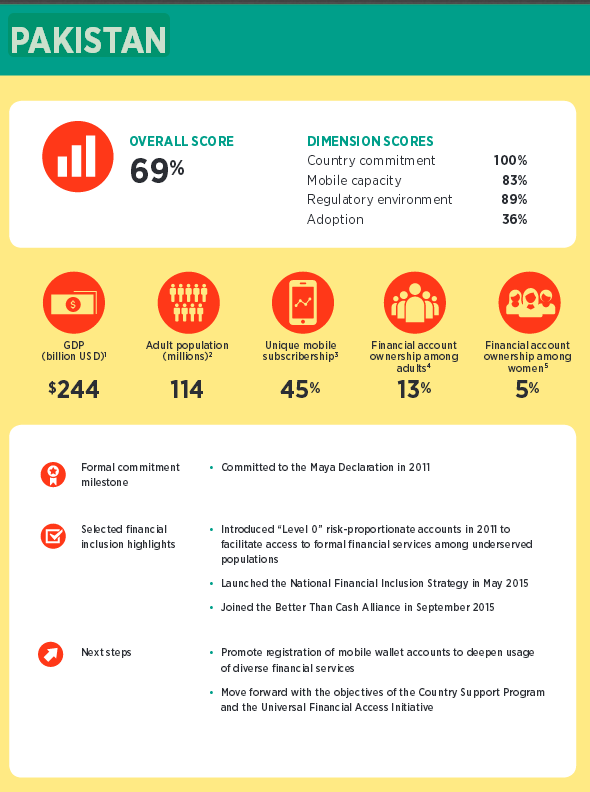

Pakistan is ranked 14th out of the 25 countries which were studied. However, do note that the report only includes emerging or third world countries, hence no welfare states are part of this ranking.

Country Commitment

Pakistan received full points in this category and scored 100%. The category includes national level participation in international financial organisations, national inclusion strategy, national quantifiable financial targets, financial services’ support by the government, a public sector financial inclusion body and the existence of a consumer protection framework.

Using local newspapers and international organisations’ reports as sources, Pakistan was awarded full points for each indicator.

Mobile Capacity

The report scored Pakistan at 83% with full points in the availability of mobile bill payment services, mobile international remittance services and mobile merchant payment services. Pakistan also got approval for 3G mobile coverage for over 67% population. However, Pakistan’s smartphone adoption is under 33%, scoring 1 out of 3, and unique subscriber market penetration is between 34-66%, scoring 2 out of 3.

Regulatory Environment

Pakistan managed 89% in the category thanks to full scores in cash management agent locations, account access and usage, mobile money platform interoperability, e-money regulations and agent banking indicators. The only indicator where Pakistan scored the least possible marks was the mobile network led mobile financial service deployments, since telecom operators are not eligible for mobile money service deployments.

Adoption

Pakistan scored the least in this category with only 36% points and scored the least possible points in almost all indicators. Frequency of account usage stood between 13-22%, scoring 2 out of 3, while all other indicators received a score of 1 out 3.

The minimum scores are awarded for each indicator where there is:

- A 5-22% formal financial institution account penetration among low earners

- 3-24% financial institution account penetration among women

- Only 2-7% borrowing from financial institutions

- 3-12% savings are made in banks

- Under 14% account holders use debit cards

- Under 9% use credit cards

- Less than 5% adults make online bill payments or purchases

- Mobile account penetration is under 17% amongst low earning adults or women

- Less than 7% people receive salaries on their mobile phones

- Less than 17% of adults make utility bill payments online.

Comparison with Other Countries

Kenya topped the charts with scores of over 84% while Pakistan stood at 14th with only 69%. Even India scored 71% thanks to higher regulatory and adoption scores. However, being a much larger country, in terms of population and area, it scored less in the mobile capacity category. Amongst others, Bangladesh scored 66% and Afghanistan scored 54% in the report.

Download the complete report here or view the report headlines here.

Yaar what is this?

>Less than 5% adults make online bill payments or purchases

>Less than 17% of adults make utility bill payments online.

Also there are poor countries that are also welfare states you know? Cuba and Sri Lanka for example. It’s not only the first world that spends on education and health. Only a Pakistani would think like that.