Update: A new notification has extended the deadline by 15 days. The last date to submit your income tax returns is now 30th November 2016. The new deadline applies to salaried individuals, business individuals, association of persons, final tax regime and companies falling under special tax year.

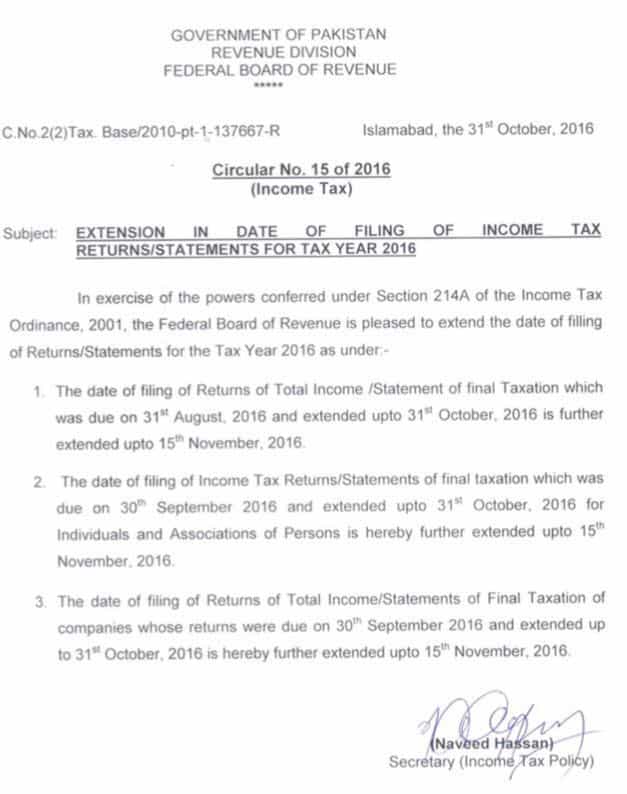

As per FBR’s announcement, the last date for filing of tax returns has been moved to November 15th.

The taxpayers did not seem to comply which resulted in an extension of the deadline. The last date has been moved several times, which is a usual practice for FBR.

Originally the last date was August 31st. This was moved to September 30th and recently to October 31st.

Now that the last date has gone by again, FBR has extended it once more. This time it has been extended for 15 days instead of one month.

The final dates for filing returns of total income/Statement of final taxation has been moved to November 15th. The date of filing income tax returns/Statement of final taxation for individual persons have also been moved to the same date.

Read More: A Guide to Filing Your Income Tax Returns Online

The same date has been given as a deadline for companies which haven’t filed their returns for total income/Statements of Final taxation.

The tax situation in Pakistan

The tax situation has not been very good in Pakistan for ages now. Only a sliver of the total population pays their taxes while the majority does not seem to care. Mistrust for the FBR is also a possible cause for that. Another reason is the way the government spends lavishly on needless things, the dancing fountain is a recent example of that.

The fountain cost us Rs. 200 million, all of which came through taxpayers money, our money. It makes sense when you think that most don’t agree to pay taxes for this reason alone.

Tax year 2017 , RS- 26634 M.Majid inspector , Mobile- 0300-4039179, Name- Ghias Arsalan , Flat , 35-A , Gulshane Hayat Colony , Old Faisalabad .

Instead of extending date line can you please make forms simple and user friendly. Or atleast give guideline for salaried person what to fill in those forms

Message here and I can help you filing the tax return.

Anyone knows how to file nill returns being a freelancer and have no property in Pakistan ? ProPak should write a detailed guide on it.

which city are you in ?

Simple declare income in foreign income field

https://uploads.disquscdn.com/images/961d13ccbbc26cf7adf5dbf1121d640098bdb3282e5c7e25a7b0a781bb536237.png

My returns were filled and uploaded on 2nd Oct but since then they are pending at FBR end. I don’t think they will be processing these returns until the final deadline is met.