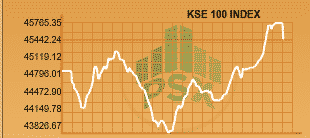

Stocks underwent a dramatic ride on Wednesday as the KSE-100 Index took a complete U-turn, registering an over 1264-point intra-day movement after panic selling had caused it to plunge at the start of the trading session. The volatility was seen in the market today.

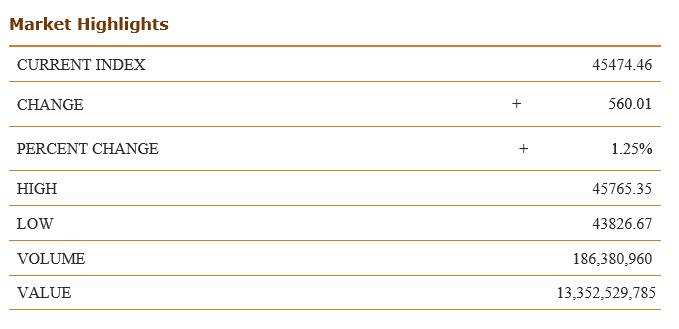

KSE-100 index gained 560.01 points, or 1.25 pc by the close of Wednesday’s trading session to reach 45474.46.

The index recovered during the latter half of the day, moving up to 45474, after falling over 1000 points within the opening hours.

The market has gone down a cumulative 15% in the past month. Earlier on June 20, the market dipped as the political uncertainty prevailing in the country with regards to the work of the Panama case Joint Investigation Team (JIT) probing the Sharif family’s assets has had a negative impact on the stock market. Sell at strength was the strategy adopted by the investors as said by the market analysts.

The index tested the day’s high at 45765.35 points. The day’s low of 43826.67 came towards market close.

Overall, 346 million shares were traded, While in KSE 100 index 187 million shares changed hands with a total worth of nearly Rs13.42 billion.

COMMERCIAL BANKS was the top traded sector with total traded volume of 87,159,400 shares. It was followed by TECHNOLOGY & COMMUNICATION with a total traded volume of 38,491,000 shares and ENGINEERING sector with a total traded volume of 35,920,100.

Shares of 372 companies were traded. At the end of the day, 190 Stocks closed higher, 169 declined while 13 remained unchanged.

TRG Pak Ltd was the volume leader with 23.27 million shares, losing Rs 1.63 to close at 42.72 It was followed by Bank of Punjab with 20.20 million shares, gaining Rs 0.04 to close at Rs 10.81, K-Electric Ltd 19.82 million shares, losing Rs 0.01 to close at Rs 6.85 and Bank of Punjab (R) with 9.95 million shares, gaining Rs 0.01 to close at Rs 0.06.

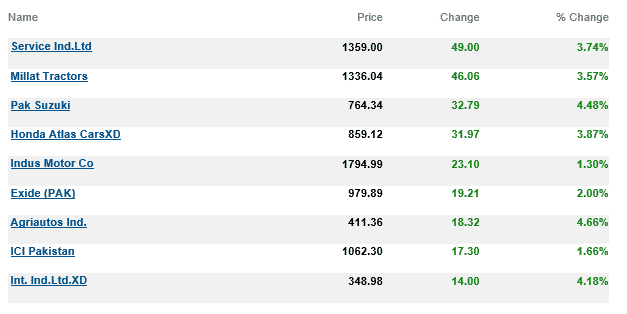

The top advancers of the market were:

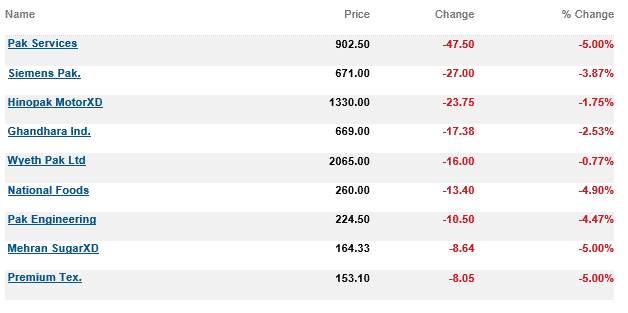

Top decliners of the market were:

Oil prices struggled near multi-month lows in European morning trade on Wednesday, as investors looked ahead to weekly data from the U.S. on stockpiles of crude and refined products later in the global day. Oil prices have been under pressure in recent weeks as concern over rising U.S. shale output offset production cuts by OPEC and non-OPEC members.

It is now currently being traded at $43.38 per barrel.