As a revolution in the B2B e-commerce service industry, Cheez Group found a solution to solving the problems which previously existed between the entire retail supply chain and the high operating expenses for retailers.

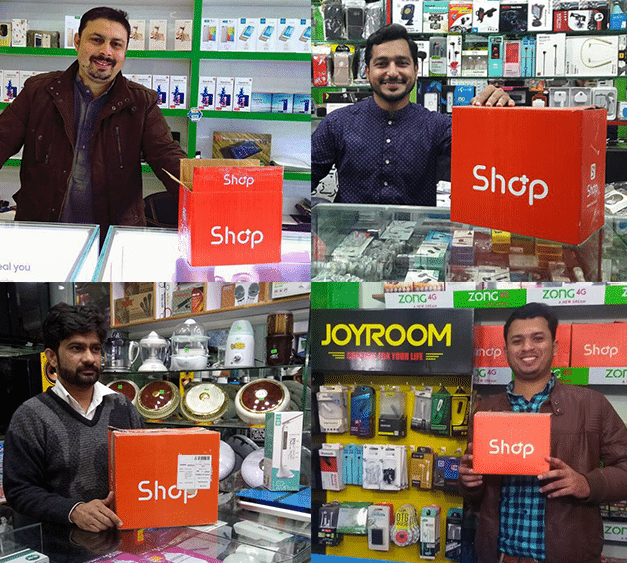

The company has managed to truly understand the needs of both the vendors and the retailers by focusing on developing the wholesale online portal, Shoplus. The dream behind the idea was to enable “One Stop Retail Solutions” for Pakistani retailers.

Shoplus serves cross-border trade and local retail industry, connects retailers directly with world suppliers, offering good products, quick logistics and efficient services. The website currently has more than 20,000 SKU & serves more than 10,000 retail stores in Pakistan.

Being the only local B2B E-commerce store that concentrates on the trade between China and Pakistan, Shoplus has caught the attention of some of the leading international companies.

UnionPay, one of the world’s largest bank card groups, announced this month that its Cross-border B2B Payment Service Platform is now connected to Shoplus.

After selecting commodities at Shoplus, Pakistani retailers can complete payments with UnionPay cards via UnionPay Cross-border B2B Platform, which changes the common practice of “Cash on Delivery” and facilitates trade between China and Pakistan following the Belt and Road Initiative. Shoplus has become the first and the only local e-commerce player in Pakistan that has UnionPay partnered with.

According to some public documents and reports, Cash on delivery (CoD) is the payment method of choice for many Pakistanis, making up for over 95 percent of online payments. In developed e`-commerce markets, online merchants receive credit/debit card payments almost right after an item is ordered. With cash on delivery in Pakistan, however, it can take well over a month before the merchant can collect customer payments via their logistics partner. This working capital gap creates grave cash flow difficulties that most merchants simply cannot overcome.

CoD is convenient for buyers but extremely inconvenient for retailers and vendors. It hinders cash flow as such orders take longer to close. It often takes months for the money to reach the seller, that too if there’s no refund/return request. This makes it difficult for them to gauge or maintain daily operations.

But now, by connecting to UnionPay Cross-border B2B Platform, Shoplus can provide local purchasers with an easier and safer payment choice to buy goods. This solves cash flow difficulties in many cases and also facilitates trade between Pakistan and other countries.

In additional to UnionPay, Shoplus’ payments ecosystem has grown to accommodate a range of electronic payments solutions.

SimSim has also joined hands with the Cheez Group to take a huge step forward in the digitization of the economy.

The two CEOs, Mr. Aurangzeb Khan from Cheez Group and Mr. Mudassar Aqil from FINCA Microfinance Bank, discussed future plans of continued progress of digital payments in Pakistan. An array of services including QR Payments, bill payments and cash management systems will be offered to the retailers on Shoplus. Both parties have big plans for the future of Pakistan and its digital prowess. The collaboration focuses on providing inspiration to merchants to move towards digital payments and climb on board the inevitable progress that Pakistan has in store.

The first attempt of electronic payment occurred in Oct 2017, on Shoplus Online & Offline Shopping Day, which was Pakistan’s first “cashless payment” shopping festival. The event has saw Rs. 120 million in revenue and had 109,356 visitors.

It is said that such cutting-edge technology will be employed again for Shoplus’ future shopping event, probably during the first half of 2018. Until then, let’s see what surprise will be waiting for us.