The Federal Board of Revenue (FBR) has reduced taxes on imported mobile phones by up to 45 percent in a bid to prevent smuggling, according to a media report.

Earlier, the government had started the implementation of already applicable taxes on cell phones brought into the country by international passengers. However, the FBR and the government have now decided to lower these taxes.

Pakistan Telecommunication Authority (PTA) and the FBR are collaborating to curb the smuggling of mobile phones, which incurs a huge loss the country’s economy every year.

ALSO READ

This is How a Rs. 4,000 Phone Could Cost You Rs. 50,000 in Taxes

The board has also made it mandatory for international travelers to register their phones with PTA. FBR has also advised the public to beware of the smuggling mafia which either uses people’s credentials illegally or sells them illegal phones.

Do note that if international travelers fail to register their phones within a time frame of 60 days, they will have to pay an extra 10 percent fine with the tax.

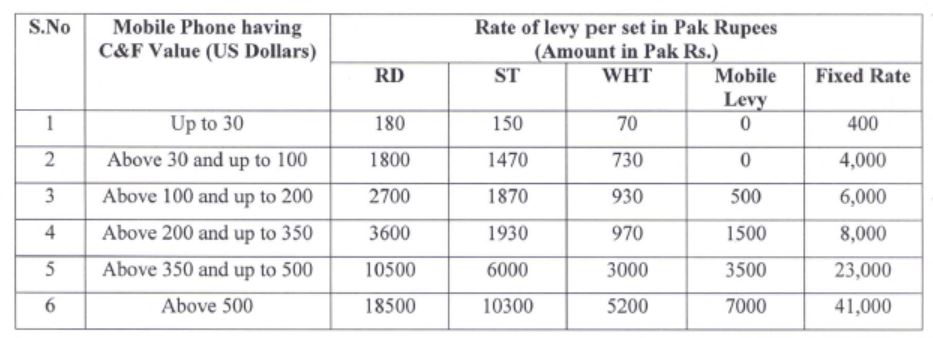

The table of taxes is exactly the same. What is the change?

USD 200 = PKR 32,500 HAI :

Yani Yahi Mobile 40K Ka PAREGA

Apko apni bezzati karana bauhat acha lagta hai?

This move is appreciated. But this tax is still too much especially on the higher end.

USD 1,000 waly phone pay USD 100 Tax ho to economical ha. PKR 16,500.

USD 500 waly phone pay USD 50. PKR 8,250.

USD 250 waly pay USD 25. PKR 4,125

USD 125 waly pay USD 10. PKR 1650

1000 waly pr 200-300$ chly ga wo kafi high end phone hai aur jo bnda 160k ka phone ly skta hai usy 30k-40k tax pay krty hoe problem nhi hone chahye. Lekin sirf 500$+ sy 41000 bht zyada hai. Ab to mostly high mid range mobile 400-600$ ki line men hi aty hain

Hassan bhai smuggling b to rokni ha na.

To bhai itna tax puri dunha dete hai jitna men kh rha hn. Aur Pakistan men mostly chori ky mobile smuggle hoty hain ye DIRBS ko bhtr kryn ti smuggling khud km hogi

Q chalega? Tum dedo 300 dollar tax. Agla 2-3 saal paisay jama kar k halal ki kamai se acha phone le aur usko loot lo. Har koi 1000 dollar ka phone lene wala seth ki olad nahi hota bhai. Kuch log 4-5 saal me aik hi dafa acha phone lete hain. Apni aqal apnay paas rakho.

Huzoor aj kl bhtreen mobile 400-600$ ki range nen hain. Jo bnada 160k-200k mobile pr krch kr rha hai usy tax dete hoe koi takleef nhi hone chahye.

hahaa what a joke when we buy mobile we already pay tax in that country according to the law this is incompetency of the gov that dont have the tax treaty or atleast they should give relaxation in terms of double tax relief

you are a stupid man. After having heard the entire argument youre still saying the same thing!!!

Haha bc gaaand phat jati hai high end phone laitay howay me to chahta hu k 500$ k upar 500$ tax lagao ta k jo har 6 months bad change kartay ho na wo keera maray app ka.

Agreed. That’ll be a lot more reasonable.

The taxes are still huge even compared to our neighbours. Not promoting buy new technology among people leads to lesser growth as a nation.

Allah say daro aor internet pay withholding tax khatam kro

Sirf witholding kyun? Mery to khyal men Sales Tax bhi nhi hona chahye. men aik freelancer hn aur ye tax kafi dfa chubhty hain khad toor pr tb jb client nhi milta. 10 mb net 1750 ka hai aur us pr 600 tax dena prta hai. Aur mobile card pr bhi maximum 10-12% tax hona chahye.

Aisy mumkin nhi ha na is liy kaha.

Withholding khatam krny ka keh rahy thy internet pay lekin kia nhi abi pata nhi kiun

Nahi tumharay internet par b 300 dollar tax hona chahiye. 1750 rupay de sakte ho to 300 dollar extra b dedena.

Doosron ko $300 k tax ki sifarish karnay walay ki 600 rupay tax dete huay jaan ja rahi. Wah yar wah! Kia baat hai apki.

Matlab k 50K ka phone 90K main.. Good! (facepalm)

How did you calculate that 50k phone will be 90k? I think you are wrong.

Smuggling rukni hai tu dealers ko pakro jaa k bechary bhr sy any walo ko q zalil kar rahy ho tm log ak phonr tu bhaiyo sy mangwana hotaa haai or tm logo ne us py bee tax laga dia koi thori se sharm hayaa karlo

lanat begta hon asi government pey billi kay bill nay hosh ora deye han middle class bohat tezi de eliminate ho rahi ha or ab guzara bohat mushkil ha Allah hum pe raham karay or achay hukmaran ata kareen

What are the new taxes? That’s the old table

The table shared above shows exactly the same tax values..

I bought used.blackberry key in 2018 and it’s 4 years old model and used mobile now the PTA have blocked my phone by no reason kindly give complete details how to reactivated .

Out of country bhej do isko , wahan sale kr k pesy mangwa lo aor yahan say PTA ka approved ly lo , aor koi hall nahi ha aor BlackBerry purchase na kro , ho saky to iPhone purchase kr lo

Iphone Xs max 256 gb pr kitna tax dna pry ga?

how could some one appericiate this move while living in pakistani culture where 1 man have to supporting at least family of 10.if like my brother who is in uk have to save every single penny coz he has to fullfil demand of his sister to bring them mobile phone and now he has to send gbp bcoz we have to pay tax here bcz our gov is such an incompetant that they has to make commener suffer to stop smuggling ?

How is this reduced tax. Kindly explain. It was 41k before and it’s still 41k on a 500$ phone. Where is the 45% reduction. Once you share an article it should be backed up by proof. The table you are showing is from the FBR Website and remains unchanged. the table on the FBR Website from March showed much lesser value of tax. If anything the tax had increased from March.

bhai ek masla sab doston ke liye …… Allah ko jawab dena hai jab mobile purchase karte hein hum ……… what exactly my needs were? how much i exaggerated? when my necessity transformed into luxury? do i have a little thought in mind that i want to purchase a better model than my friend’s? showing off to others? sticking to the latest model?

the cost of the mobile = the salary of a person working a whole month?

the cost of the mobile = the salary of a person working a whole year? (aisay bhi loag hein)

samsung galaxy fold’s launching price $1980 = Rs. 3,16,800/-

Huawei nova3 tax is 7150 rupees asked by PTA

can someone tell the total amount that i would need to pay as tax for iphone x 256gb? where do i have to pay this amount?

Rampage