Honda Atlas Cars has announced its financial results for the year that ended on March 31st 2020.

The company has reported a profit of Rs. 681.75 million, down by massive 82.31% as compared to a profit of Rs. 3.85 billion recorded in the same period last year.

During the fourth quarter, the automaker has, for the second time, reported a loss. It has reported a loss of Rs. 28 million in the outgoing quarter. It had reported a loss in the third quarter of the year as well. The result was accompanied with a cash dividend of Rs. 1.0 per share.

The sales during the year were down by 42.14% to Rs. 55.04 billion as compared with Rs. 95.12 billion recorded last year.

ALSO READ

Pakistan’s Auto Industry in Shambles as Some Resume Production & Others Await Green Signal

The major reasons behind the drop in profits ware the decrease in sales as the volumes decreased by 54% due to a rise in prices, rising finance cost by 64.06 times, low gross margins, low demand in the country and due to the Rupee/Dollar parity. It is worth mentioning that Honda had increased vehicle prices multiple times during the year.

Disruption in the supply chain due to Covid-19 could have also contributed to lower margins.

The country’s automobile sector is facing one of the worst slowdowns in decades, primarily from contracting demand due to the COVID-19 and poor customer sentiment.

However, the cost of sales during the year was stated at Rs. 50.95 billion, down 36.30% against Rs. 87.82 billion due to low production, which took the gross profits to Rs. 4.09 billion against Rs. 7.30 billion.

Units Sold (March 2019-March 2020) |

|||

| Models | Units Sold 2019-20 | Units Sold In 2018-19 | Difference |

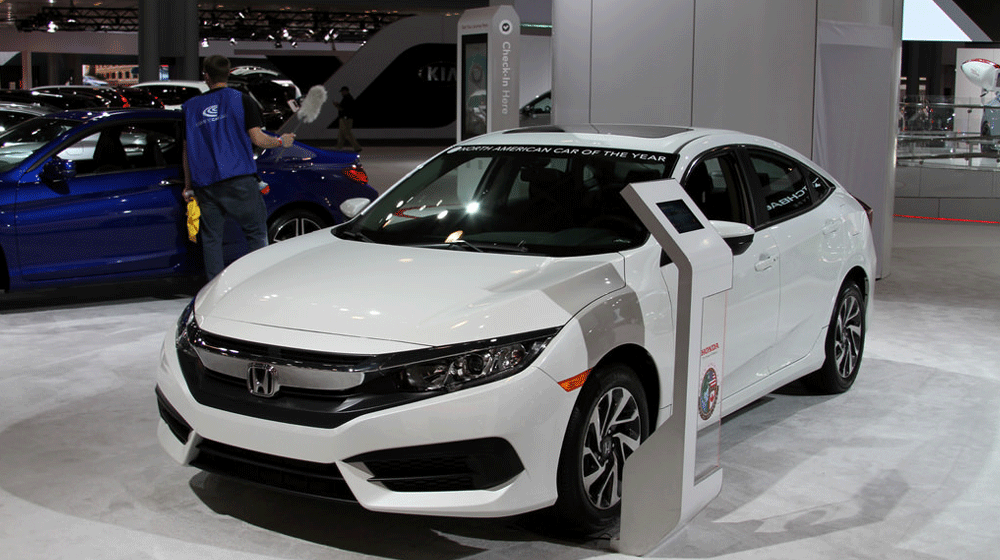

| Civic and City | 18,906 | 42,945 | -56% |

| Honda BR-V | 3,435 | 5,424 | -36.70% |

| Total | 22,341 | 48,369 | -54% |

Other income of the company also went down by 51.30% during the year to Rs. 638 million as compared to Rs. 1.31 billion in the same period last year due to a drop in new car bookings and realization of short term investments to manage the liquidity position of the company.

ALSO READ

Javed Afridi Reveals the MG HS Electric SUV Prior to Launch [Pictures]

Financing cost increase significantly by 64.06 times to Rs. 727.44 million as compared to Rs. 11.18 million. The unprecedented increase in finance cost was due to increased borrowing to fulfill higher working capital requirements on high-interest rates throughout the year. The company resorted to bank financing and resultantly, the financial charges increased.

Distribution and marketing costs came down to Rs. 667.90 million as compared to Rs. 931.78 million during the period under view. Administrative expenses were also reduced to Rs. 738 million as compared to Rs. 800 million with other operating expenses decreasing by 19% to Rs. 1.04 billion as compared to Rs. 1.28 billion.

Earnings per share of the company decreased to just Rs. 4.77 from Rs. 26.97.

However, HCAR’s share at the bourse closed at Rs. 186.91, up by 4.48% or Rs. 8.02 with a turnover of 0.46 million shares on Tuesday due to the company’s dividend announcement.

Still not is loss. Just reduced profit.

Blame excessive profiteering for reduced sales.

People of Pakistan must continue boycott of big 3 till reasonable reduction in prices & significant improvement in quality as presently big 3 are producing crap literally.

I m sure if people got successful to do that, this Mafia will come to.its knees inshallah.

Only a little sacrifice required by the people.

I request to all Plzzzz do complete boycott of Toyota Indus, Suzuki & Honda and use imported car for time being.

U will see the result.