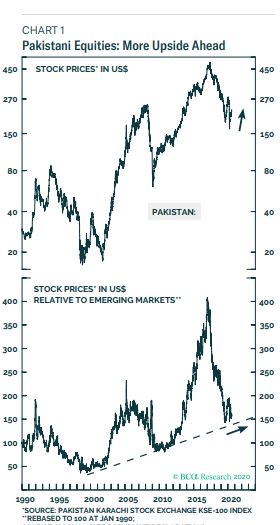

Pakistani bourse is set to outperform the Emerging Markets equity benchmark as the equities at Pakistan’s stock market are likely to move higher over the next six months.

This was stated by renowned Canadian advisory firm BCA Research, a leading independent provider of global investment research, in its latest report.

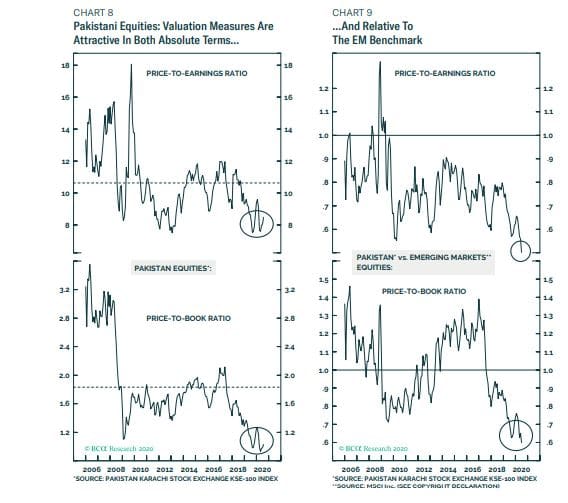

The report stated that Pakistani stock prices have already priced in plenty of negatives and that Pakistani equities are likely to move higher over the next six months. Pakistani stock prices in US dollar terms are currently 20% lower than their January high and 56% lower than their 2017 high.

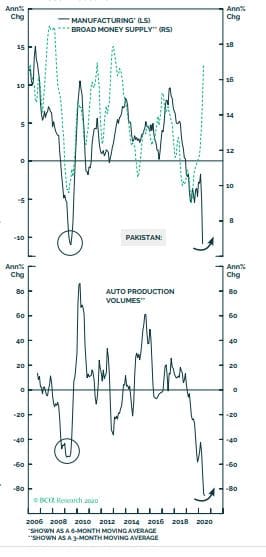

Meanwhile, the government projected a contraction in real GDP during the fiscal year 2019-20 (ending on June 30), the first in 68 years. Strengthening the balance of payments (BoP) position and continuing policy rate cuts will increase investors’ confidence and benefit its stock market, added the report.

BCA research recommended buying Pakistani equities in absolute terms and continuing to overweight the bourse within the emerging markets space. The stock market will benefit from a business cycle recovery following the worst recession in history, worse than during the 2008 Great Recession, said the report.

The research house mentioned fertilizer and cement producers, which together account for nearly 30% of the overall stock market, will benefit from falling energy prices, a significant cut in interest rates, and supportive government measures. The government recently approved subsidies to encourage fertilizer output.

In the meantime, the country’s construction stimulus package and its easing of lockdown orders will help uplift demand for cement over the second half of 2020, said the report.

As a result, both the fertilizer and cement output is set to increase. Besides, a cheapened currency will limit fertilizer imports and help cement producers export their output, which will benefit their revenue.

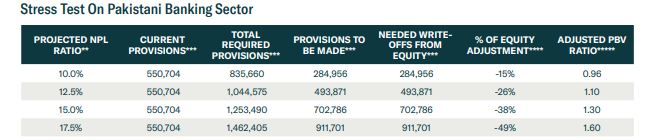

BCA stated in its report that banks account for about 22% of the overall stock market. A stress test on the Pakistani banking sector shows it is modestly undervalued at present.

Even assuming the worst-case scenario for non-performing loans (NPL), where the NPL ratio would rise to 17.5% from the current 6.6%, the resulting adjusted price-to-book ratio will be only 1.6, said the report.

Both in absolute terms, and relative to EM valuations, Pakistani stocks appear attractive, it added.

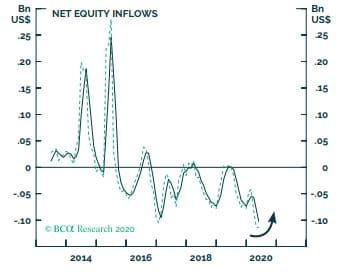

BCA expects Pakistan’s macro-dynamics to improve in the next six months with the net portfolio investment also likely to increase after being at a record low this year.

Finally, foreign investors have bailed out of Pakistani stocks and local currency bonds since 2018. Ameliorating economic conditions will lure foreign investors back, said BCA.