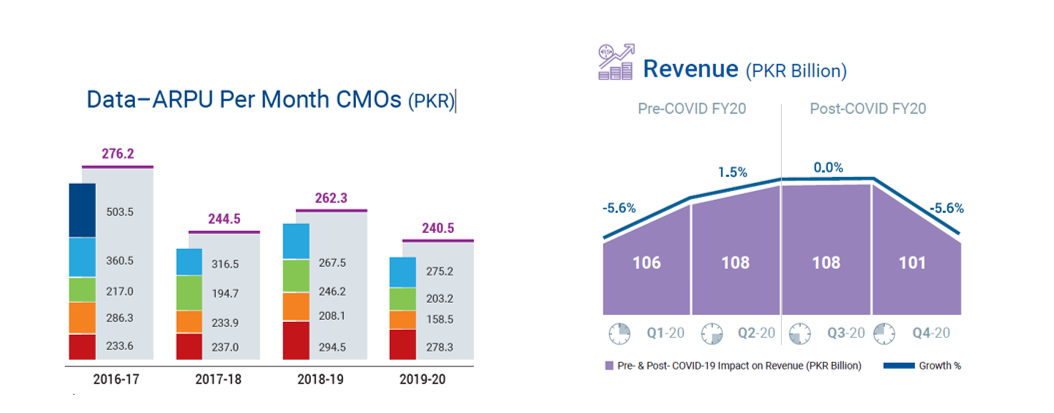

The average earning (average revenue per user per month) of cellular operators dropped by 8.31 percent in the financial year 2019-20 due to multiple factors, including the varying consumption patterns of the customers due to the COVID-19 pandemic.

The Average Revenue Per Users (ARPU) of the telecom industry decreased to Rs. 240.5 in FY20 from Rs. 262.3 reported in FY19, according to Pakistan Telecommunication Authority (PTA).

The drop in revenues was translated by the outright withdrawal of 10 percent service/ administrative/operational charges by the operators at the beginning of the financial year on the directives of the Supreme Court of Pakistan (SCP).

Furthermore, the consumption trend of cellular phone services has kept shifting regular calls to internet based (Whatsapp) calls, which have become increasingly common during COVID times.

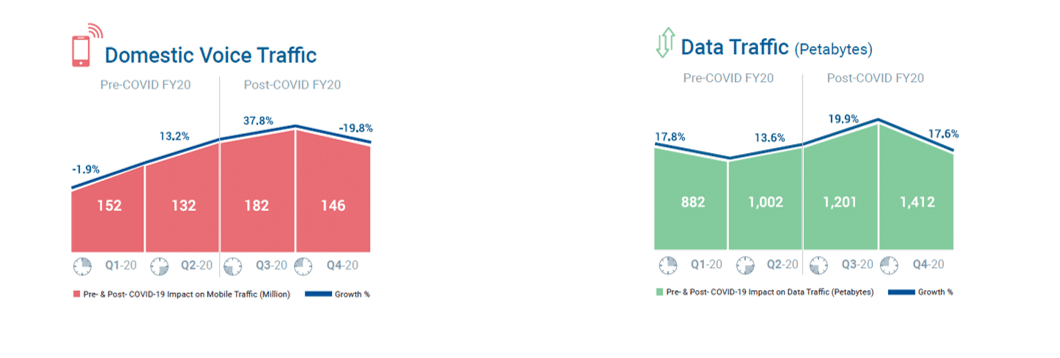

The consumption of the regular voice call decreased tremendously due to COVID-19, which ultimately impacted negatively on the use of call services for personal and commercial use across the country, mainly in the last quarter of FY20.

On the other hand, the consumption of internet services remained stable and relatively registered growth, particularly in the cities with uninterrupted broadband services as these customers consumed internet services for their office work, educational, and entertainment purposes.

Operators, one after another, offered free internet and data packages to the customers in difficult times for a limited period, which also offset the revenue streams considerably.

PTA, in its annual report, stated that the telecom operators face challenges in maintaining their ARPUs where voice is still a dominant factor in the year while overall industry ARPU declined by 8 percent during 2020, owing to competing data prices offered by service providers in general and reduced offers in the wake of COVID-19 in particular.

Jazz maintains the highest ARPU of Rs. 278.3 in FY20. It is followed by Telenor, with an ARPU of Rs. 275.2. ARPU of Zong and Ufone stood at Rs.203.2 and Rs. 158.5 in FY20, respectively.

Pakistan is considered a low ARPU and predominantly a prepaid subscription market where subscribers enjoy the flexibility of altering their usage patterns in response to any price fluctuations introduced by operators.

Cellular Operators Profits

The cellular mobile sector registered a decline of 4.8 percent in its revenue, from Rs. 445 billion in FY19 to Rs. 424 billion in FY20.

A major setback was endured by Zong, which reported a negative profit (loss) of Rs. 3.6 billion in FY20 as against a positive profit of Rs. 12.9 billion for the same period last year.

Telenor and Jazz continued to earn positive profits of Rs. 4.1 billion and Rs. 36.8 billion, respectively, in FY20 though profits declined by 79 percent and 7 percent, respectively, compared to the previous year.

As the businesses reopen and the economy is set to pace up gradually, it is expected that the revenue streams of mobile phone services will also have a positive impact through voice and internet services.