The Pakistani Rupee (PKR) has continued its steep decline against the US Dollar (USD) in the interbank market for the second day of this week.

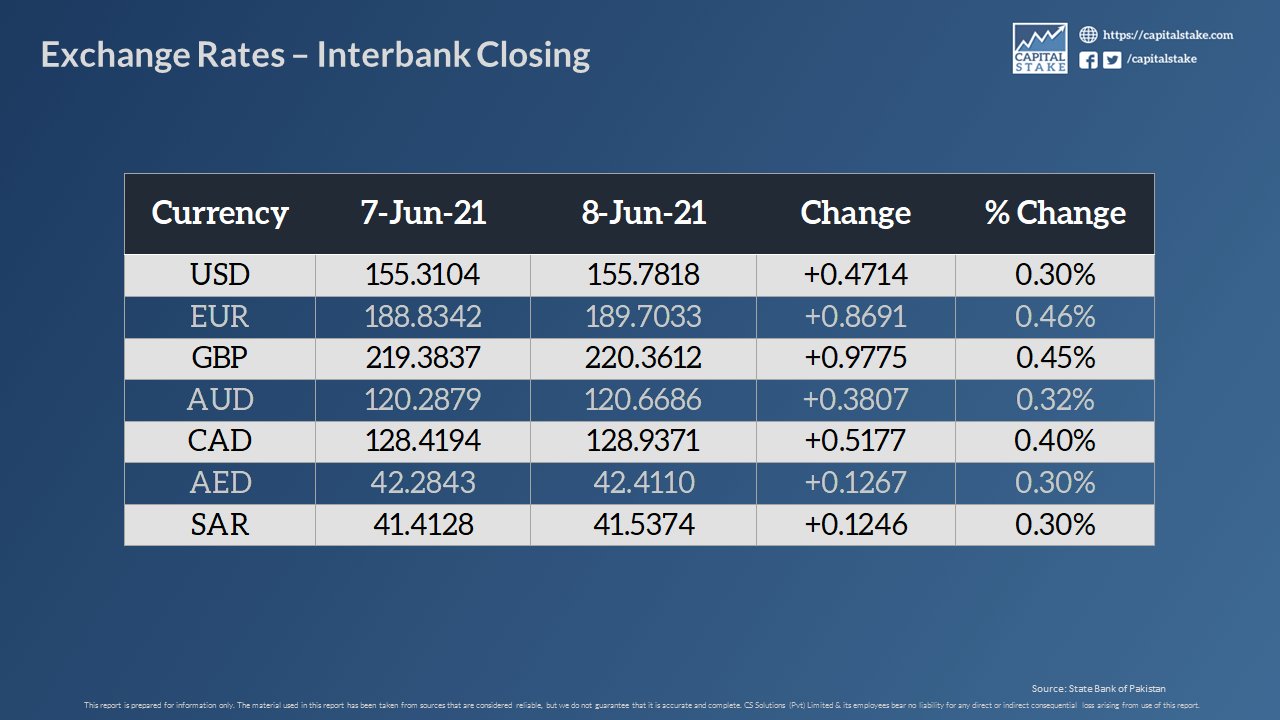

The rupee was closed at Rs. 155.78 against US Dollar at the end of the trading day today (Tuesday, 8 June), significantly down by 47 paisas as compared to Rs. 155.31 to the USD yesterday (Monday, 7 June).

ALSO READ

Rupee Witnesses Its Biggest Fall Against the US Dollar in Months

Yesterday, the PKR had posted a loss of 70 paisas against the greenback and also crossed the boundary of the Rs. 155 exchange rate for the first time since 25 March 2021. In the past month – since May 7 – PKR has depreciated by Rs. 3.11 against the US Dollar.

A. A. H. Soomro, the Managing Director at Khadim Ali Shah Bukhari Securities, told ProPakistani that the “Pressure on currency is stemming as the economy opens up, imports grow faster than the exports & REER at 103”.

He said that with the high prices of oil, TERF imports, economic resumption, and food one-offs, the trade deficit is nearing the Red Zone. “However, remittances and RDAs are solid. Hence, maintaining below Rs. 160 in the foreseeable future is likely amid political pressures,” he explained.

Dealers see a higher demand for the dollars due to the fiscal year ending on 30 June 2021, which is expected to keep pressure on the local unit.

The PKR also posted losses against most other major currencies in the interbank currency market today.

It went down substantially by nearly 87 paisas against the Euro, eroded by 97 paisas against the Pound Sterling (GBP), lost 38 paisas against the Australian Dollar (AUD), and went down by 51 paisas against the Canadian Dollar (CAD).

ALSO READ

Govt Bars KPMG Pakistan’s Partner from Auditing Public Interest Companies

Additionally, the PKR also lost against the UAE Dirham (AED) and the Saudi Riyal (SAR) by nearly 12 paisas each.

J