The government has prepared a comprehensive set of directions for the Kamyab Pakistan Program, under which loans will be offered for the SME sector, Agriculture sector, and low-cost housing, at lower interest rates.

The program has been drafted in consultations with the State Bank of Pakistan (SBP), the Securities and Exchange Commission of Pakistan (SECP), Pakistan Banks’ Association (PBA), Naya Pakistan Housing & Development Authority (NAPHDA), and Micro Finance Providers (MFPs).

ALSO READ

Kamyab Pakistan Will Uplift 4.5 Million Underprivileged Households: Finance Minister

A draft of the program was presented in the Economic Coordination Committee (ECC) of the Cabinet. The program is aimed at scaling up the already existing Kamyab Jawan Program and has brought on board other relevant organizations such as micro-finance banks and rural support programs to increase outreach and availability of cheaper liquidity for lower tiers of the economy.

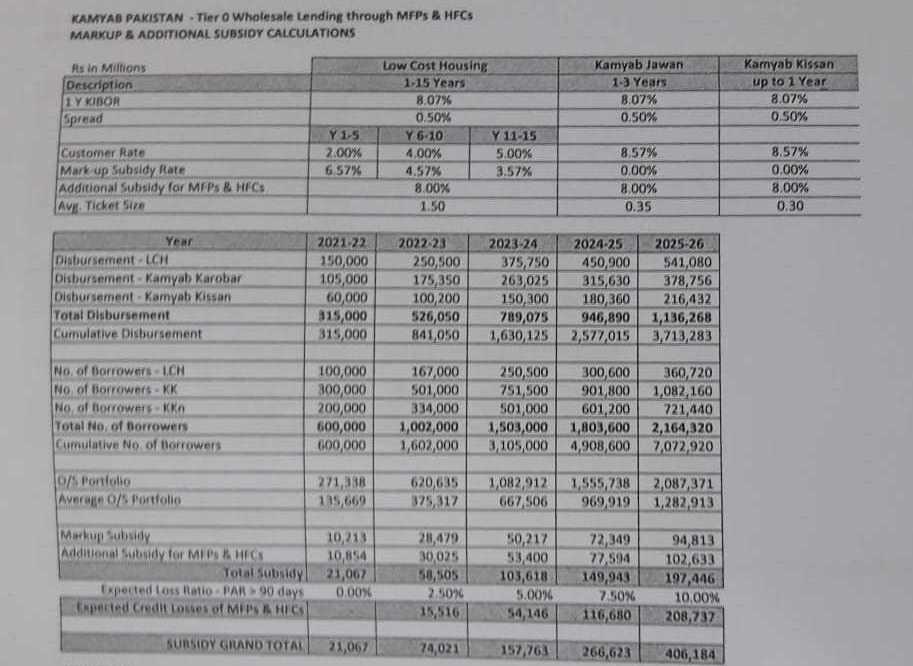

Under Kamyab Pakistan Program, commercial banks, development finance institutions (DFIs), and Pakistan Mortgage Refinance Company (PMRC) will extend Wholesale Loans to Micro-Finance Providers (MFPs) to be disbursed onwards.

These loans by MFPs will be given under three categories: Kamyab Karobar for businesses, Kamyab Kissan for the Agri industry, and Naya Pakistan Low-Cost Housing Program (NPLCHP).

Kamyab Pakistan Program will also aim to integrate the government’s Skills Development Program for educational and vocational training. In an attempt to provide the entire chain of accessibility, it is intended that the recipients of these skills programs have access to loans for entrepreneurial initiatives.

The proposal of the program estimates that over three million households will benefit from this program through a cumulative amount of over Rs. 1,600 billion in the next three years. Kamyab Pakistan Program is initially put in place for seven years, but it may be extended further.

Loans under this program will be extended to households registered with the National Socio-Economic Registry (NSER) of BISP/Ehsaas. The defined criterion for households defined therein is average monthly family income below Rs. 50,000, and a priority clause has been added for beneficiaries of the Ehsaas program.

ALSO READ

Kamyab Jawan Brings Together Content Creators to Be the Voice of the Youth

These loans will also be exempt from rule 3(2) of Cash management and Treasure Single Account Rules, 2020.