The Khyber Pakhtunkhwa Revenue Authority’s revenue collection grew by 20 percent in the first quarter (July to September) of the fiscal year 2021-2022 compared to the same period in the last fiscal year.

In a tweet, Provincial Minister of Khyber Pakhtunkhwa for Finance, Taimur Khan Jhagra, said that Khyber Pakhtunkhwa’s revenue authority collected 20 percent more tax year-over-year (YoY) in the first three months of the fiscal year (FY) 2021-2022. Moreover, the first quarter’s tax revenue is 60 percent more than what was collected in the same period two years ago.

1. @kpra_official is an organisation we can all be proud of in Pakhtunkhwa; increasing collections by almost 60% vs. two years ago & 20% vs. last year.

It is hard to increase tax collections while improving tax-payer perception. Crucially, KPRA has also done this successfully. pic.twitter.com/Fr4LoTN7yq— Taimur Saleem Khan Jhagra (@Jhagra) October 18, 2021

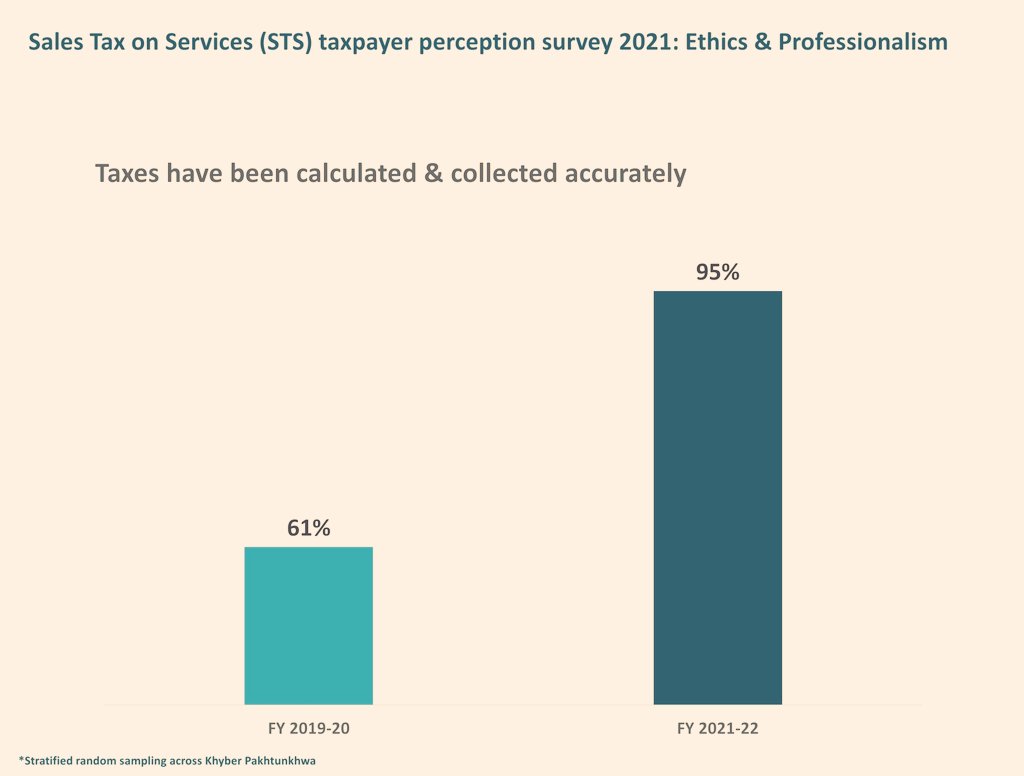

According to a survey, two years ago, only 61 percent of respondents had trust in the accuracy of tax collections. Today, that has increased to 95 percent.

Two years ago, 65 percent of taxpayers praised the ethics and professionalism of the Khyber Pakhtunkhwa Revenue Authority (KPRA) team. Today, that number stands at 89 percent.

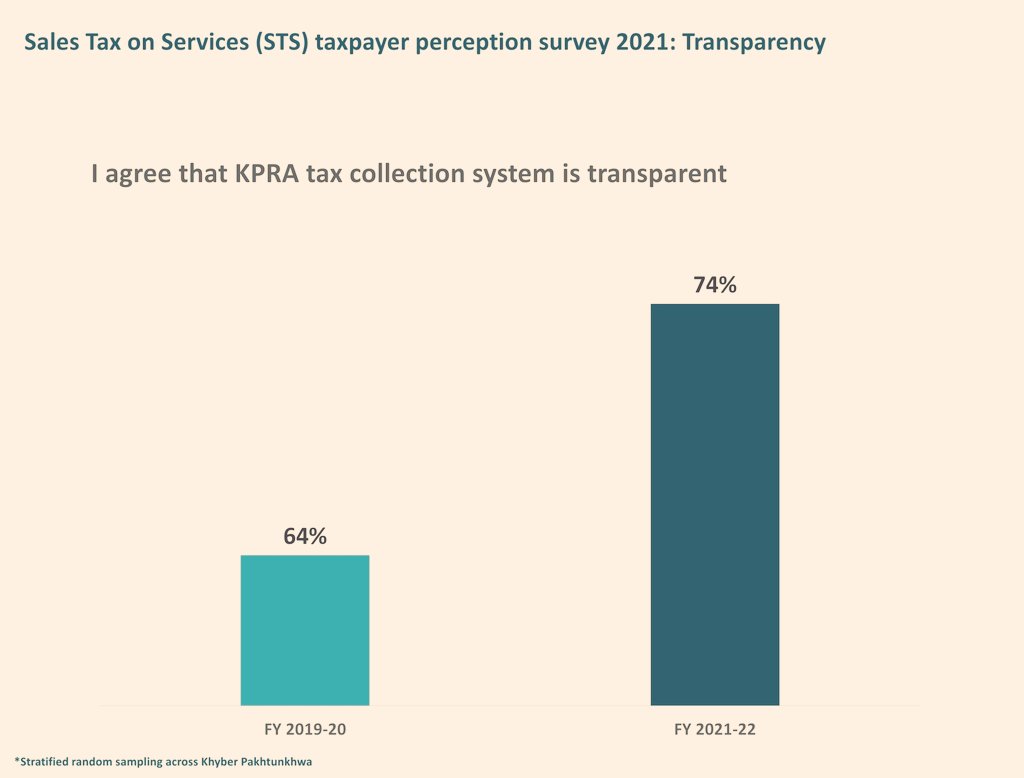

Similarly, two years ago, 64 percent of respondents praised the transparency of the revenue authority’s tax collection system. Today, that number stands at 74 percent.

Jhagra added that in February 2020, 47 percent of respondents had confidence that tax money was being spent on public welfare. That number has now risen to 60 percent.

He said that the KPRA’s success was due to consistency of leadership and ambitious goals. “Just three years ago, KPRA’s collection stood at Rs. 10 bln annually,” he said. “That will surpass Rs. 25 bln this year; driven by ambitious target setting”.

In addition, the authority’s focus on incentive-based pay and data-driven operations had improved its performance, Jhagra said.

“Getting Pakistan to have the right tax collection culture will take time,” he concluded. “There is still tons to do. But kudos to the @kpra_official team that has improved KP’s tax collection culture in leaps and bounds within two years, while massively improving collection.”