The Pakistani Rupee (PKR) slid to a new all-time low against the US Dollar (USD) and posted losses in the interbank market today. It lost 47 paisas against the greenback after hitting an intra-day low of Rs. 179.20 against the USD during today’s open market session.

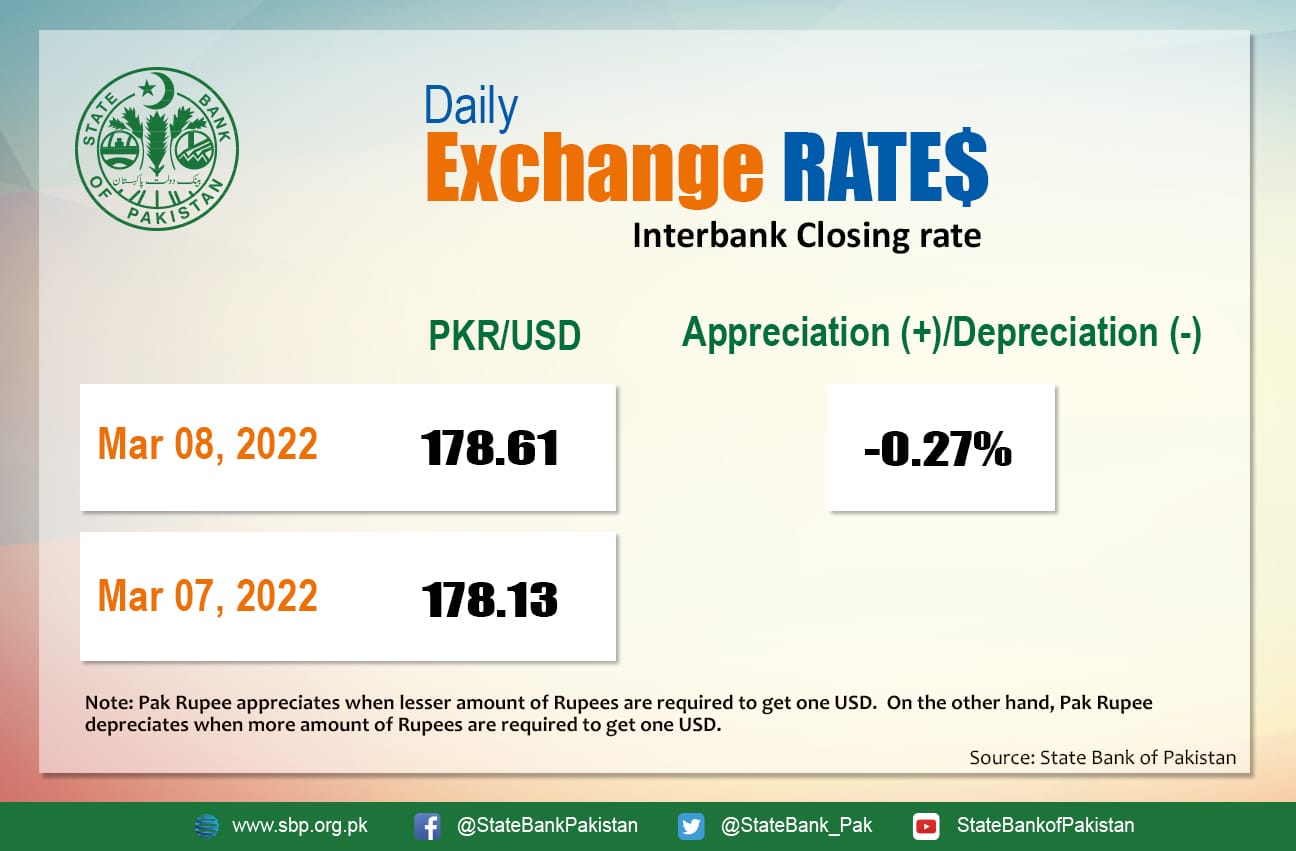

It depreciated by 0.27 percent against the USD and closed at Rs. 178.61 today after losing 64 paisas and closing at 178.13 in the interbank market on Monday, 7 March.

The Pakistani Rupee has so far lost 13.37 percent or PKR 21.07 against the US Dollar during the ongoing financial year. It has lost 1.18 percent on a calendar-year-to-date (CYTD) basis, and 14.74 percent since its high on 14 May amid high inflationary pressures and the uncertainty regarding the State Bank of Pakistan’s (SBP) monetary policy announcement.

PKR slides further, closing at all-time low of 178.61, down 0.27% DoD.

Today’s Closing : 178.61, -0.27% DoD

-1.18% CYTD

-14.74% since its CY21’s high (on 14-May-21)

-11.80% FYTD@StateBank_Pak#SBP #Pakistan #Economy #AHL pic.twitter.com/HpBDmTiPoB— Arif Habib Limited (@ArifHabibLtd) March 8, 2022

The rupee crashed to a fresh all-time low against the dollar today amid rising political tensions currently engulfing the nation. Pakistan Peoples Party’s long march (Awami March) is currently headed towards Islamabad a day after the party ‘gave’ Prime Minister Imran Khan 24 hours to resign, dissolve the assembly or prepare to be deposed via a no-confidence motion.

In terms of market expectations, analysts and experts have blamed a multitude of factors, including inflation and the Russia-Ukraine-infused economic blowbacks as reasons for today’s historic plunge. Yesterday’s horrid PSX drop has also added to extreme negative-vertical pressure on the rupee and cast fears among foreign investors who have lately been quite wary of locating capital for businesses in Pakistan.

Other Factors Responsible for the Rupee Spillover

Globally, oil rose to a 14-year high of $139 a barrel during late hours on Monday amid concerns about supplies as the United States and European governments pondered outlawing imports from Russia, the world’s second-largest oil merchant. In this regard, market players suggest a rejection of Russian oil would lead to catastrophic consequences for the global market, with rates rising as high as $300 per barrel. Consequently, emerging economies like Pakistan will most definitely face the full brunt of the exorbitant oil rates, potentially desecrating forex reserves.

Locally, the oil industry has projected respective hikes of 12.02 percent and 16.82 percent in ex-refinery prices of Motor Spirit (MS) Petrol and High-Speed Diesel (HSD), taking the burden of Price Differential Claims (PDCs) on both the products to Rs. 16.25 per liter and Rs. 20.69 per liter, respectively, during the last fortnightly of March.

The PKR reversed gains against some of the other major currencies and reported losses in the interbank currency market today. It lost 12 paisas against both the Saudi Riyal (SAR) and the UAE Dirham (AED) and 18 paisas against the Euro (EUR).

Conversely, it gained Rs. 1.06 against the Canadian Dollar (CAD), Rs. 1.38 against the Pound Sterling (GBP), and Rs. 2.10 against the Australian Dollar (AUD) in today’s interbank currency market.