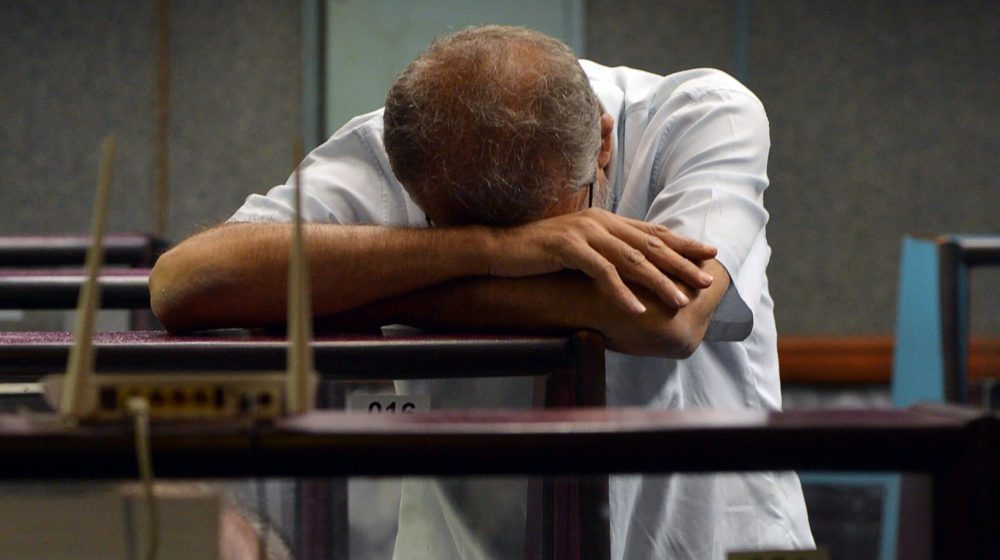

The government just introduced a ban on luxury imported items, a few of which are now becoming ‘necessities’, like Cadbury Dairy Milk, which is my favorite chocolate. I am really upset, which is why I sat down to write this piece.

Let us consider hardcore economics. The first phase of contractionary policy came when the State Bank of Pakistan (SBP) started increasing mark up rates after the higher inflationary pressure, which is now over 13 percent in 11 months (July-May 2021-22). Inflation spiked due to many other factors but also because of the oil price hike which pushed an increase in local fuel and electricity tariffs.

The Pakistan Tehreek-e-Insaf (PTI) government had consumed a huge increase in fuel prices to insulate the masses from inflationary impact. This puffed the fiscal deficit, and the government’s expenditures were much higher than income. This needs to be addressed forthwith but the government’s political expediency and skirting the taking of harsh measures escalated external payment issues.

Inflation was around five to six percent during the Pakistan Muslim League-Nawaz’s (PML-N) tenure. It began to swell and went out of control until recently. Subsequently, the demand for the introduction of a higher markup and macroeconomic instability crept in. This did not happen overnight; years went into attaining this excessive imprudence over various successive tenures.

We are now facing problems again, with a host of macro data that is out of hand.

The Economic Diagnosis

The second phase of contractionary economic policies was severely overdue at the time and the forex reserves nosedived just six months ago. They peaked at $27.2 billion in September 2021 and then began to drain. It continued to lose pace until early May 2022 at $16.1 billion, and $11 billion in forex reserves withered away in almost seven to eight months.

The first phase of the contractionary monetary policy started when the SBP raised the mark up after a rise in CPI inflation. Let us track the reasons behind this rapid descent.

A key contributor to the forex depletion is the trade deficit which was $39.3 billion, with imports touching $65.5 billion in the first 10 months of FY 2021-22. In 2017-18, the trade deficit recorded an all-time high at $37.7 billion for a full fiscal year, which was less than current year’s 10 months. Furthermore, remittances are around $26.1 billion in July-April 2022 (10 months).

Interestingly, exports are also $26.2 billion in the same period. Combined, remittances and exports are $52.3 billion, which is still $13 billion short of imports. The current account deficit is at $13.77 billion in 10 months of FY 2021-22. The forex reserves depletion is $11 billion (given above), depicting a close comparison of two key statistics. This has also put pressure on the currency.

The sharp decline of the rupee’s value against the dollar in the last two weeks (April-May 2022) to Rs. 201 per dollar from around Rs. 185 per dollar left the authorities no option but to introduce harsh measures. Resultantly, 800 detailed items (38 categories of items) were slapped with an import ban. This was not a knee-jerk reaction of the Ministry of Commerce but a well-thought-out exercise.

Prime Minister Shehbaz Sharif, with the Cabinet, accorded the approval for this imposition. The action was taken in cognizance that the World Trade Organization (WTO) may not object to it as its Safeguard Measures (WTO Rules) suggest that a country can opt for any protectionist measures when its macroeconomic stability is at stake due to its rising import bill.

Policy Distractions

Why were these measures introduced and why was such a situation created? Was it all done without any policy sense or was it just a natural catastrophe?

No. This was a clear policy distraction and a divide was observed among policymakers, as was discussed over the last few years, and many were against the International Monetary Fund’s (IMF) program altogether.

Growth and macroeconomic stability have been mutually exclusive or incompatible at many stages in the history of Pakistan’s economy. Essentially, Pakistan’s balance of payment becomes unstable when it crosses 5.5 percent growth. The Asian Development Bank (ADB) and the IMF had locked horns on this issue as well because the IMF is chiefly responsible for the balance of payment support and occasionally sacrifices growth for macroeconomic stability.

Why Good GDP is Bad

Pakistan had two consecutive years of GDP growth crossing above 5.5 percent, which had initially resulted in a huge expansion in forex reserves before squeezing back within a year. Economists thought that GDP growth should be a key objective at this stage in the country instead of stabilization.

A few more consecutive years of above 5.5 percent growth can bring more investment and further growth but cutting back for stabilization may not be a prudent move at this stage when such a momentum of growth is achieved after decades of low growth vicious circle and the grip of poverty. A huge debt trap, expanding energy losses, and a low tax base are still the economy’s other key challenges. Growth could be their panacea, but not stabilization.

Once stabilization is achieved, Pakistan will ultimately have to progress towards growth again. If so, why should we not make moves to achieve a higher growth path? Placing this argument here indicates a direction where the IMF and independent policy-makers differ on the given scenario as the IMF is all for stabilization.

So, Pakistan pursued a mix of paths for stabilization and growth, wherein it also lost purpose, and its forex reserves drained within less than a year. This left the government no other option but to ban the imports of certain ‘luxury items’. The interest rate/central bank mark up rate is already higher and likely to stay around 13 percent, which is another contractionary monetary policy due to the higher inflationary pace during the last year.

Corrective Measures

Experts advise that the local industrial base should be boosted to facilitate the production of the major imports. It is now high time for investors to set up their plants and machinery and start the local production of the goods in question. Many are doing so, many have done it, and many will follow suit. It is all about how they are provided facilities, confidence, and consistent policies to persevere and keep investing.

This will lead to reduced imports and may also help to increase exports, which will then reduce the trade deficit and will foster consistent improvement in the local GDP growth. Around a dozen local car manufacturers recently entered the local market, as did mobile manufacturers, so food and fashion manufacturers can also be brought in easily.

Reduced trade deficit and budget deficit help to improve the health of the economy. It is like controlling the diet of an obese person. The tax rates on any luxury items can be increased and tax revenue can be expanded but local manufacturing should be facilitated as well.

should have tried “You” local chocolate ! should have saved all the hassle of writing

It has been a long awaited decision by the common people that luxury items are banned completely, a decision made decades later than it should have been. While some people are worried about not being able to indulge in luxuries, others are facing difficulties to make ends meet on a regular basis because of the rising inflation.

If it brings solace, the rich can consider sacrificing their “luxuries” as their contribution for the good of the community.