Pakistan equities witnessed an alarming sell-off during the early hours of trade on Friday after the government suddenly increased the prices of petroleum products by Rs. 30 per liter.

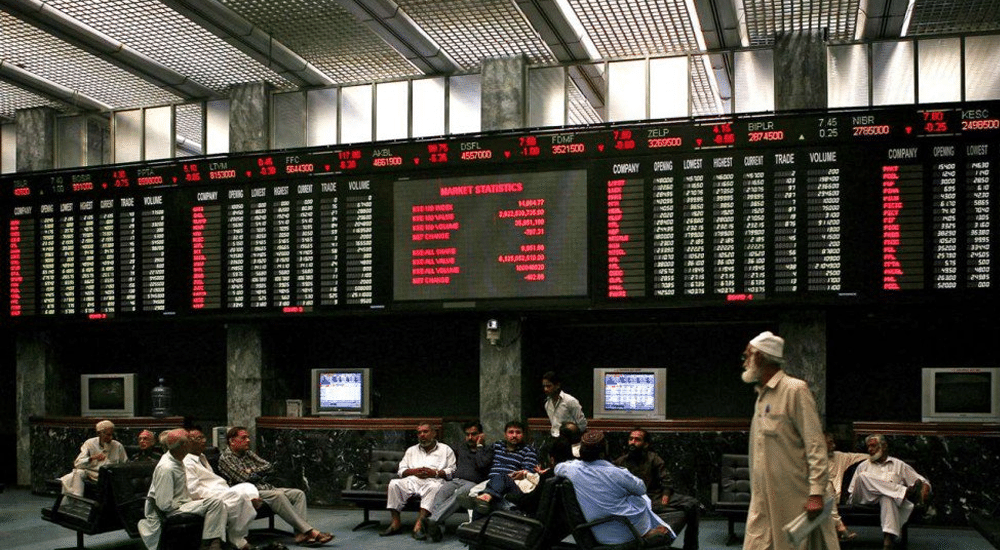

After opening trade at 42,250.28 points, the benchmark KSE-100 Index appeared bearish from the opening bell and immediately dropped into the red zone after shedding 755 points during the first two hours of intraday trade, with banking, cement, and fertilizer sectors the top negative contributors on the bourse at the time. At midday, the market had lost 1086 points.

By the end of the day, KSE-100 was closed at 41,314.88 points, down by 923 points or 2.23 percent.

The Assistant Vice President at JS Global, Muhammad Waqas Ghani, told ProPakistani,

Moody’s downgrade of Pakistan from ‘Stable’ to ‘Negative’ fueled the bearish sentiments of the already hesitant investors. The government finally took tough measures this week for the restoration of the IMF program, reflecting the decision of hiking POL prices through withdrawal of PDC and increase in electricity tariff.

He added, “However, any further increment in fuel prices through the imposition of sales tax and PDL would take inflation estimates to around 19% paving the way for a rate hike. The recent T-bill auction and secondary yields also point toward another round of rate hikes. All this and a tough budget expected next week would likely keep markets under pressure for some time.”

During live trade, local investors opted to offload their positions after the government decided to increase fuel prices for the second time in a week, potentially fulfilling an overriding pre-condition set by the International Monetary Fund (IMF) for the resumption of its loan program.

Around 225 million shares were traded at the exchange, with 268 of the 347 active scrips declining in value, only 67 advancings, and 12 remaining unchanged.

According to Capital Stake, overall market volumes appreciated from 156.89 million shares in the last session to 220.87 million shares. K-Electric Limited (KEL -6.46 percent), Pakistan Refinery Limited (PRL -3.23 percent), and Cynergyico PK Limited (CNERGY -4.63 percent) led the volume chart. The scrips had 30.04 million shares, 21.52 million shares, and 20.26 million shares traded, respectively.

Top Volumes

| SCRIP | PRICE | HIGH | LOW | CHANGE | VOLUME |

|---|---|---|---|---|---|

| KEL | 2.47 | 2.65 | 2.40 | -0.16 | 30,062,500 |

| PRL | 17.37 | 18.30 | 17.15 | -0.58 | 21,760,817 |

| CNERGY | 5.16 | 5.55 | 5.11 | -0.24 | 20,259,734 |

| PAEL | 15.34 | 16.39 | 15.10 | -0.98 | 9,997,500 |

| PIBTL | 5.93 | 6.37 | 5.56 | -0.45 | 8,539,500 |

| WTL | 1.48 | 1.50 | 1.45 | 0.00 | 8,240,500 |

| SILK | 1.40 | 1.43 | 1.35 | -0.04 | 7,799,000 |

Sectors dragging the benchmark KSE 100 index lower included Banking (184.11 points), Cement (130.35 points), and Fertilizer (96.02 points). Company-wise, Millat Tractors Limited (MTL 66.93 points), Habib Bank Limited (HBL 57.63 points), and Fauji Fertilizer Company Limited (FFC 46.05 points) were the top negative contributors.

The Refinery sector lost 4.51 percent in its cumulative market capitalization. Pakistan Refinery Limited (PRL 3.23 percent), National Refinery Limited (NRL 3.43 percent), and Attock Refinery Limited (ATRL 6.35 percent) all closed in the red.

The forex market has also remained under pressure with PKR/USD closing at 197.92 in the interbank today after the government again increased the prices of petroleum products by Rs. 30 per liter. In the past seven days, the government has hiked fuel prices by Rs. 60, which can be considered the most dramatic petroleum price shift in Pakistan’s near 75-year history.

Equity markets around the globe also showed a mixed trend. Crude oil prices slipped lower with WTI crude oil price falling by 0.29% to $116.53 while Brent crude oil was down by 0.20% to $117.38.