2022 was another bad year for Pakistani stocks, with the market value (market capitalization) of listed companies at PSX falling 17 percent to reach Rs. 6.4 trillion.

According to Topline Securities, the equity market continued its fall this year. In USD terms, the market plummeted 35 percent to reach US$ 28 billion.

Topline CEO Mohammad Sohail said, “Another bad year for Pakistan #StockMarket. Index down 11% in 2022. Last 6 years worst period for investors. In long term, stocks have performed well with [a] 19% annual gain a year. Though 2023 will be a tough year, I remain long-term positive on Pakistan equities”.

Another bad year for Pakistan #StockMarket. Index down 11% in 2022. Last 6 years worst period for investors. In long-term stocks have performed well with 19% annual gain a year. Though 2023 will be a tough year, I remain long term positive on #Pakistan equities pic.twitter.com/g2jCAGjrUK

— Mohammed Sohail (@sohailkarachi) December 24, 2022

Top Sectors

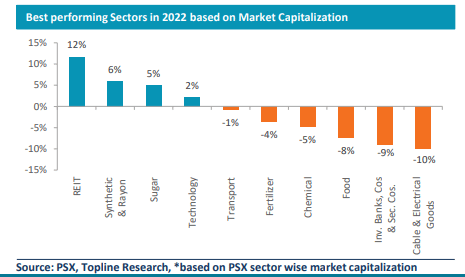

Real Estate Investment Trust (REIT), Synthetic & Rayon, and Sugar were the top-performing sectors in 2022. Despite bad market conditions, their market cap has increased by 12 percent, 6 percent, and 5 percent respectively.

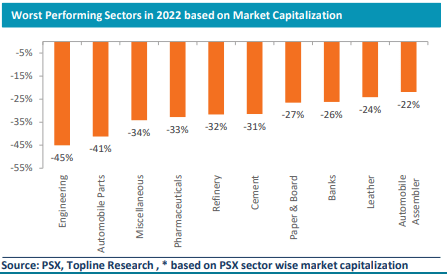

The technology sector was up 2 percent and outperformed the market despite a fall in globally listed technology stocks. On the other hand, Engineering, Automobile Parts, and Miscellaneous sectors remained the worst-performing sectors posting a decline of 45 percent, 41 percent, and 34 percent, respectively.

The REIT sector, which has only one listed company, gained in 2022 due to stable dividend yield coupled with changes in regulations on REIT investment for banks. To recall, the State Bank of Pakistan (SBP) recently allowed banks to count their investments in shares issued by REIT towards achieving housing and construction finance targets.

Synthetic & Rayon also posted a strong performance led by a rally in Ibrahim Fiber Limited (IBFL). Sugar sector performance was led by JDW Sugar Mills (JDWS) which announced a buyback.

Worst Sectors

The engineering sector (mainly steel-related companies) was severely impacted due to the economic slowdown and lower construction activity. The automobile parts sector also remained amongst worst performing sectors primarily due to import restrictions, high financing rates, and demand slowdown.

The report notes sectors with a minimum market capitalization of US$ 100 million adjusted for new listings including Adamjee Insurance (AICL), and Telecard Limited (GEMSNL).

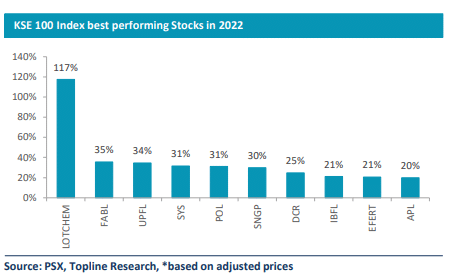

Stocks: LOTCHEM Doubled While AIRLINK Was Down Substantially in 2022

Lotte Chemical (LOTCHEM) was the top-performing stock in the market in 2022 where it gained more than 100 percent. Investors were excited over the potential sell-off by Lotte Chemical Corporation South Korea (a parent company of LOTCHEM) and the subsequent public offers for minority shareholders.

LOTCEHM was followed by Faysal Bank (FABL) and Unilever Pakistan Foods (UPFL). The strong stock performance by FABL is on an announcement to convert itself into an Islamic Bank followed by a special dividend. Similarly, UPFL stock was up 34 percent as the company posted strong profitability growth of 33 percent YoY in 9M2022.

Systems Limited (SYS), Pakistan’s largest listed IT firm remained amongst the top-performing stocks for the third consecutive year as the company continued to post strong profitability growth in spite of economic challenges.

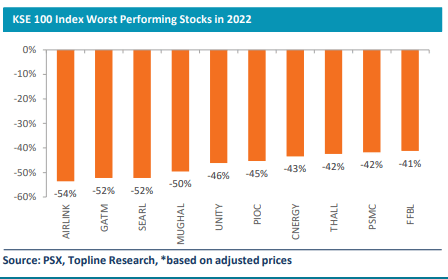

Air Link Communication (AIRLINK) declined 54 percent due to low profits led by lower volumetric sales. Gul Ahmed Textile Mills (GATM) also reported a decline of 52 percent amid a slowdown in textile exports.

Searle Company Limited (SEARLE) was down 52 percent due to lower profits led by falling gross margins driven by a significant jump in raw material cost and the company’s inability to immediately pass full impact on to consumers.