Given Pakistan’s huge external debt issues and worsening domestic economic clout, another International Monetary Fund (IMF) program remains the only option to save the economy.

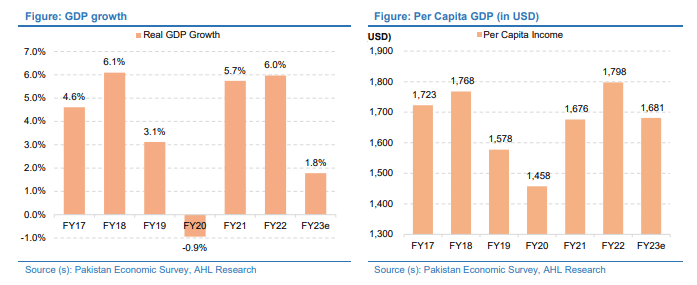

According to Arif Habib Limited’s (AHL) annual strategy report for the calendar year (CY) 2023, Pakistan’s GDP growth rate is expected to be slashed by more than 4 percent, with a combination of below-par exchange rate, high inflation, low tax revenue, and post-flood spending expects a tight monetary policy stance to keep things tough throughout the year.

Economic Outlook

Pakistan has a total external debt servicing obligation of USD 23 billion in fiscal year (FY) 2022-23, of which USD 6 billion has been repaid, and, USD 4 billion rolled over. Moreover, with further repayment obligations of 75$ billion during FY24-26, the external account remains in a tight spot.

The government estimates disbursements of USD 103 billion during the next three years to finance the repayments and the current account deficit using a combination of bilateral, private debt, and multilateral flows. To unlock these flows, it is pertinent that Pakistan stays engaged with the IMF for the long term.

GDP growth is expected at 1.78 percent during FY23 against 5.97 percent last year, while the current account deficit (CAD) is expected to narrow down to USD 7.2 billion (2.0 percent of GDP) in FY23, according to the report.

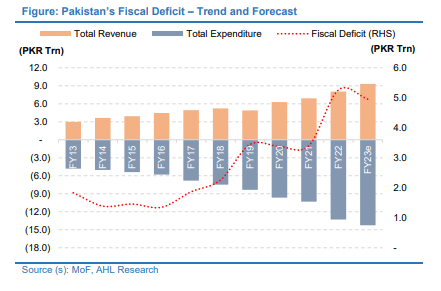

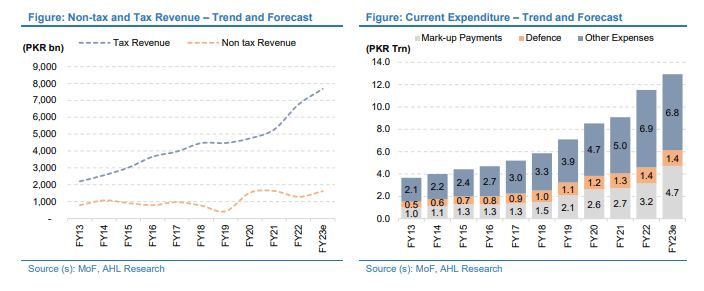

Conversely, a combination of lower revenues, higher flood spending, and rising borrowing costs are likely to keep the fiscal deficit around Rs. 5.0 trillion (5.9 percent of GDP).

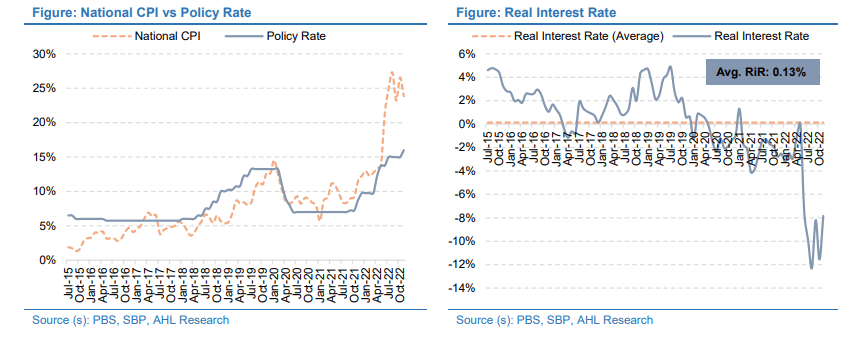

The report forecasts a tight monetary policy stance to continue until August 2023, when inflation is expected to ease off to 11-13 percent, providing room for a rate cut. Cost pressures, supply shocks, electricity and gas tariff hikes, and a weaker Rupee were the primary triggers for higher CPI. With international commodity prices down and the high base effect kicking in, inflation should come down, in 2023.

The report also sees Pakistan completing the current program with another program post-general elections which will be essential to address both long-term structural issues as well as external financing needs.

PKR is Artificially Stabilized but Further Depreciation is Likely

PKR/USD has stabilized over the past few months following administrative measures undertaken by the SBP including limits on LC opening, bans on certain imports, and curbs on dollar repatriation to keep dollar outflows in check. This has, however, created a vibrant grey market with a 10-12 percent gap between official and unofficial rates hurting official remittances in the process (10 percent decline in 5MFY23).

The report does not see these measures as sustainable and expects the SBP to gradually loosen administrative measures as the IMF’s 9th review concludes and other flows materialize. Against this backdrop, the data forecasts the PKR/USD to depreciate to 250/263 between June-December 2023.

Revenue Targets Likely to be Missed

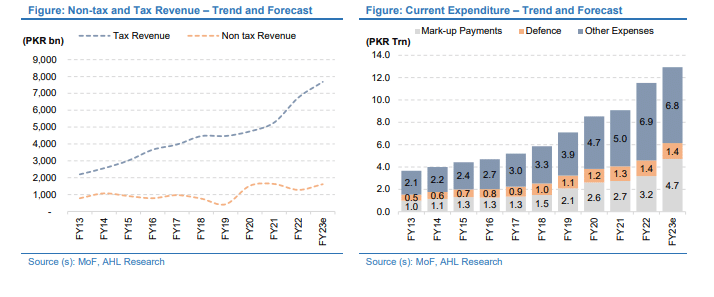

One of the key concerns on the fiscal front is the government’s revenue target aiming to increase overall revenue (gross revenue receipts) by 30 percent YoY in FY23, with the hope that FBR tax collections will rise to Rs. 7.4 trillion. Tax-GDP ratio is projected at 9.5 percent, compared to 10.1 percent last year.

This view is a bit over-optimistic, given the slow reforms on the tax front. In line with the conditions set forth in the recent IMF negotiations, the government has aimed for an increase in the overall revenue target on the back of higher FBR tax collections as well as non-tax income.

These goals will also solidify the government’s medium-term target of expanding the tax base, streamlining the collection process, and formalizing the economy, in an effort to minimize budget deficits. While tax revenue growth has been on track thus far, the report sees risks to the downside emanating from a sharp slowdown in economic activity and a prolonged curb on imports. Moreover, it expects a shortfall in non-tax revenue targets particularly Petroleum Development Levy (PDL).

Another Mini-Budget Likely

To recall, in its latest seventh and eighth review report, the IMF stated that the government has committed to activating contingency measures as soon as monthly data show signs of underperformance against the (IMF) program revenue targets, including an immediate increase in GST on fuel as a prelude to reaching 17 percent; further streamlining of GST exemptions including on sugary drinks and other unwarranted exemptions, and/or increasing Federal Excise Duty on cigarettes and other RDs, if required.

This calls for another mini-budget due to the emerging threat of revenue shortfall; we believe the government would exercise all aforementioned contingency measures in addition to revising up the GST rate from the current 17 percent. The research indicates that every 1 percent increase in GST from here on out will result in additional tax collection of around Rs. 85 billion.

Survey Results

According to the report’s survey results, the majority of the respondents expect a continued economic slowdown in 1HCY23. Moreover, inflation is expected to remain elevated in FY23 while the majority expects the interest rate to close in June 2023 in the range of 15-16 percent. Current account expectations are in-line with SBP’s expectation of 3 percent of GDP.

On currency outlook, the market expects parity to settle above Rs. 250/USD by FY23 end. Lastly, the respondents expect the KSE-100 index to close CY23 somewhere between the 45,000-50,000 level, which is another over-optimistic perception.

Do you expect 2023 to be a better year than 2022? Let us know in the comment section below.