The Pakistani Rupee (PKR) fell against the US Dollar (USD) and posted losses during intraday trade today.

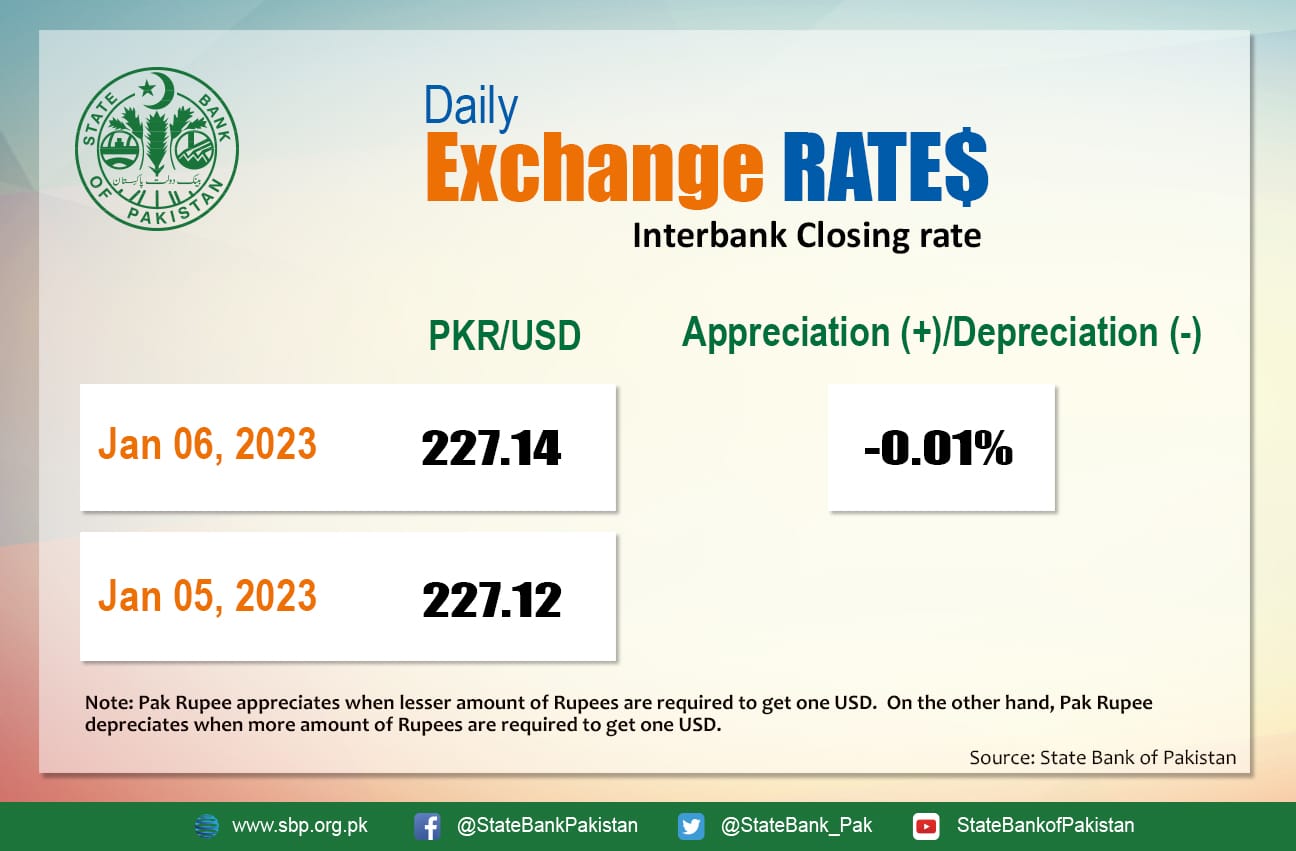

It depreciated by 0.01 percent and closed at Rs. 227.14 after losing two paisas. It quoted an intraday low of 228.475 against the greenback before close.

The local unit was all red against the greenback 13th day in a row and opened trade at 227.00 in the open market. By midday, the greenback moved lower against the rupee. After 1 PM, the local unit was still bearish and stayed at the 227 level against the top foreign currency before the interbank close.

The rupee reported losses against the US Dollar today after news that Prime Minister Shehbaz Sharif on Thursday personally reached out to International Monetary Fund (IMF) Managing Director Kristalina Georgieva and implored her to relax conditions regarding energy price increases and the imposition of new taxes.

The phone call came a few days ahead of a face-to-face meeting between the premier and the head of the IMF, which is expected to take place on the sidelines of the Geneva Conference.

In any case, Shehbaz Sharif’s call to the IMF executive indicates that the finance ministry has failed to woo the lender to play a few cards in Pakistan’s favor.

In what emerged to be an alternative to the IMF, Finance Minister Ishaq Dar earlier expressed hope for a $3 billion second bailout from Saudi Arabia within days, vowing to raise funds through the sale of assets to supplement the critically low foreign exchange reserves. However, Saudi cash assistance can only postpone the default; it cannot solve the problem indefinitely.

Globally, oil prices rose on Friday in hopes of increased Chinese demand, but the broader global economic outlook kept crude benchmarks on track for a weekly loss. Earlier in the session, both contracts rose by more than $1.

China, the world’s largest crude oil importer, anticipates that passenger traffic by road, rail, water, and air will more than double during the upcoming Lunar New Year holidays compared to the same period in 2022.

At 4:25 PM, Brent crude was up by $0.38 or 0.48 percent to reach $79.07 per barrel, while the US West Texas Intermediate (WTI) was also green at $74.11 per barrel.

Further support came from a larger-than-expected drop in US distillate inventories in the week ending December 30, 2022. On a weekly basis, however, both the Brent and WTI contracts were set to fall by more than 7 percent from the previous week, weighed down by fears of a global recession.

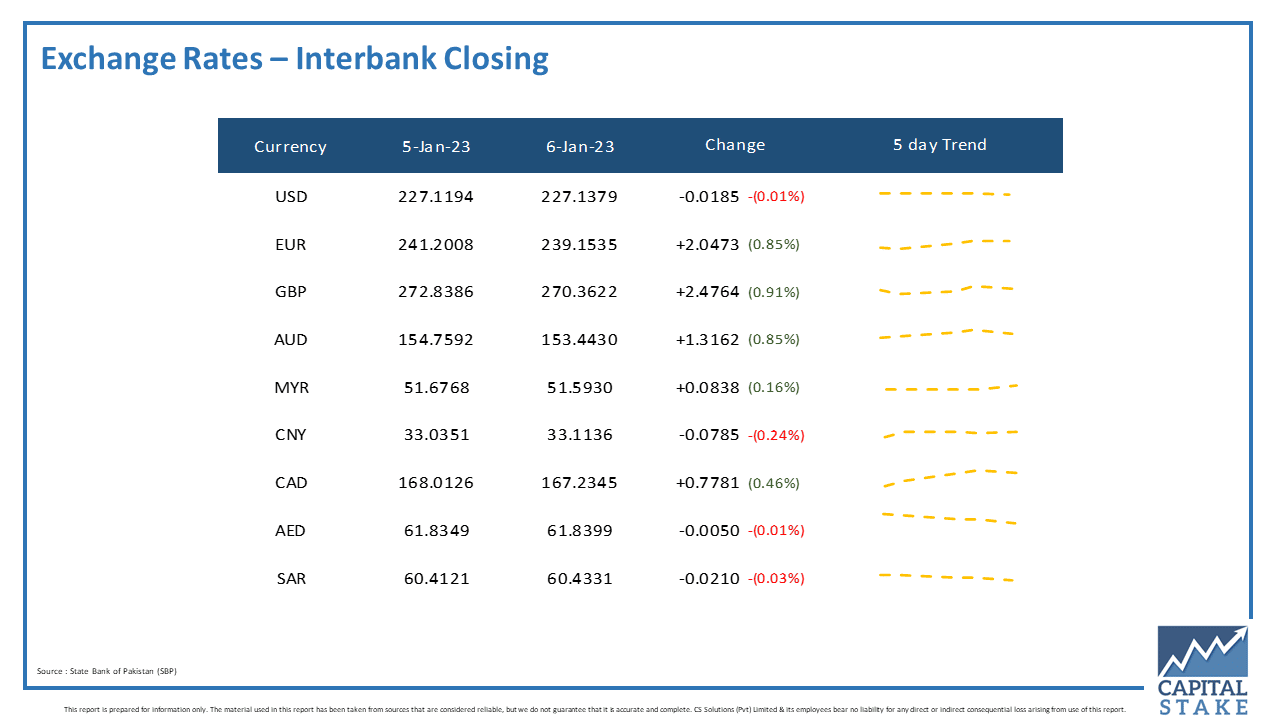

The PKR was bullish against most of the other major currencies in the interbank market today. It gained 77 paisas against the Canadian Dollar (CAD), Rs. 1.31 against the Australian Dollar (AUD), Rs. 2.04 against the Euro (EUR), and Rs. 2.47 against the Pound Sterling (GBP).

Conversely, it held out against the UAE Dirham (AED) and lost two paisas against the Saudi Riyal (SAR) in today’s interbank currency market.