Consumer Price Inflation (CPI) in Pakistan will likely hit a new record high of 37.27 percent in May as current workings suggest another sequential increase of 1.07 percent month-on-month (MoM).

According to a report by JS Global, the surge is a result of higher increase in food prices, which is 30 percent of the CPI basket.

The report further expects food inflation to clock in at 47.99 percent year-on-year (YoY) this month, with a sequential increase of 0.81 percent MoM, finally pacing down from its recent run rate of ~4.5 percent MoM since the past four months.

At the expected projection of 37.27 percent, current workings suggest another sequential increase of 1.07 percent MoM, lower than the average 3.3 percent MoM increase witnessed in the past four months, however, closer to the usual 0.9 percent MoM increase witnessed in ordinary times. This would take the expected headline CPI for July-May 2022-23 (11MFY23E) to 29.03 percent.

As per the report, the recent decline in petroleum product prices is not expected to reflect in readings for May-2023. If the same is included, the report’s estimates decline by 10 basis points.

On the core front, it expects the Non-Food and Non-Energy (NFNE) inflation to clock in at 30 percent, another record-high reading, with an MoM increase of 2.7 percent.

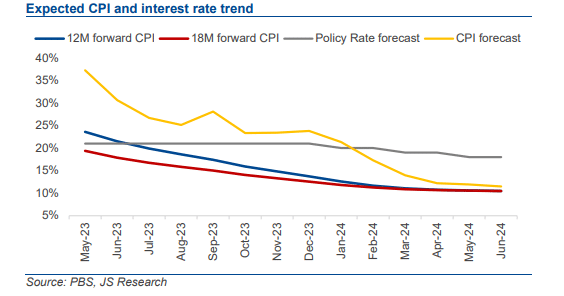

Forward-Looking CPI Signals Monetary Easing in 2HFY24

The report expects May-2023’s reading to be the peak for inflation readings, after which despite an MoM increase, it sees the YoY trend to soften on account of the base effect from June 2023.

“As we expect FY23E CPI to average at 29 percent, an MoM average trend of 90bp is expected to average FY24F CPI at 20 percent. On the core front, we expect NFNE pace to decline from 20.4 percent YoY in FY23E, to 14.8 percent YoY in FY24F,” it added.

The same is also expected to lead to monetary easing during 2HFY24.

To recall, CPI, on a 12-month forward basis averages at 23.6 percent as per estimates, reflecting ~250 basis points negative real interest rates from the current Policy Rate of 21 percent. On an 18-month forward basis, the average clocks in at 19 percent, reflecting positive real interest rates of 200 basis points.