If you’re planning on pursuing higher studies with a degree of your choosing, having some financial backup is essential. Whether it’s an overseas or domestic institution, getting an MS or PhD certification is quite the expensive pursuit. Here’s how to get a loan from a bank for higher studies in Pakistan.

Currently, we’re looking at a minimum 6-figure budget for your enrolment.

Do check Applying For Foreign Scholarships.

Pursuing higher studies in Pakistan is getting tough day by day with the increase in academic expenses. This is an obstacle in the way to improve the literacy rate which has already fallen to 58%.

This is when study loans come handy as they are a source of relief for students to support their dreams of pursuing higher education. These loans provide much-needed assistance to the students who are aiming to achieve professional degrees from both local and international institutes.

The concept of taking student loans is very popular among students living or studying in developed countries including America, England, Australia, and Germany. However, In Pakistan, the process is still under heavy developmental schemes.

Organizations are now providing financial aid to various categories of students, and the future looks bright!

Let’s have a look at the current list of financial institutions – or banks – that offer student loans for higher education.

National Bank Of Pakistan | NBP Student Loans

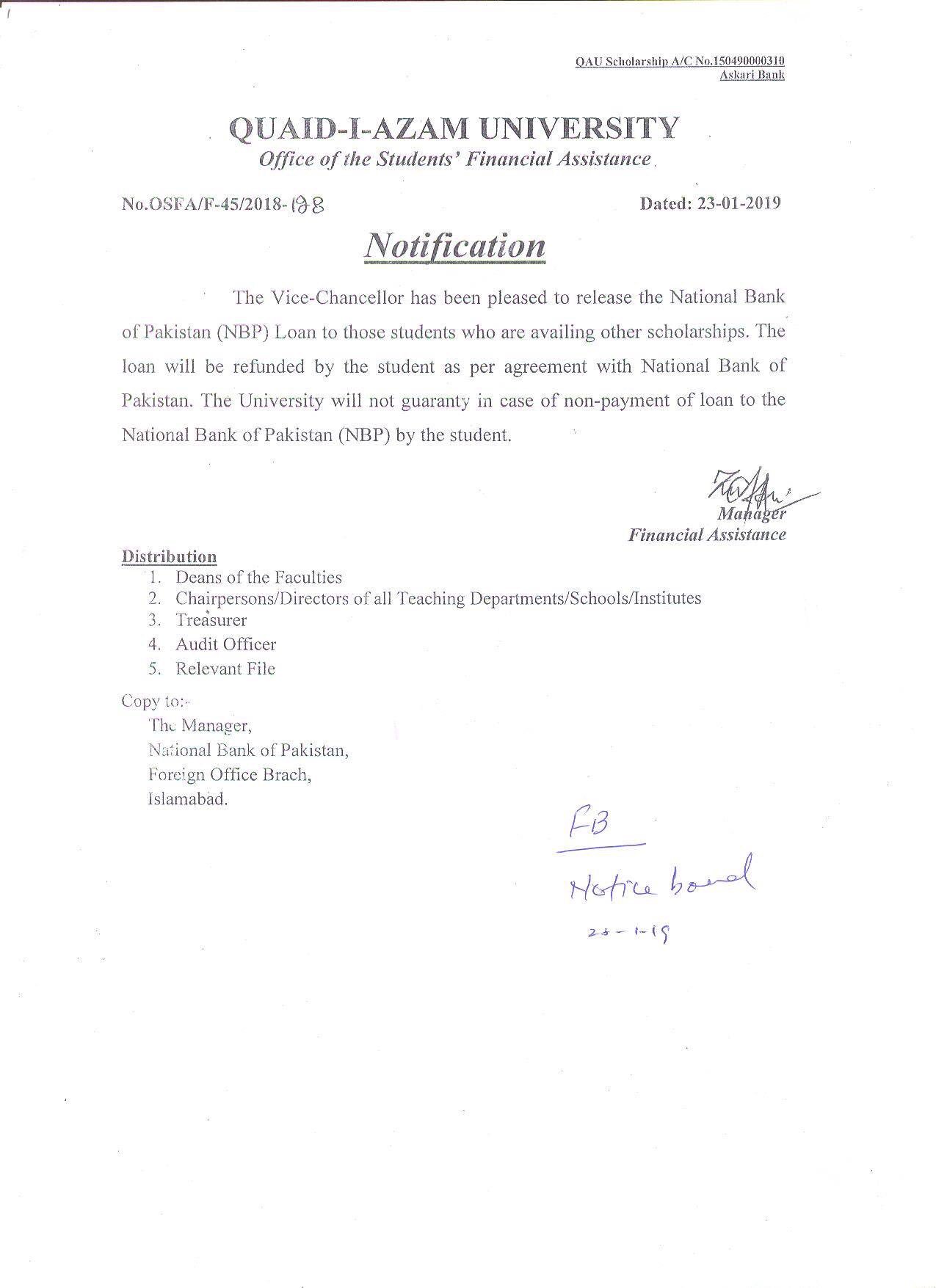

In collaboration with the Government of Pakistan, NBP has launched a student loan scheme in partnership with major commercial banks.

Banks that are in collaboration with the SLS (Student Loan Scheme) program are:

- Habib Bank Limited (HBL)

- United Bank Limited (UBL)

- Muslim Commercial Bank (MCB)

- Askari Bank Limited (ABL)

SLS is administered by the NBP and offers interest-free loans to students who require financial support for higher studies. Applicants are required to meet the prescribed criteria to be eligible for this scheme.

These loans are paid either directly to the university as the tuition fee and boarding expenses, or to the student in the form of textbooks. QAU was quick to inform its student body regarding upcoming proceedings for the program:

How To Get A Loan | Application Criteria

Please note: The students who avail the loan will have to repay it back in a 10-year duration that will begin a year after they’ve graduated or 6 months into employment.

- Students must have at least 70% marks in their recent exams.

- The applying student must get admission to a public sector university that covers areas of study including Engineering, Electronics, Mathematics, Physics, Medicine, Computer Sciences, Natural Sciences, Business Studies, Chemical Technology, Agriculture, Chemistry and Islamic Jurisprudence.

- The student in need of loan must be 21 years old or younger for bachelor programs and 31 years or younger for master’s programs.

- The student must be 36 years old or younger to apply for Ph.D. programs.

To fill the application form, please visit this site. Provide required details and submit important documents online. The form also has guides on how to post everything via mail.

Personal Loans | Standard Chartered Bank

With exciting schemes, easy repayment options and competitive interest rates, the Standard Chartered Personal Loan is a hassle-free way to fulfil your needs.

Whether you need cash to design your dream home, give your children the best education, make your daughter’s wedding the talk of town, or take that dream vacation with your loved ones; Standard Chartered Personal Loans is a service you can’t ignore.

Key Features | How To Get A Loan From A Bank For Higher Studies In Pakistan

Key features of the Standard Chartered Personal Loan:

- Loans are available with range of repayment options from one to five years inclusive of extra charges.

- You can borrow a maximum 2 million PKR at a time.

- Interest rates are market competitive and properly supervised.

- No security, collateral or guarantors required.

- Documentation is easy and processing is quick.

- There’s a top-up facility on existing Personal Loans With Standard Chartered Bank. Visit their site for detailed info.

Documentation requirements:

- A valid CNIC

- Copy of Valid CNIC

- Salary Slip/Proof of earning

SCB’s rates vary with gross salary mark-ups, as shown in the image above^.

The bank offers a simple instalment calculating table for interested parties. Here it is:

For Terms and Conditions, please read the bank’s take on personal loans.

These loans are paid either directly to the university as the tuition fee and boarding expenses, or to the student in the form of textbooks.

Other Banks | How To Get A Loan From A Bank For Higher Studies In Pakistan

- Bank Alfalah: Bank Alfalah provides loans for Pakistani students who are willing to study abroad. The bank provides assistance in the required currency according to a standard YoY plan. This amount is provided to cover:

- Tuition fee,

- Living expenses, and

- Application charges.

These loans are paid either directly to the university as the tuition fee and boarding expenses, or to the student in the form of textbooks.

The student must submit required documents at any branch of Bank Alfalah to qualify for a loan program.

2: Habib Bank ltd: The bank provides a loan-sum money against a fixed deposited amount to the student. The interest rates on each loan depend on what type of re-imbursement schedule is drafted between the bank and student.

Although banks have certain criteria for granting personal loans in the student-pay category, it isn’t difficult to get one.

Your credit history is a record of how you’ve managed your credit over time. It includes credit accounts you’ve opened or closed, as well as your repayment history over the past 7-10 years. This information is provided by your lenders, as well as collection and government agencies, to then be scored and reported.

To find out whether you’re ready to take on new debt, you can measure your credit status against the criteria that lenders use when they review your application. When you apply for a new credit account, lenders evaluate your application based on key factors commonly known as the 5 Cs of Credit.

Note: A good credit score shows that you’ve responsibly managed your debts and consistently made on-time payments every month.

Your credit score matters because it may impact your interest rate, term, and credit limit. The higher your credit score, the more you may be able to borrow and the lower the interest rate you could receive.

Well, there you have it guys! This was all about how to get a loan from a bank for higher studies in Pakistan. We included extra information for ease of understanding for everyone. If you have any questions, feel free to leave a comment in the section provided below.

Good luck!

Hi sir can you please tell me about bank alfalah loan scheme .Do they need any collateral for providing loan