A loan is when money is given to someone in exchange for repayment at a custom rate of principal amount + interest. You agree to terms before receiving amount in full, although it depends on which bank you’re going to go through. Here’s how to get a loan from Pakistani Banks. Get in!

Related: Get Loan Relief On Credit Cards | Housing | Auto Finance | Personal Loan

A loan may be secured by collateral such as mortgage, or it may be paid off using credit card systems. Again, it depends on the type of bank you decide to go through.

The following description provides apt detail regarding loans from banks in Pakistan. Each talking point is succinct and to the point.

How To Get A Loan From Pakistani Banks | Standard Chartered

Featuring exciting schemes, easy repayment options and competitive interest rates, the Standard Chartered Personal Loan is a hassle-free way to fulfil your financial needs.

Features

- Loans available with range of repayment options from 1-5 years

- Borrow up to PKR 2 million

- Competitive interest rates

- No security, collateral or guarantors required

- Easy documentation and quick processing

- Top up facility on existing Personal Loans with Standard Chartered

Eligibility

You only require a valid copy of your National Identity Card – CNIC – and Salary Slip.

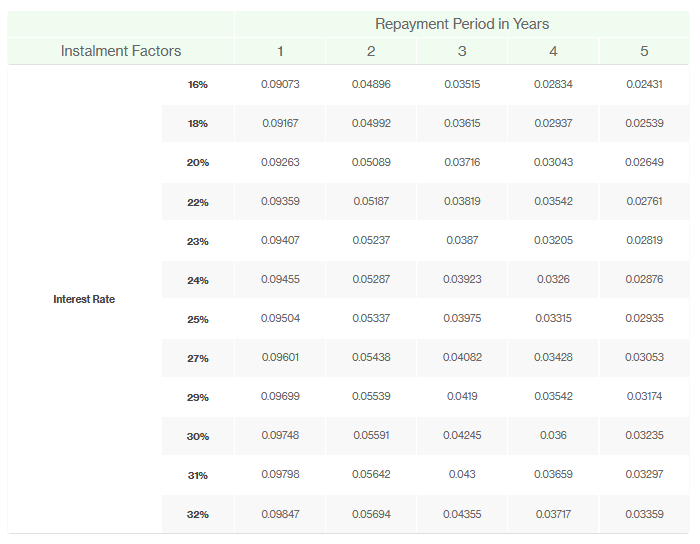

Installment Calculation

To calculate your payment installments on a Personal Loan, simply multiply the amount you want to borrow by the relevant number below:

Additional Charges | FAQ

Read their Terms & Conditions to understand your position.

Apply here to sign up and apply for a personal loan at Standard Chartered!

For Business Persons and Self-Employed Professionals, minimum age is 21 years at the time of application. Maximum age should not be more than 65 years at the time of financial maturity.

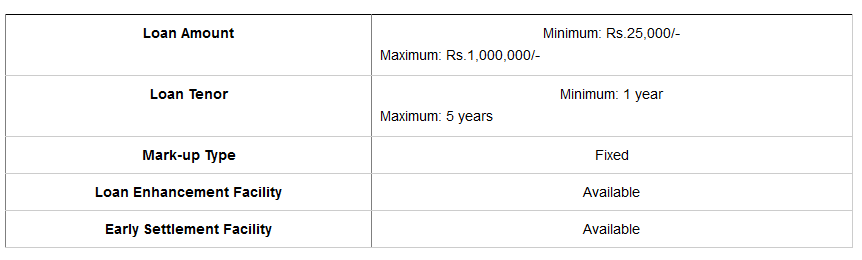

Personal Loan | Internet Banking | HBL

Habib Bank Limited offers financial assistance in a variety of ways to its customers. With their tentative loan schemes in full effect, HBL offers a flexible loan facility for everyone.

Features

- Financing limit between PKR 25,000 to PKR 3,000,000

- Repayment tenure(s) ranging from 12 to 60 months

- Availability of top-up facility after every 12 months

- Life insurance coverage

Criteria

- Salaried individual whose salary is being credited to HBL account

- Applicant to be 21 years or more at the time of loan application and 60 years or less at the time of loan maturity

Conditional Documentation

- Verified copy of CNIC

- Verified copy of salary slip

- Letter from employer (if applicable)

Dear readers, HBL’s Terms & Conditions apply all the way!

Visit this link and apply NOW for a personal loan from HBL.

Home Convenience | Bank Alfalah Personal Loan

With Alfalah Personal Loans, get customized financing without any collateral attachments!

Basic Features

- Financing facility starting from PKR. 50,000 up to PKR. 2 Million

- Tenure ranging from 1 Year to 5 Years

- No security/collateral requirement

- Complimentary orbits on sign-up

Offerings On Loan | Documents Needed | Eligibility | Schedule Of Charges

Why Alfalah? | How To Get A Loan From Pakistani Banks

- Hassle-free processing with minimum documentation

- Affordable mark-up rates

- Partial prepayment option; visit here for more info

- Loan top-ups/enhancements for more financing

- You can top up the loan amount based on revised income and repayment history

- Multiple repayment options

- Non-Checking Account

- Direct Debit

- Cross Cheque

- ATM

- Internet Banking

- Mobile Banking

- Cash Payment at branches

- Multiple income sources allowed for higher loan limits

- Balance transfer facility for outstanding personal loan(s) and credit card(s)

- Special Discounts and Minimal Documentation for existing Bank Alfalah account holders and customers

In order to apply, visit this link, scroll down, and get a Bank Alfalah Personal loan.

Faysal Bank | Lending

Lending

- Option A (recommended): Faysal Flexi Credit

- Local Relief: Faysal AutoCash

- Faysal Personal Installment Loan

- Faysal Car Finance

Mortgage

- Faysal Home Finance

According to Faysal Bank’s lending manifest, the process for taking loans is pretty much straightforward. From simple banking solutions to high value investments, you can choose one that best suits your requirements.

For Business Persons and Self-Employed Professionals, minimum age is 21 years. Maximum age should not be more than 65 years at the time of financial maturity.

To apply for a Faysal Bank Loan, click on APPLY NOW and provide all details in spaces provided.

Muslim Commercial Bank | MCB

MCB Personal Loan is a Fast, Affordable and Easy option to meet your immediate financing needs.

Key Features

- Minimum Loan Amount: PKR 50,000

- Maximum Loan Amount: Up to PKR 2 Million

- Tenure: 1 year to 5 years

- No collateral required

- No processing fee if loan is not approved

- Approved Cities: Karachi, Lahore, Rawalpindi, Islamabad, Faisalabad, Hyderabad, Multan and Peshawar.

Eligibility

- Salaried individuals working in the Private sector, Government of Pakistan and Armed Forces

- Any person who has taken a credit card, personal loan or an overdraft facility from any bank in Pakistan.

- An existing MCB Car4U customer who took the MCB car loan more than 1 year ago

- Any MCB salaried customer whose salary is being credited in MCB for more than a year

- Minimum Net monthly Salary

- Salaried Customers: PKR 30,000 to PKR 40,000/- depending on employer

- Govt. Officers/ Armed Forces: PKR 30,000

Prime Customer Eligibility

Salaried: if you have a Monthly Gross Salary of over PKR 500,000

Initial Documents

- Copy of Salary slip/ Proof of income

- Copy of Valid CNIC

For further information, please call MCB Phone Banking at 111-000-622 (MCB Bank) or visit your nearest MCB Bank branch or click here.

For Business Persons and Self-Employed Professionals, minimum age is 21 years. Maximum age should not be more than 65 years at the time of financial maturity.

Note: All loans shall be processed and approved as per MCB Bank Limited sole discretion in accordance with regulations and Bank’s approved policies and procedures.

SILKBANK | Personal Loan | How To Get A Loan From Pakistani Banks

SILKBANK offers a variety of options for personal loan at all branches in Pakistan.

Suitable for people who:

- Have one time borrowing need

- Want the peace of mind through monthly payments

Features and benefits

- Loan amount up to Rs. 2 million

- Flexible tenures of 1-5 years

- No security, no collateral

- Top-up facility

- Balance funds transfer option

- Pre & Partial payment option available

Eligibility

- Pakistani residents

- Foreign nationals with approved company guarantee

- Salaried individuals

- Age: 21-65 years

- Income: minimum Rs. 40,000/- monthly

- Offered in major cities of Pakistan: Karachi, Lahore, Rawalpindi, Islamabad, Hyderabad, Peshawar, Multan & Faisalabad.

Flexible

- Monthly installments with Pre-payment and Partial Payment Facility

To apply for SILKBANK Personal Loan, email at [email protected] or visit your nearest SILKBANK Branch.

You can visit this website for an online application procedure.

Summit Bank | Consumer Banking | Personal Loans

Summit Bank offers a secure personal financing solution according to the following features:

Benefits:

- Quick Processing

- No Processing Fees before approval

- Minimum Documentation

- Competitive Rates

- Complimentary Credit Life Insurance

Requirements:

- Pakistani Resident & CNIC holder

- Age between 21yrs to 65yrs

- Minimum net Income PKR 15,000/-

- Salaried individual only

Note: All of the items above are subject to Summit Bank’s Terms & Conditions.

For Business Persons and Self-Employed Professionals, minimum age is 21 years. Maximum age should not be more than 65 years at the time of financial maturity.

Visit this site to apply according to steps provided.

NBP Saibaan | Loan From Government

Eligibility *

Age Requirement:

Income Requirement:

Length of Service/Business Requirement:

|

How To Apply? | How To Get A Loan From Pakistani Banks

Instructions for completing the Application Form:

- Fill-in the form completely

- Print the “completely filled” form

- Get it signed by Referees

- Sign it yourself

- Attach the Required Documents

- and submit “In PERSON” to NBP Saibaan Team

Note: The form is designed to be viewed in Adobe Acrobat Reader.

For Business Persons and Self-Employed Professionals, minimum age is 21 years. Maximum age should not be more than 65 years at the time of financial maturity.

Well, there you have it guys! This was all about how to get a loan from Pakistani banks. If you have any questions, feel free to leave a comment in the section provided below.

Good luck!