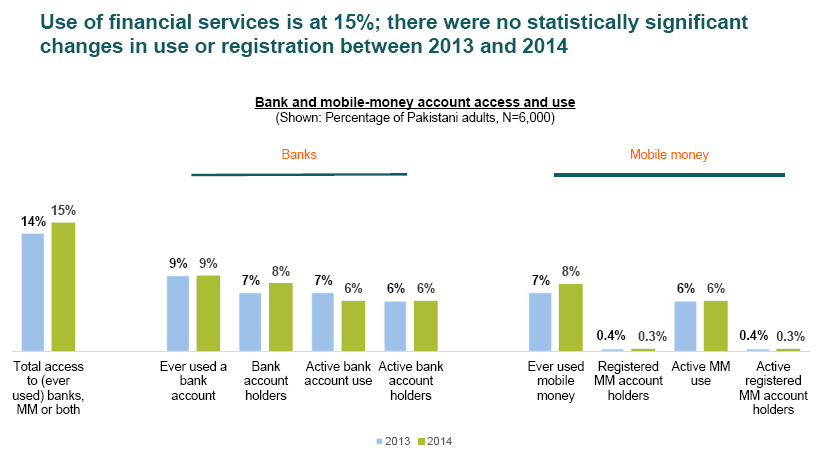

Despite high awareness and just 7% of Pakistanis having a bank account, a huge chunk of Pakistanis have never used Mobile Financial services, while one fourth have never heard of any mobile financial brand in their lives, said Financial Inclusion Insights (FII) survey report, jointly conducted and launched by Karandaaz Pakistan and Inter Media.

Report said that financial inclusion in Pakistan is still at lower side of the graph as compared to regional markets, showing a huge potential is still available for the mobile financial services in the country.

Based on over 6000 interviews carried out in 2014 with adults aged 15 and over, the report aims to provide actionable, forward-looking insights to support product and service development, and delivery.

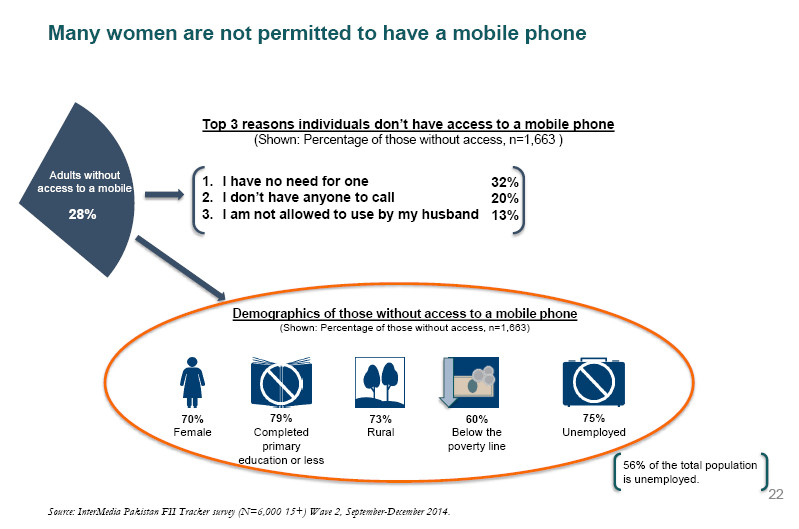

Need for More Focus on Women

Report said that 24% men used Mobile Financial Services at least once, while only 10% of females used the service.

1 in 10 women without mobile phones aren’t permitted by their spouses to own a device, however remaining 90 percent don’t own mobile device because either they don’t need it or because they don’t have anyone to call.

This shows that largely untapped female market can be partially reached through women specific awareness programs; for example 53% of the females that think they don’t need a phone or they don’t have anyone to call can be equipped with phone because there’s a clear need for a phone for every adult.

Removing Language Barrier Will Help

Report said that Financial Inclusion could also be bettered by operators if services are offered in traditional Urdu scripts (for Mobile Financial Service Menus through USSD and SMS receipts). This is especially important for inexpensive and basic phones that are more likely to be accessed by lower-income populations.

Survey found that 49% of Pakistanis can’t understand Roman Urdu vs. 35% for traditional Urdu, hinting that by offering Urdu scripts will allow a greater number of Pakistanis the ability to navigate mobile money interfaces on their own.

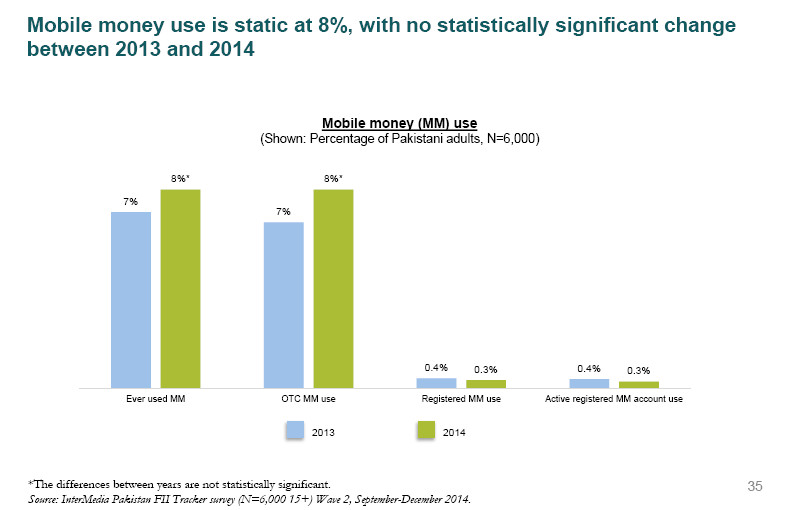

Growth has Gone Stagnant

Report claims that after a good start during 2010-2013, growth in mobile financial services has halted. Only Sindh witnessed 100% growth during 2013-14, while other provinces witnessed almost no growth.

Perception Challanges

Report said that there are perception issues with mobile financial services with more than half of adults thinking that they don’t need mobile financial services because they don’t make any financial transactions. Interestingly, more than half of these “who said they don’t need mobile financial services because they don’t make any transactions” receive remittances as a primary or secondary source of money.

Tapping the Untapped Areas

While distance has become less a barrier to account registration (especially after biometric re-verification of SIMs as customers can register accounts with a single SMS), proximity still impacts the frequency with which individuals are using mobile money.

The closer individuals are to a mobile money agent, the more likely they are to regularly use the services.

As of late 2014, there were nearly 190,000 branchless banking agents. However, at least half of all agents work with more than one provider meaning the number of unique agents is likely less than 100,000.

With a country of Pakistan’s size, there is a clear need for more agents, particularly in areas which are currently not covered by mobile financial service agents. Operators can use existing agent location maps to identify areas without an agent close by (within several kilometers), and license new agents to operate in these areas.

Download Full report: You can download full report by clicking this link.

So Sad…….

Some issue with mobile payments posted in this blog post. http://blogs.brightspyre.com/2015/04/problems-with-mobile-payments-adoption-in-pakistan.html/

Not willing to try mobile banking because of serious security flaws in banks online systems.

Even if you loose money while using ATM due to some technical error it takes weeks or sometimes months to get your money back…..

2 months to be exact for re imbursment of cash if any technical occurs during atm transactions.

another informative article related to MFS..good job attaa bhai !!