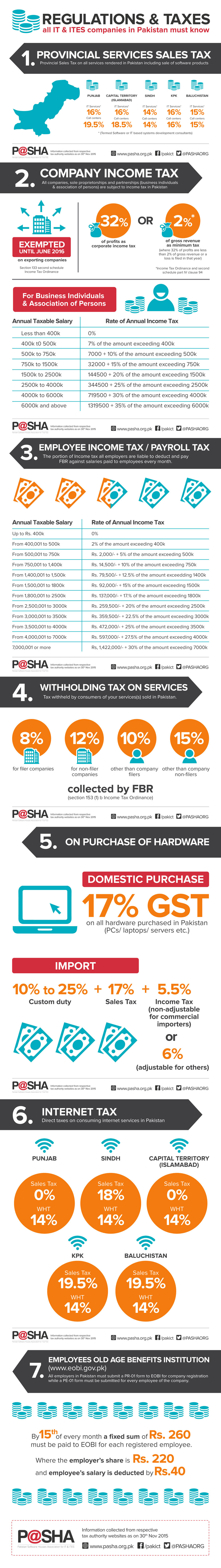

Two things in life are certain, death and taxes. And we’d wager both of them are dealt with the same level of confusion and dread. In an effort to deal with what is in its power, PASHA has published an infographic to demystify taxes in Pakistan.

The detailed graphic lists down the ‘Provincial services sales tax’, ‘Company income tax’, ‘Employee income tax/ payroll tax’, ‘Witholding tax on services’, ‘Tax on purchase of hardware’, ‘Internet tax’ and ‘EOBI’.

via PASHA

Nicely done but isn’t custom duty on PC/ Laptop 2%?

Being an individual freelancer(work mostly for foreign clients) which category I come in. I believe I am business indivisual ? Also what is Annual taxable Salary ? Is it gross income or something that comes after all the expenses ?

You are a business individual and the taxes are imposed on your gross income, no matter what your expenses are

if you are an employee whether under a contract or permanent, then all gross payments by your employer (including salary, wage, allowances, perquisites, loan not at market rate etc.) are considered to be your salary and are taxable on gross basis irrespective of your expenses. Further, if you have a business i.e. trading or manufacturing, then your income is taxable net of business expenses.

For detailed information about which expenses are allowed by FBR and which income is exempt, kindly contact a tax consultant.

Further, as you are freelancer i.e. person earning by exporting HR, accounting, IT or any other technical skills using internet then your income is exempt from tax till June 30, 2016. For exact law reference, consult tax advisor.

There is no tax imposed on foreign remittances for now but Govt is planing to impose tax in mid 2016.

horrifying … i’d say ‘go to hel’ to the govt …

but it would be pointlesss , considering we already live there -_-

Huge taxes with Zero pay back services by the Government. In Europe, taxes are also high but in return they provide reasonable services to their citizen.

EOBI Rates are wrong…Correct Rate is 400+60=460 per IP