Do you remember this $4 phone that was released in India just last month? If yes, have you ever wondered that how much taxes a Pakistani consumer would have had to pay for this $4 Phone if it were released in Pakistan?

While this phone isn’t coming to Pakistan, we are here giving a taxes’ comparison just to give you an idea of how badly are we taxed and the telecom sector in particular.

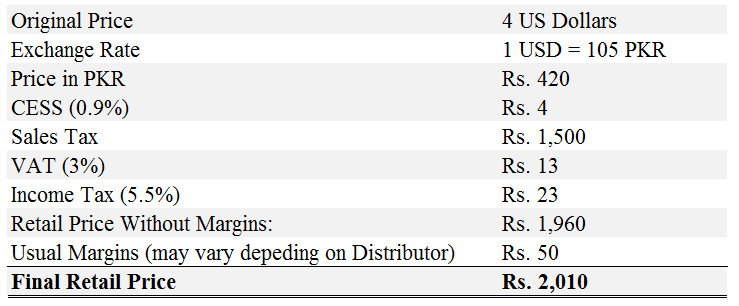

For information purposes, here is the list of taxes that $4 smartphone will have in Pakistan and then check the final price for your amusement.

So a $4 could cost you at least Rs. 2,010 in Pakistan, all thanks to taxes.

Explanation of Taxes:

CESS: CESS is the tax applied on the transportation of goods through or with-in Punjab. Purchases made in Sindh or other provinces could avoid this tax.

Sales Tax: This sales tax is that was recently doubled in this year’s budget. Sales tax on phones/smartphones is Rs. 500, Rs. 1,000 or Rs. 1,500 depending on the specifications of the phone.

Based on this $4 phone’s specifications, a Rs. 1,500 sales tax would be applicable in its case.

VAT: A 3% VAT is applicable on the import of all categories of handsets.

Income Tax: 5.5% income tax is applicable on the import of all categories of handsets.

Points to ponder:

– Telecom sector is one of the most tax generating sectors in Pakistan. Still government doesn’t stop increasing taxes on the sector.

– All taxes, when they reach a threshold level, start impacting negatively on industry, government as well as on consumers. Same has happened in Pakistan as taxes on telecom sector showed negative results through declined revenue for private sector and also declined tax collection for the government sector during 2014-15.

– Regardless of negative impact, government hasn’t stopped increasing the taxed on telecom sector. As a reference, taxes on smartphones/feature phones were increased this year as well.

– We know that a 10% increase in internet adoption results in GDP growth of 0.04 percent to 1.5% with emerging markets having higher impact. Authorities concerned should consider that with undue taxes on mobile phones and telecom sector, they are just raising the entry barrier for masses and that will ultimately result negatively for the national economic growth.

– There are countless researches (from both national and international institutes/agencies) that suggest that taxes on telecom sector hinder the overall growth of a country. How will our leaders get this point and start thinking long-term instead of achieving short-term goals?

What a shame.

Too many taxes but proud to be Pakistani. We are Highly taxes paid Nation in Telecom Sector.

actually , it should read “proud to be a lemming … “

No….. you are actually a proud patwari my friend!

Yes i am Pakistani and i deserve taxes.

Not only in Telecom sector bro, har sector mai yeh haal hai..

If this is true then how is it possible that a company is selling a mobile phone at Rs.1200 in Pakistan. There is something wrong with this calculation or maybe I am misinterpreting it.

Not all phones are taxed at 1500 (as mentioned above). This tax is calculated based on phone specs. Smaller phone (feature phones) are taxed less.

That is the point I was thinking about. Thank you for the explanation. Aamir Sb you are great.

HaHa

Very interesting point

Means they will calculate the tax on

Processor Cores

Ram

EMMC etc?

And camera pixels

And battery

And the number of buttons it has (because…pakistan)

hahaha…

This is true and factual:

30,000 pay 8,000 taxes. Who in their right minds would charge so high in taxes on phones, that are considered as a tool for economic growth.

on 30,000 government share is Rs:4320 not 8000 please correct , 3600 profit margin of distributor or whole seller

which is equal to 14.4%

Jibran aap nay to Aamir ko Shame Shame kara di……………haaaaaa…..actually he tries to be over smart that how we poor nation is being looted by current PML(N) Govt. instead finding people are getting smart in Pakistan with familiarization of OS.

i am here not supporting any party, but peoples should know what is true, some peoples are here think we are so intellectual and smart even without knowing about the A.B.C of taxes but showing we are experts. Government priority is to maximize their revenues, if they increase sales tax from Rs:1000 to Rs:1500 on luxurious mobile which is not wrong in my point of view. But if the the import volume goes down because of this step then it will be problematic for the government and for industry as well.

Jibran bhai aap ne khud he to last me likha hua hai kay “total taxes % collected by Government” which included Profit margin of wholesaler / distributor.

Dear Jibran:

I cannot understand this sheep mentality that “if they increase tax from . . .which is not wrong in my point of view” . . is fine?

Have you ever wondered why tax more a sector that is already taxed heavily, rather than increasing the tax base — how about taxing properties of government functionaries with properties abroad?

How about heavily taxing land holdings above 1000 acres, or property businesses who deal in hundreds of houses every month, rather than trying to mint money from the ordinary consumers in cities selling their homes . . .

Your (and people like you) case is the same as that of the Story about the king who was advised by his advisor to first stop all people (who were mandated to cheer the king’s speech every month) on the bridge leading to venue and charge taxes for their coming, and the people paid — then taxes were doubled, and then the people were given a caning as well as taxing, and then the King asked them if there was anything bothered them . . .

They said something similar to you. . .”Your highness please ask the soldiers to cane faster as it delays us greatly due to long lines.”

You have forgotten your fundamental rights Jibran, and are focusing on the rat race they designed for people like you, losing the sight of the greater picture. Sad really — I expect people with the name Jibran to have the wisdom and breadth of vision which at least pays homage to the person you are named after.

You maybe a mathematical guru — and good enough . . . such people are also needed — but please stop trying to use your mathematical expertise to preach visionary leadership to people — a visionary sees well beyond what you are saying.

Stick with mathematics to do calculations.

how dare..!! after so called intellectuals now wisdom man comes here,welcome dear, if you read my comment completely or speak complete truth instead half then i think you should not need to become more wiser here, if you see i have also mentioned the negative aspect of its.But i don’t understand the mentality of sick minded peoples like you who are not ready to condemn such a childish and unprofessional way to explain taxes which is totally wrong and baseless.

But wiser and intellectuals guys like you having no morel value and grace to at least say wrong to the wrong things.Your eyes could not be able to see the difference 378% of taxes by propakistani and 26% or 31% taxes, and your wisdom mind not ready to believe that a smart phone in Rs:420 impossible, your eyes also not ready to see the revised sales tax slabs for import of smart phones, the reason is because of party affiliation, your dead heart and blindly believes on the things without using your own wisdom.

If you are enough wiser give all of us the answer of our simple questions:

1. From where we can import a luxurious smart phone in rupees 420.??

2. How much the sales tax on mobile of Rs:420 .?

3. What comes if you less 26% from 378% its so simple brother

3. How much tax collected by the government on mobile of Rs:15,000 ?

I hope you should know answers of these questions but you don’t have enough moral values and heart to answer these because of your liking and disliking.

Come on brother hopefully you don’t run like others so called intellectuals now.

Did you calculated the original retail price in India (After TAX and margin)?

This 4$ phone in India is compensated by Indian Govt, it would be great if you calculate the correct retail price before comparison.

After all it is your duty not to force negative vibes or thoughts in our country (if you also think you are a responsible person)

So you’re telling me that i should be happy to pay RS: 3100 tax to govt on a RS: 15000 phone i import from China?

Let me enlighten you that you’re trying to calculate all these based on just figures given by govt while i have ordered several mobiles/tablets from China (AliExpress) during last 2 years. And you have no Idea how i feel when i paid RS: 3350 on a $60 smartphone ((UMI Rome) i ordered (about 56% tax) and how delighted i was when i paid RS: 7250 on $102 Onda Tablet (About 70%).. or RS: 14000 on 2 UMI irons phones where real cost was about 36000 (RS: 7000 tax on RS: 18000 per phone).. Do your math on percentage.

Keep in mind there are no usual margins in it as there is no middle buyer.. also keep in mind, all these purchases are from last year (2015).. It’s all tax for govt and If you really believe that a normal consumer should be okay paying 31% or 56% or 70% tax to govt then i believe you sir either belong one of those mf patwaris, collecting all these taxes in their pockets or you belong to some royal family where taxes like these are less than the tip you pay to waiters on your dinner. In either case, don’t talk for normal consumers.

Astonishing

most of the phones are priced more in India than in pakistan, eg: iphone 6s currently costs 48199 INR which is 75000 PKR but you can get it here for 68900 PKR, same goes for samsung galaxy s7 which is available there for 48900 INR while in Pak for 60000PKR

in logon ko abhi unke 3g k rates ka ni pata :D :D in ko zra wo 4g k rates to bta jo mujhe btaye thy india me 4g rates :D ghanty or 15 min ka hisab :D

and whole gulf is most costly for 3G and 4G… their rates.. OMG

Masha’allah aap ka standard bhee India pur akar khutum hota hai — what a narrow mind.

waha petrol b 65 INR ki range m ha, yaha 65 PKR, ya phir ham UK k taxes p start ho jayn, jahan death tax b hta ha? Pakistan has one of the lowest living costs in the world. germany me ap study kerny jayn, 8 lac PKR deposit mangty hain, per year, apart from study expenses, apka accomodation, khanay peenay ka kharcha. yahan hamay ghr walay monthly 10,000pkr dete hain, ham usme b guzara ker lete

don’t get me started, admin ne India sy muqabla lagwaya tha, that was the response for him

Jazak Allah :)

Filers or non filers, we are paying huge taxes already. Prepaid tax on every item being sold or bought in the market.

Why am I paying income tax on a phone if I am being taxed at the source? I do not get the logic.

Panama needs your money!

OMG! The taxing scheme is shady at its best. Sales Tax and VAT? Why in the world there is double taxing?

If you have seen how juice is extracted from Sugarcane, you will understand how tax system works in Pakistan.

That’s a really nice way to sum it up.

Pakistan will imposed tax on sun, and air you breathe. Effective immediately

Adding value to cheap things… ha ha ha

Haha, as per your calculations, a Rs 0/- phone would cost Rs. 1600. I’m sure you chose a 5$ phone just to make this look exaggerated. How about you do this on a Rs: 7000/- phone, I am sure the 300% would come down to about 30%

My point of selecting this phone was that world is making efforts to bring down prices to unimaginable levels, to enhance smartphone adaption. And look at what we have in our agendas.

we have Panama, Harrods and Swiss bank accounts what else in agendas you need?

we only have a sense of disparaging reforms in our agenda -_-

i don’t believe Pakistan will EVER recover …

What a Panama……… all thanks to taxes.

Sadly I remember Churchill words for Indians which can be also applied to Pakistanis as Pakistan was carved out from India.

he was DAMN right …

CHIEF reason why most people just want to LEAVE this hel hole !

kuch b ho ja ma tu mia saanp ko hi vote do ga………………..when we choose jahil and jungle leader this will be happen

Intellectual man please see the following

Rs.450/- to Rs.2010/- astonishing gap.

Sab mil kar naara lagao ‘Jiay Nawaz’.

Yahan dil khol kr bolo lekn vote phir bhi ussi ko do.

Such a poor and unprofessional way to explain taxes and making peoples fool, seriously feels shame on the management of “propakistani” i haven’t see such a disgusting post from you. You taking base rate 420 PKR what a nonsense .. and added Rs:1500 as a sales tax on Rs:420 mobile, Shame..!! 1500 is maximum tax, and you also added 50 rupees margin on mobile of rupees 420, which is 12% of the original amount.

Peoples see the attaced factual calculations

I am sure app jaisay log government ko advise kartay hain. And btw, app jaisay kisi aur nay IMEI tax bhi propose kiya hay, which will be Rs. 1,500 and that’s in addition to current taxes.

The whole point is, is this rational to tax one sector — and leave others, such as dairy, murghi etc — to a point that it has started to collapse?

what i am trying to say, they didn’t take a fair base rate (from where you would import a smartphone in rupees Rs:420.?? ) which is actually wrong, and they also charged Rs:1500 as sales tax which also ludicrous, and hopefully you would be able to see and understand the difference in 378% tax and 31% or 26% , how much exaggerated???

and secondly i don’t have any affiliation or sympathy to government or any party except my profession but yes doubt on yours after your logical comment.

“So a $4 could cost you at least Rs. 2,010 in Pakistan, all thanks to taxes.”…Really!!!

Then phones of brands like QMobile, Alcatel, Haier etc selling in market at around Rs.1500/- must have actual cost of – $8 (minus 8).

Well Done PML (N), anything left to be taxed or any kind of a tax left to impose on

Btw this phone was never launched in India. It was more of a prototype and even the ones showed belonged to some other manufacturer with the named wiped off :P. Having said that, the fact of Taxes is unfortunately true

Also I am not sure if 1500 will be the sales tax for this phone since it is not ‘high-end”

Mobile Phones are currently charged to sales tax under three categories i.e. Rs300, Rs500 and Rs1,000, based on their features. (AND YOU GUYS HERE ARE CHARGING RS:1500 ON MOBILE OF Rs:420)The proposed new slabs are Rs300, 1000 and 1500, respectively. Enforced through Finance Bill, 2016, effective from July 01, 2016.

Now i am talking with the lay man not with the SO CALLED INTELLECTUALS, what should be the rate of sales tax on mobile of Rs:420..???

Just assume If original price is rupees 420 PKR (which is almost impossible, but maybe some intellectual maybe import on this price by using illegal means) even then the price will be:

Import Price Rs: 420

Add Taxes:

CESS (0.9%) Rs: 3.78 *(Only in Punjab)

Sales Tax (Should be) Rs: 300

VAT 3% (also known as Additional Sales Tax 3%) Rs: 12.60

Income Tax (5.5%) Rs: 23.10

Total Taxes (3.78+300+12.60+23.10) Rs: 339.48

Rupees “339.48” is the share of government if you import a smart phone on Rs:420 by using illegal way.

You should apologize on your unprofessional post.

Jibran jaag jayain, its 2016, not 2015. Charging schedule you are mentioning expired on June 30th, 2016. Now new rates are applicable.

haahaa.. Ab aapko english smaj nai aa rehi tu ma kuch nai kar sakta,

I have mentioned : “The proposed new slabs are Rs300, 1000 and 1500, respectively. Enforced through Finance Bill, 2016, effective from July 01, 2016.”

If you have any reference let us all show if not then go to consultant hopefully he will tells you.

Kisi k sath doshmni ya muhabat ma itna andha b nai hona chahiya insaan ko, sehi ko sehi or ghlat ko ghlat kehna sekhain, ya party warty k chakar ma parh k ku apna emman tabah kar rehy hn.

GO NAWAZ GO!!! OR ATLEAST GIVE SOME RELIEF!!!!