The government has collected taxes of around Rs 200 billion from mobile phone consumers during the last four and a half years.

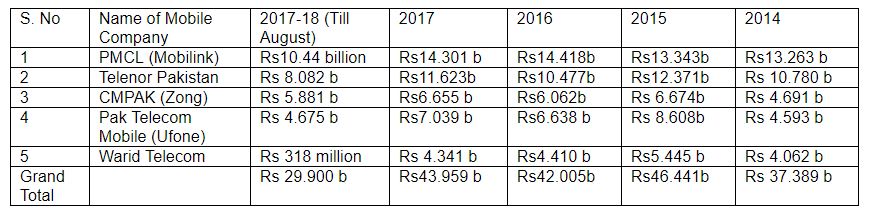

The year-wise taxes collected from mobile phone consumers during the last five years are given as below:

The Ministry revealed that previously, the Telcos used to report a lump sum figure of tax deducted from all consumers. The reported figure was only verified to the extent of deposits in the national exchequer.

In order to obtain consumer wise data from the Telcos, Pakistan Revenue Automation Limited (PRAL), the IT arm of FBR, in consultation with Telcos has developed a utility which requires Telcos to upload consumer wise withholding data in a mutually agreed format. The Telcos with the intervention of PTA have agreed to upload data on the new format from August, 2017.

So far two Cellular Companies i.e. M/s Pakistan Mobile Communication Limited (PMCL) (Jazz) and M/s Pakistan Telecom Mobile Limited (PTML) (Ufone) have uploaded their data on the new format.

The data uploaded by the Pakistan Telecom Mobile Limited (PTML) contain certain errors. PRAL is in contact with PTML for removal of said errors. The remaining two companies i.e. M/s Telenor Pakistan (Pvt) Ltd and M/s CM Pak (Zong) have yet to upload their data and are being pursued to complete the task at an early date.

Since the upload of the new software, the Telcos are to provide information of customer wise usage of telephone including easy loads / calling cards used per month. The information obtained can then be cross-matched by the concerned tax office with the tax deposited by the Telcos.

Tax collected from mobile subscriber’s u/s 236 of the Income Tax Ordinance, 2001 is deposited by Mobile Operators on a weekly basis.

Itna Tax Dete hai Phir Bhi Koi Aisa Surprise Month Nikalo K Jaha 100 Pe 100 Milay :

Itna Pysa jama kiya Aur Flats Kahreed liye London Main

Us Ganje ne aur uski Mafia Faimly ne

This tax shouldn’t be equal for all. There must be slabs of balance and rate of tax just like income tax slabs.

If a person is recharging Rs. 2,000/annum withholding tax should 5%, and it should be increased 1% with every additional 1,000. With this practice Govt can collect more tax from rich people and less from poor. Fix tax rate for persons who use 20,000-40,000 and 2,000-4,000 is a crime.