In order to provide Shariah compliant alternative of conventional Long Term Financing Facility (LTFF) to meet long awaited demand of exporters, State Bank of Pakistan has issued Islamic Long Term Financing Facility (ILTFF) based on Mudarabah. Under the scheme, traders can avail benefit of up to Rs. 2 billion through Islamic Banks.

It is a major breakthrough for traders’ community who can avail this facility for enhancing their business in various sectors.

It is pertinent to mention here that the central bank has been offering long-term refinance facility since 2008 for plant and machinery through commercial banks and development finance institutions to allow exporters an opportunity to avail concessional financing for imported and locally manufactured plant & machinery.

However, such facility could not be availed through Islamic banking institutions in absence of a Shariah compliant alternative.

Islamic Long Term Financing Facility (ILTFF)

ILTFF will allow exporters an opportunity to avail long-term refinance facility of State Bank of Pakistan for purchase of imported and locally manufactured new plant and machinery from the eligible Islamic banking institutions.

The facility shall be available to the export oriented projects if their annual export is at least equivalent to US$ 5 million or fifty percent of their sales constitute exports, whichever is lower. The period of financing under the ILTFF shall not exceed more than ten years including a grace period of maximum two years while maximum limit for obtaining financing under this facility by a prospective customer shall be Rs. 1.5 billion.

The participating Islamic banking institutions shall undertake due diligence process in accordance with their respective financing policies before sanctioning the facility subject to the respective prudential regulations prescribed by State Bank of Pakistan for each type of customer.

Islamic banking institutions may participate in the scheme by submitting an application to the concerned department of State Bank of Pakistan. Under the scheme, Islamic banking branches of conventional banks may also apply to State Bank of Pakistan for allocation of limit subject to a maximum of 20 percent of the limit under LTFF for utilization under ILTFF.

ALSO READ

SBP Wins Prestigious IFN Award for Promoting Islamic Finance

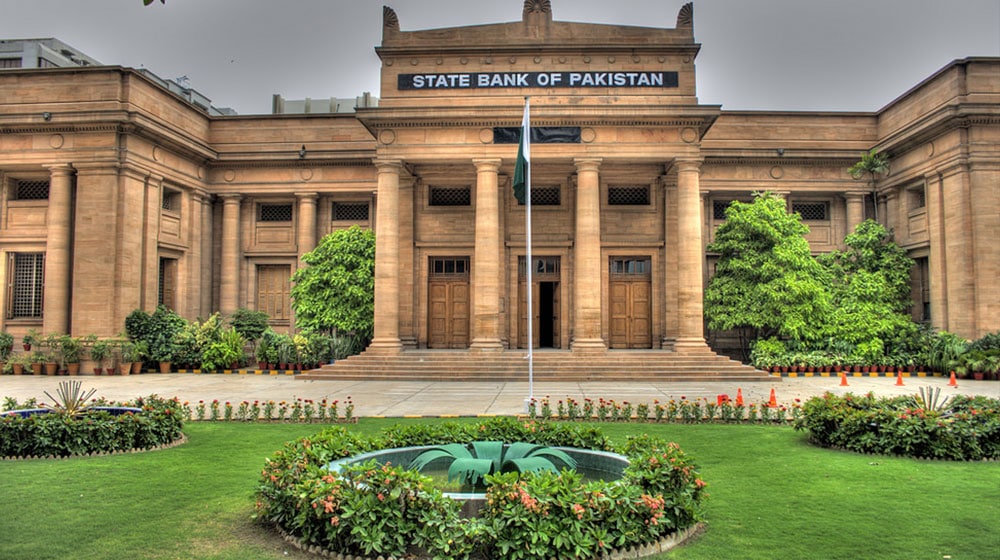

This is another manifestation of commitment of State Bank of Pakistan, which has been playing an instrumental role for promotion and development of Islamic banking in the country on sound foundations.

Due to continuous efforts of State Bank of Pakistan and relevant stakeholders, the market share of Islamic banking industry’s assets and deposits in the overall banking industry has increased to 12.4 percent and 14.5 percent, respectively by end December 2017.

Assets and Deposits of Islamic banking industry have been consistently growing with a compound annual growth rate of over 25 percent for the last 10 years. At present, 5 full-fledged Islamic banks and 16 conventional banks with standalone Islamic banking branches are providing Shariah compliant products and services with a network of over 2,581 branches spread across the country.