The government, in its recent policy change during budget 2018-19, has prevented non-filers from booking or importing new cars. Fiscal year 2018-19’s Finance Act 2018 changes will come in effect starting 1st of July, 2018.

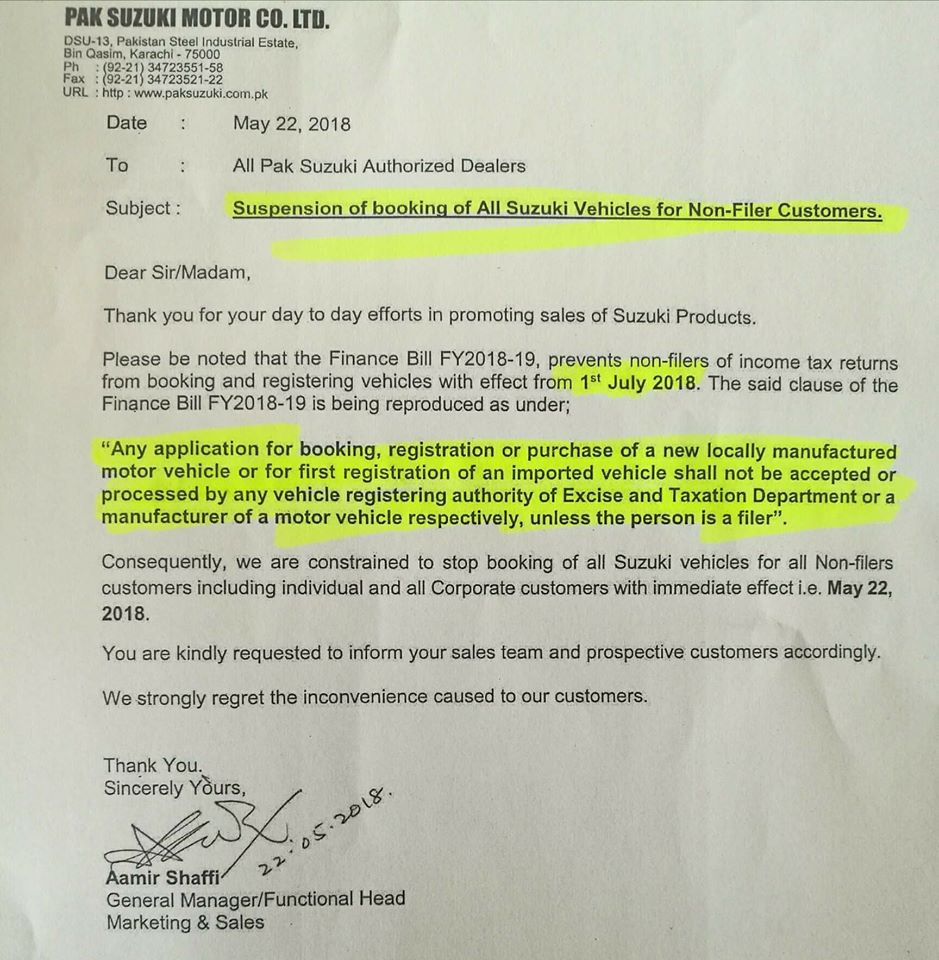

Major car companies in Pakistan, including Pak Suzuki and Toyota Indus, have already been sent notices by the government to implement the new changes and will stop taking new bookings from non-filers. The new act states,

Any application for booking, registration or purchase of a new locally manufactured motor vehicle or for first registration of an imported vehicle shall not be accepted or processed by any vehicle registration authority of Excise and Taxation Department or a manufacturer of a motor vehicle respectively, unless the person is a filer,

Even though the Finance Act will be functional in July, the companies have already notified their dealerships to suspend new bookings that will take longer than July to deliver as the policy change might cause complications leading to order cancellations or delays in the future.

ALSO READ

ProPakistani Roundup: Here’s Everything You Want to Know About Budget 2018-19

Indus Motor Corporations (IMC) urged its customers in a public notice to change their status to tax-filer. The notice reads,

While announcing the budget for the fiscal year 2018-19, the Government has recently introduced a new policy order to restrict all non-fillers from purchasing locally manufactured and/or imported vehicles. This includes all individuals whose names do not appear in the Active Taxpayer’s List as well as those customers who have already booked a vehicle and are expecting delivery after 30th June, 2018.

Moreover, the company says that any orders made by non-filers that are pending and will get delivered after June 30th, might get canceled if they fail to attain a tax-filer status in time. Honda Atlas is also highly likely to follow suit shortly.

Pending Bookings

Auto companies have asked their authorized dealerships to individually contact non-filer customers whose orders are scheduled to get delivered in June. Same goes for those who are pending balance payments and deliveries scheduled to be fulfilled after July. The dealerships will contact each customer and ask them to change their status to tax-filer.

ALSO READ

Here’s How You Can File Your Income Tax in Pakistan [Guide]

The companies have also informed their respective partner banks to stop taking orders from non-filers. The auto companies have asked the government to reverse these changes, as they will lose significant sales, and will take this matter to the court because this change will also encourage even more illegal own-money practices.

The condition set by the government is also likely to encourage investors, profiteers and individuals being filers to purchase vehicles and resale them on higher prices to non-filers,

Non-filers, for now, can still pay own-money to get their vehicles delivered before the 1st of July, at premiums of Rs. 70,000 to Rs. 150,000 on various popular models.

End of Auto Industry :

RIP Government Policies :

Why are you blaming the Government for it?

Being a Non-tax filer is an illegal activity so it should be curbed. Shouldn’t it?

Ok. What about a widow who has meagre resources or a housewife who gathers/borrows money to buy the legendary mehran, what options do they have? In a country where only poor pays taxes and riches have all their wealth stored outside in international banks, this policy is totally illogical. Pay 2% and make illegal money white!! this is the policy given to the one who do not have any guess how much do they have. Pity!!

Do you even know how much it costs to file a tax return ? A widow who can manage to arrange loan to buy a mehran can afford that too.

Government of Pakistan completely rely either on taxes or foreign loans. On the later you will curse government, so what is the solution ?

Should government abolish taxes considering such scenarios ? Why don’t other countries read your logic and do the same ?

Only 3% Pakistanis pay taxes, rest 97% aren’t all rich.

So you want to save auto industry which you will see flourishing in coming years. What about government (any government in Pakistan) which totally rely on either taxes or foreign funding, what should government do ?

Please don’t say that as rich aren’t paying taxes why poor should pay as 3% Pakistanis pay taxes, rest 97% aren’t in rich category.

Pakistanis have a big mount, always expecting from government and crying.

Adnan U ignorant!

More steps should be taken against non tax filers in other fields too!

Thumbs up!

Yep, and the fine will not work, but a ban on buying new expensive items/properties will surely force these non fillers to enroll and pay due taxes accordingly.

Wonderful step, it should’ve been taken earlier………

Good decision, someone who is going to Spend 2 Million Rupees to buy a car can spare a change for Rs. 3000 to file Tax return. If he is educated, can do it himself for free.

Maybe, it will be cost cutting turning point for auto industry too.

lol