According to a landmark report, access to capital is not going to be an issue for startups going into 2019.

The report, which was prepared by Madera Outsourcing, is the first of its kind in Pakistan. Over a dozen VCs who have invested (or are looking to invest) in Pakistan were consulted and the results are impressive – by the end of 2019, startups in Pakistan will have access to more than Rs. 13 billion ($100 million) in capital.

According to Mustafa Najoom, who founded Madera Outsourcing and is also the Country Head for 1839 Ventures, “Pakistan is entering into a new wave of startup investing. Startup founders don’t have to worry about the lack of capital available in the local market. Their focus should be only growth, growth, and growth”.

Challenges to Get to Rs. 13 Billion

There are a plethora of challenges in Pakistan and how effectively they’re dealt with is going to directly impact the Rs. 13 billion which will be available for local startups.

For investors, the regulatory environment needs to be made more conducive and that cannot happen without the support of the government and the State Bank of Pakistan.

Dr. Vaqar Ahmed of the Sustainable Development Policy Institute (SDPI) said:

Some important conclusions here. Perhaps one could add as Samar Masood puts it “Section 27A of the Banking Companies Ordinance 1962 prohibits any person, company, firm, etc from inviting deposits of money from the public for investment in their venture or for borrowing.”

The section not only prohibits crowdfunding indirectly but gives an edge to the existing players in the market that provide financing by specifically exempting banks and authorised government entities. Consequently, start-up founders are forced to approach exempted entities who enjoy dominance by virtue of Section 27A.

While there have been efforts by the SBP and the SECP to facilitate startups and add regulation for employee stock options for instance, nothing has come of it so far. Even if a foreigner wants to invest in Pakistan, the process has a lot of associated costs, which are a deterrent.

Speaking about the challenges of investing in Pakistan, a VC advisor said:

Why would an angel give Pakistani startups a seed round of, say, 20k when costs on it are going to be more than 10%? Furthmore, if he is not Pakistani-born, it can take up to 3 months for share transfer. The angels are better off going to Middle East or Turkey etc.

Startups will also have to be innovative at solving social problems, building a track record of action and have a solid growth plan to catch the eyes of VCs looking to invest in Pakistan. The setup of Sarmayacar’s $30 million VC fund and Gobi Ventures’ entry into Pakistan courtesy of a $1.5 million investment into Sastaticket are proof that the checkbooks are open but only for the right startups.

According to Fouad Bajwa, a VC advisor and the co-author of the report, “This is the best time to be creative, find local solutions to our social and economic adversities, be innovative and employ emerging 4th industrial revolution technology and strategies. We are booked for growth!”.

Deal Flows for Pakistani Startups in 2019

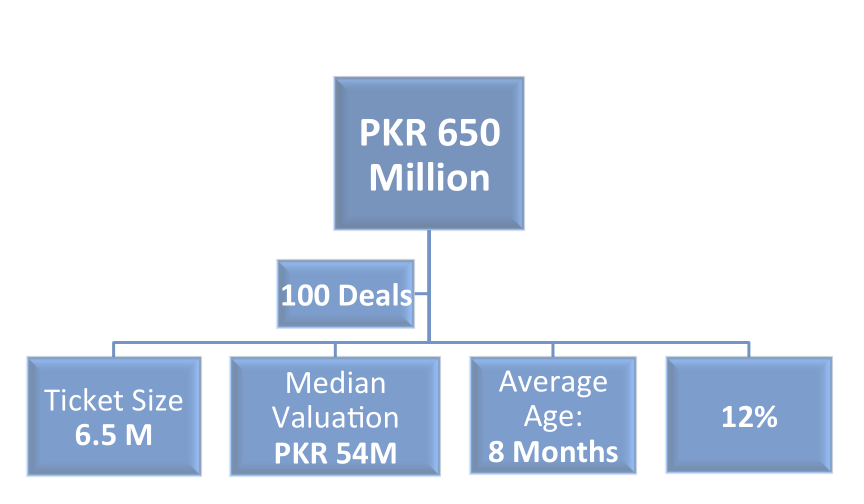

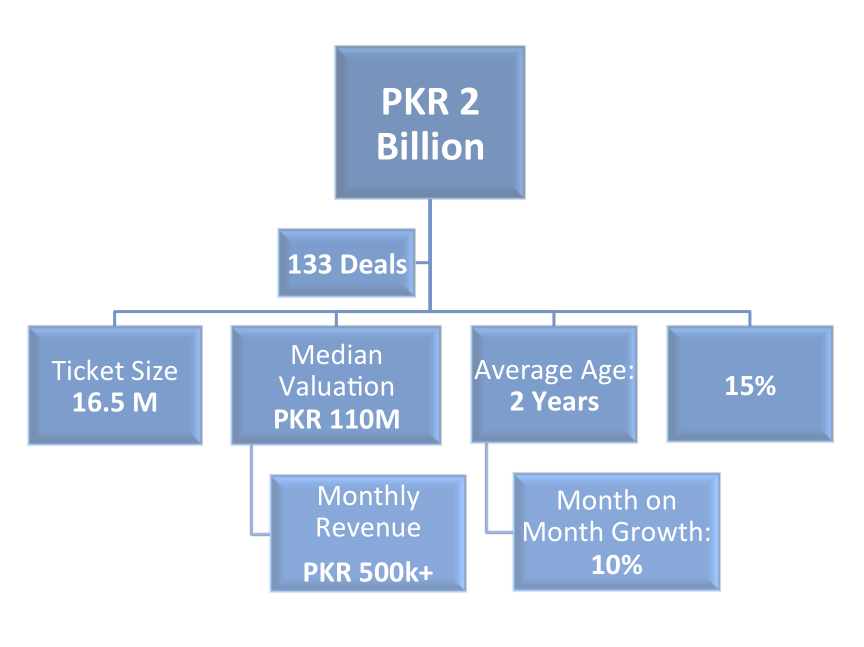

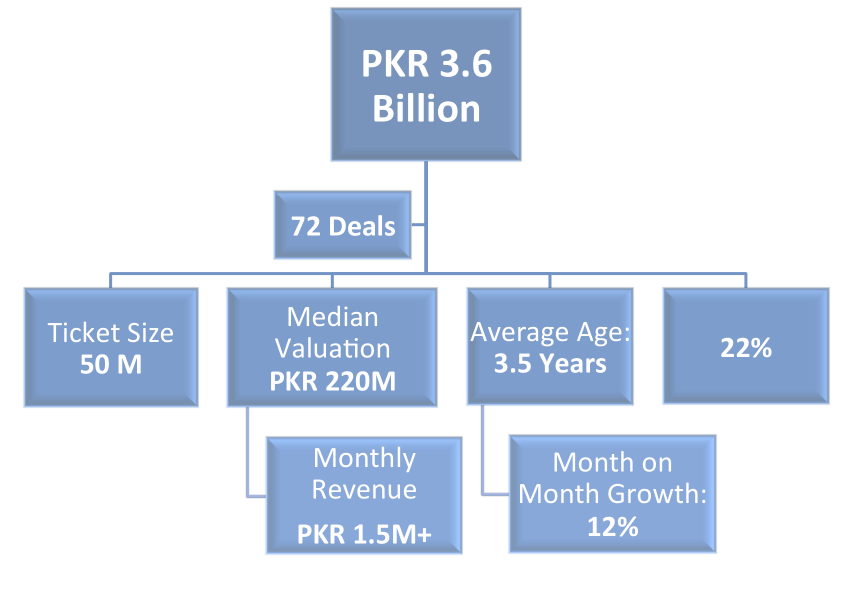

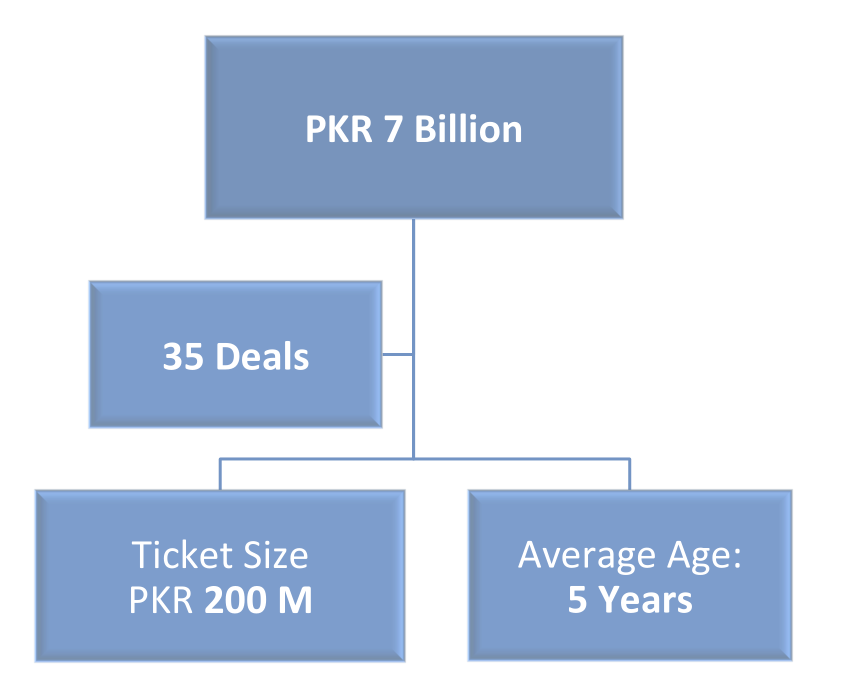

For the first time ever, deal flows for venture capital funding in Pakistan have been made public.

These will give startups an idea of the opportunities available and allow them to align themselves with the actual investment landscape.

According to Fouad, previously, startups were either overvaluing themselves or living in silos with regards to the available deal flow climate.

Where the Money Will Go?

Here’s a breakdown of exactly how much funding could be available for startups across various growth stages in 2019.

Pre-Seed funding – 5%

Seed funding – 15%

Seed Plus funding – 27%

Series A – 53%

The report concludes by emphasizing the need for corporate accelerators which are independent of universities and the government.

“VC syndicates should back these accelerators with the major metric being growth. This will help startups transition from Seed Stage to Series A”.

If and only if there are no corrupt people involved else this money will vanish just like dew drops in a desert.