The Financial Action Task Force (FATF) has reportedly expressed satisfaction over Pakistan’s efforts to curb money laundering and terror financing in the country – to some extent.

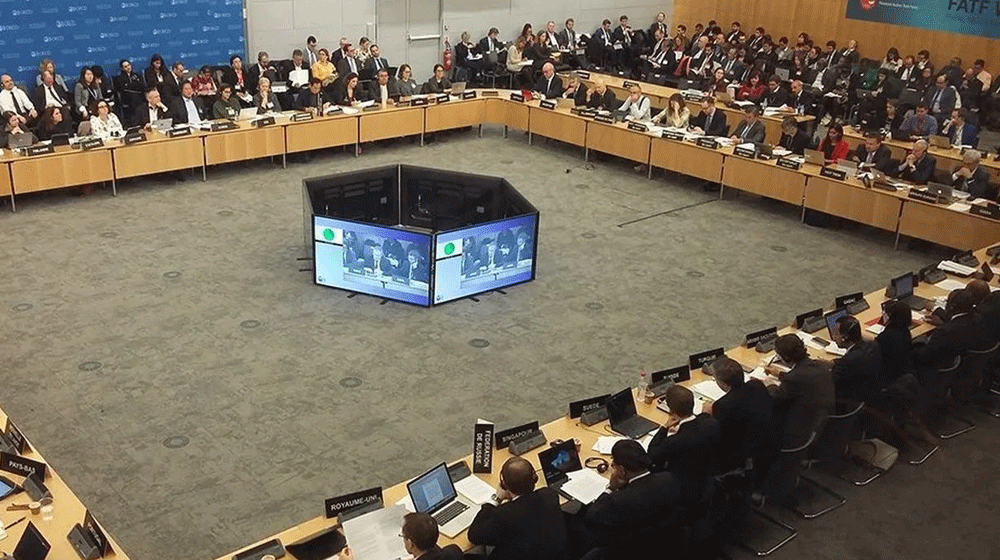

A high-level delegation led by Finance Secretary, Arif Ahmed Khan, is currently in Sydney to attend a three-day FATF conference.

Pakistan’s delegation also includes members from State Bank of Pakistan (SBP), National Counter Terrorism Authority (NACTA), Federal Investigation Agency (FIA), Federal Board of Revenue (FBR) and Finance Monitoring Unit.

ALSO READ

FATF Report Identifies Major Concerns That Pakistan Needs to Resolve Immediately

An official from the finance ministry has revealed from the feedback received from Sydney that for the first time, Pakistan’s action plan has been appreciated by the FATF team.

“At the end of day two proceedings, most of the ten-point action has been reviewed,” the official said, adding that the financial task force has also suggested a few doable things before February’s next examination in Paris.

This would be followed by a broader inspection of Pakistan’s efforts to get rid of money laundering and terror financing in May, probably in Sri Lanka or Australia.

May’s meeting will decide whether Pakistan’s name would be removed from the greylist in September.

ALSO READ

Pakistan Urges UK to Assist in Tackling the Money Laundering Issue

The official further maintained that the FATF delegation had reviewed the report dispatched before the meeting. During the course of the meeting, questions were raised regarding the details and the task force team appeared to be satisfied with the briefing.

As per the report, Pak-Afghan and Pak-Iran borders are the main routes for terror-financing and money laundering. It adds that Pakistan has identified and blocked over 4,600 suspected transactions since 2015.

“A total of 1,167 transactions have been captured during 2018 alone, including 975 suspected transaction reports and 210 financial intelligence reports,” the report added.

The third and final round of the conference will conclude today, Thursday. After the conference, the FATF team will release its guidelines for Pakistan’s course of action until the next meeting.

BRING PAYPAL PAYPAL PAYPAAAAAAAAAAAAAAAAAAAAAAAAAALLLLL

& PayPal Is Not Neccessary for Pakistan : You Have Enough Option :

Aur PayPal Isn’t come in Pakistan Due to Indian Pressure to PayPal

with other options (i.e payoneer) you have limited access to global market.. With paypal you have complete access…

It’s like Paypal is Google and Payoneer is yahoo search engine (not even bing)…

ME WANT COMPLETE CONTROL… :(

Look Payoneer too much costly for Pakistanis, I got a payment transfer of 47$ from some international Ad company to Payoneer. They deducted 3$ on transfer, 24$ on activation fee for Pakistnai card holders and 3$ more for monthly account maintenance fee. So at the end I got 17$. Now to get the 17$ I had to pay more 2% + Bank fee + Currency conversion charges then I will get some rupees in my hand. This is a real case and why the Govt/SBP thinks over it about such issues. That’s why money laundering and illegal money transfer is propagate. Paypal is must to bring in Pakistan.

GPay A SAKTA HAI

Think again there are many websites which only accept paypal as their payment service