The global economy is facing supply chain challenges amidst the coronavirus outbreak in China.

Moody’s, in its latest report, has predicted an economic growth slowdown across the Asia Pacific region, triggered mainly by the deadly outbreak in China.

Pakistan has significant reliance on China as the country is its largest trading partner. Pakistan sources the bulk of its raw material, intermediate and capital goods from China.

Moody’s shared its research report where it predicted that the coronavirus outbreak could add to pressures on growth, with the impact felt primarily in trade and tourism, and for some sectors through supply-chain disruptions, too.

“The outbreak of the coronavirus has added a further dent to growth prospects at a time when economic growth trajectories throughout the region were already declining,” says Deborah Tan, a Moody’s Assistant Vice President and Analyst.

Raja Omar, Chairman RCCI ICT Awards, Rawalpindi Chamber of Commerce and Industry stated that ”Rawalpindi business community comprises of mainly traders and we have a handful of cottage industries. The trading concerns import Chinese goods directly or buy from sole importers and then the items are retailed to the end-user.”

Even in the case of the manufacturing sector, the raw materials are mostly Chinese, he added. Thus by the current quarantine of Chinese goods, the Pakistani economy is going to be drastically affected and we might see closures of certain businesses as well, stated Raja.

He also mentioned that Pakistan, as most of the other countries, relies on Chinese imports and he personally feels that Pakistan should also focus on trade with the Central Asian countries. In the end, the market speculation always has an effect on the economy; investors hold their money, and future projects halt in these type of scenarios, he maintained.

Ossama Rizvi, an economic and geopolitical analyst stated ”For Pakistan, the effect of Coronavirus could be very serious. It takes on two dimensions. First, the health concerns, we should be prepared – and there have been some positive developments in this regard. Second, is our trade. As with the rest of the world, our trade is going to be certainly effected with China. Many businesses are still closed and people are avoiding travel to China and interacting with people there, creating logistics issues.

”I believe there are already many businesses and businessmen that are feeling the heat of this epidemic,” he added.

Moody’s lowered China’s growth, reflecting the impact of the virus which has killed 2,236 people in China so far, while over 74,000 have been infected by the disease.

“This makes the region more susceptible to changes in investor sentiment, triggered by unexpected shocks such as the coronavirus outbreak, although market access for our rated portfolio has not been negatively affected by the outbreak. Weaker growth prospects could, in turn, increase debt service challenges for the region,” added Moody’s.

Moody’s highlighted that reduced growth prospects could expose comparatively weaker economies to changes in investor sentiment. It noted that deepening integration with the global financial system also increases susceptibility to capital flow reversals.

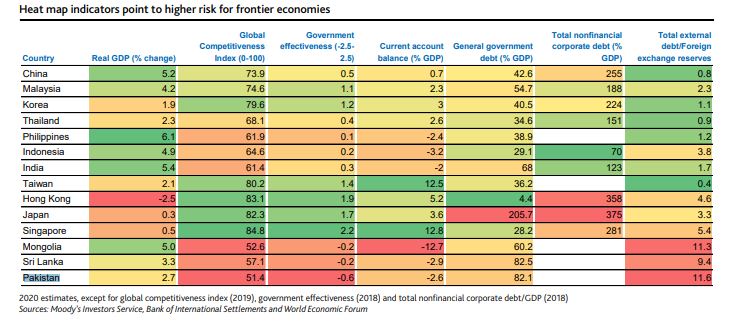

”If investors recalibrate their demand for assets from the region, funding costs could rise. This scenario would present particular challenges for the debt issuers that are most dependent on external debt, notably some frontier market sovereigns. For insight into the relative fundamental strengths and debt vulnerabilities across Asia, Unsurprisingly, frontier economies such as Pakistan, Sri Lanka and Mongolia emerge as the most vulnerable,” projected Moody’s.

“We have lowered our China growth forecast to 5.2% for 2020 from 5.8% previously, reflecting a severe but short-lived economic impact, with knock-on effects for economies across the region,” De Guzman said.

Pakistan China Trade Likely to Go Down

However, to assess any likely negative impact on trade and supply chain due to coronavirus, the Ministry of Commerce held a meeting, where senior officials from the Ministry, TDAP, representatives from Textiles Wing, technical members of the Ministry of Commerce and Commercial Counselor in Beijing (via video link) were present.

Keeping in view the feedback from private stakeholders consultations and an in-house analysis by the Ministry of Commerce and TDAP, the officials deliberated on the possible effects of coronavirus on domestic production and exports by taking into account recent global and bilateral trade trends, possible bottlenecks in supply chains, availability of stocks and supply of raw materials and intermediate goods.

The Commercial Counselor, Beijing, apprised the participants that although there are slight delays in shipments, except for Hubei Province, normal trading activities are expected to resume in the next 10 days. Secretary TDAP and representative from Textiles Wing informed that the intermediate goods’ stock cover was sufficient for 6 to 8 weeks.

Keeping in view the feedback from all participants, a monitoring and evaluation mechanism is being put in place. The Ministry of Commerce is cognizant of the situation and is keeping a constant eye on the issue.