Oil prices dropped more than 33% after OPEC’s failure to strike a deal with its allies regarding production cuts, causing Saudi Arabia to slash its prices as it reportedly gets to ramp up production, leading to fears of an all-out price war.

U.S. West Texas Intermediate crude briefly dropped 33.07% to $27.58 per barrel. International benchmark Brent crude futures also plummeted 29.51% to $31.91 per barrel.

Hammered by withering demand due to the coronavirus, the oil market is sinking deeper into chaos on the prospect of a supply free-for-all.

Brent futures suffered the second-largest decline on record in the opening seconds of trading in Asia, behind only the plunge during the Gulf War in 1991.

Osama Rizvi, a economic and geopolitical analyst who has a special focus on the Oil markets told ProPakistani,

Oil markets plunged 30 percent this morning as the markets opened after the recent announcement by KSA which amounts to a price war. This drop is unprecedented and happened only in 1991 Gulf War. Now there are multiple ways in which one may interpret this. The most important thing is that one needs to discern the bigger picture here: If KSA is doing this to teach Russians a lesson than they are utterly mistaken about it. If they are doing this for market share than we must not forget what happened in 2014. Ever since 2016 when the Vienna Agreement was signed I have been pointing out to the fact this deal cannot go on for always and they would need an exit strategy – which they don’t have. The main issue remains sluggish demand growth.

Osama further stated that this was bound to happen. Production cuts is not the solution. He sees oil prices testing the 2016 low of $26 bbl. But he emphasized that prices will recover soon.

”There will be some sort of deal, as this can’t go like this forever.” said the analyst.

Benefits for Pakistan

For a country like Pakistan, it is great news. Pakistan imports 80 percent of its oil from foreign sources. This can have a positive impact on our import bill, which can go down further. However, a further drop will not be beneficial as it will affect the global markets, and our exports might suffer due to low global demand, noted Ossama.

According to Arif Habib Limited’s report, Pakistan is a net importer of oil with petroleum group imports contributing 25% to imports. WTI Oil prices averaged USD 56/bbl during the past 12 months and have currently nosedived to USD30/bbl. Pakistan will be able to save USD 5 billion per annum on its imports.

A decline in oil prices reduces Pakistan’s import bill resulting in lower trade and current account deficits and saves foreign currency. Consequently, lower oil prices also translate to lower inflation demanding monetary easing leading to better consumer purchasing power benefitting other sectors with higher demand, said the report.

The report noted that the most visible impact of lower oil prices would be on inflation as it has been the talk of the town and an Achilles heel for the government. Average Arab light oil price for Feb-20 was USD 58/bbl. The ex-refinery price for Motor Gasoline should decline by Rs. 20/liter, which would reduce inflation by 80bps, as it would be fully visible in April-20 CPI.

This can nullify the expected food price increase due to Ramzan. April -20 CPI could decline to 9.2% YoY, stated the report.

PSX Crash and Recover

Pakistan Stock Market’s benchmark index, KSE- 100 crashed to 2,106 points or 5.5% soon after opening, as the international oil prices crashed by more than 33%. The trading in securities has been suspended for 45 minutes.

If the KSE 30 index falls 4.5% or more, trading is halted for 45 minutes, analysts told.

A.A.H Soomro, managing director at Khadim Ali Shah Bukhari Securities Pvt said,

There was panic selling in oil stocks in the market today. The index weight is 20% of the Exploration companies which dragged the index down.

He added that Pakistan benefits massively from an oil price decline. This is a temporary decline despite a massive macro stimulus oil prices crash. He further emphasized that the stock exchange is not the true representative of the economy.

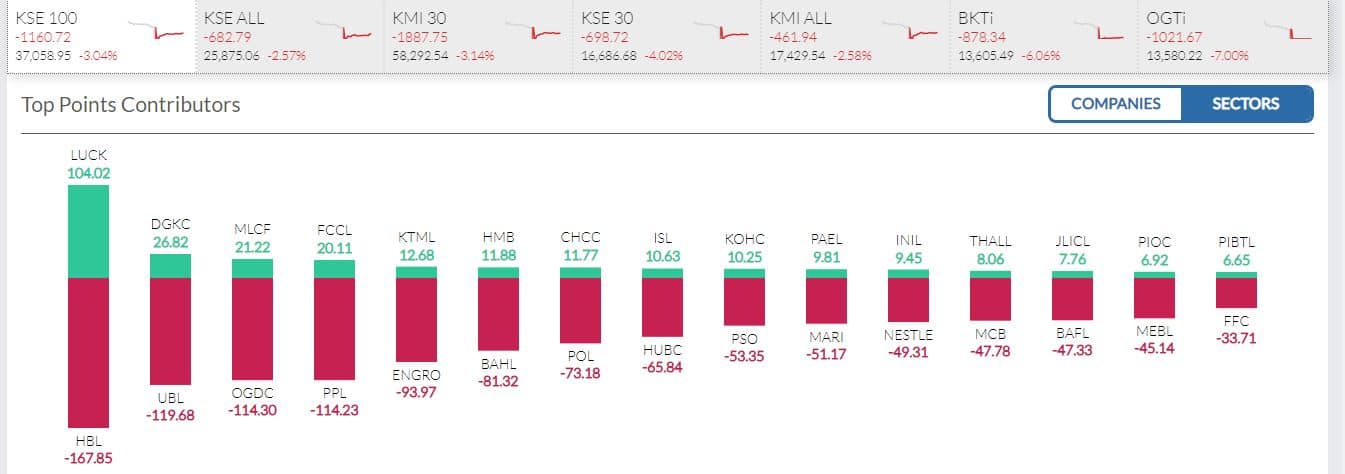

However, after the closing, the KSE-100 recovered 1141 points after touching an intraday low of 2,302 points or 6.02%. The index was closed at 37,058 points, down by 1160 points or 3.13%.

Top Points contributors:

I feel sad for the writer, at one side he is writing that it is a “good news for Pakistan” and right after that he is writing, PSX Crashed. Does he even know what it means?

PSX does not represent the economy. All stock markets have crashed. It’s about the overall implications of oil prices in the economy.

Its not good for Pakistan,

Since Imran Khan decided to increase the Tax for oil.

See how much he reduce recently, Rs.5.

Don’t expect anything from such liar.

i’m waiting for dollar crash to take place.

But there is no price drop in oil in Pakistan what is going on?