Federal Board of Revenue (FBR) has notified concessionary Statutory Regulator Orders (SROs) for a reduction in duty and tax rates for import of pulses and edible oil/seeds.

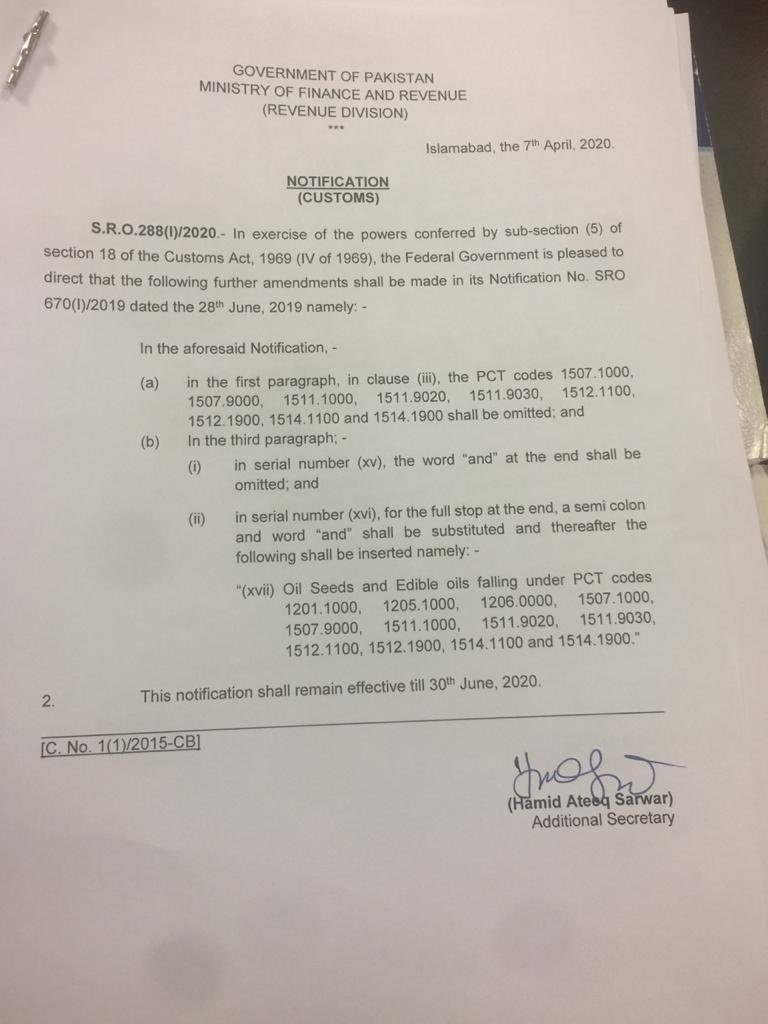

Through SRO 288(I)/2020 the government has also withdrawn additional customs duty on import of pulses. The additional customs duty shall not be levied till June 30, 2020.

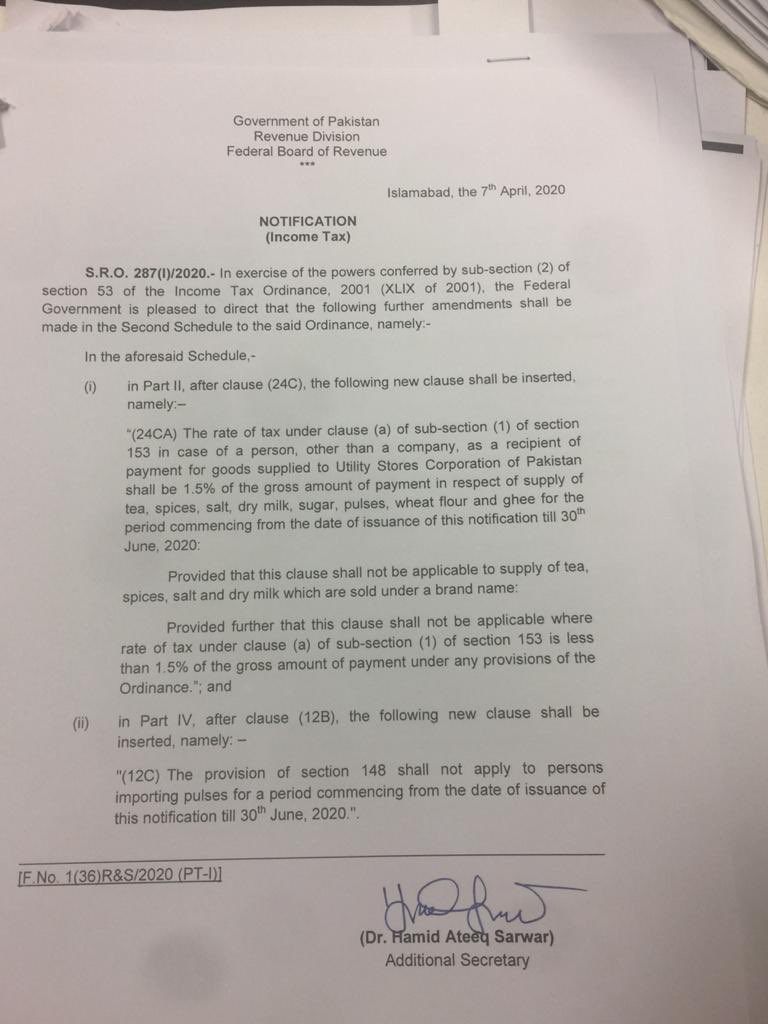

It has notified an exemption from 2.0% additional Customs duty on the import of oilseeds and edible oil in the above-mentioned notice. Through SRO 287(I)/2020 the government has allowed exemption from withholding income tax on import of pulses till June 30, 2020.

According to the SRO 287(I)/2020, the rate of tax under Section 153 shall be at 1.5% in the case of a person, other than a company, as a recipient of payment for goods supplied to Utility Stores Corporation of Pakistan.

The tax rate shall be applied to the gross amount of payment in respect of the supply of tea, spices, salt, dry milk, sugar, pulses, wheat flour and ghee for the period commencing from the date of issuance of the notification till June 30, 2020.