The investment of the Islamic Banking Industry (IBI) has surged to an all-time high of nearly Rs 0.9 trillion by the end of June 2020, due to the issuance of new Sukuk by the government in the recent months, according to State Bank of Pakistan (SBP).

The issuance of GoP Sukuk of Rs 198.2 billion during the period under review is the primary cause of the investment reaching Rs 900 billion. Pakistan Energy Sukuk (PES II) was issued in June, which generated funds for the government at the rate of six-month Karachi Interbank offered Rate (KIBOR) minus 10 basis points (0.1%).

It was the first time that the government managed to raise liquidity at a rate below KIBOR. This will save the government Rs. 1.8 billion on its debt repayment every year, until the instrument’s maturity a decade later. Hence, it is a good option for the government to retire its circular-debt.

The growth in the investment of the Islamic banking industry will further enhance streams of revenues of the banks participating in the Sukuk’s investment, resulting in profitability not only for Islamic banks but also for the Islamic banking divisions of conventional banks. This growth will also come on a sustainable basis, SBP said.

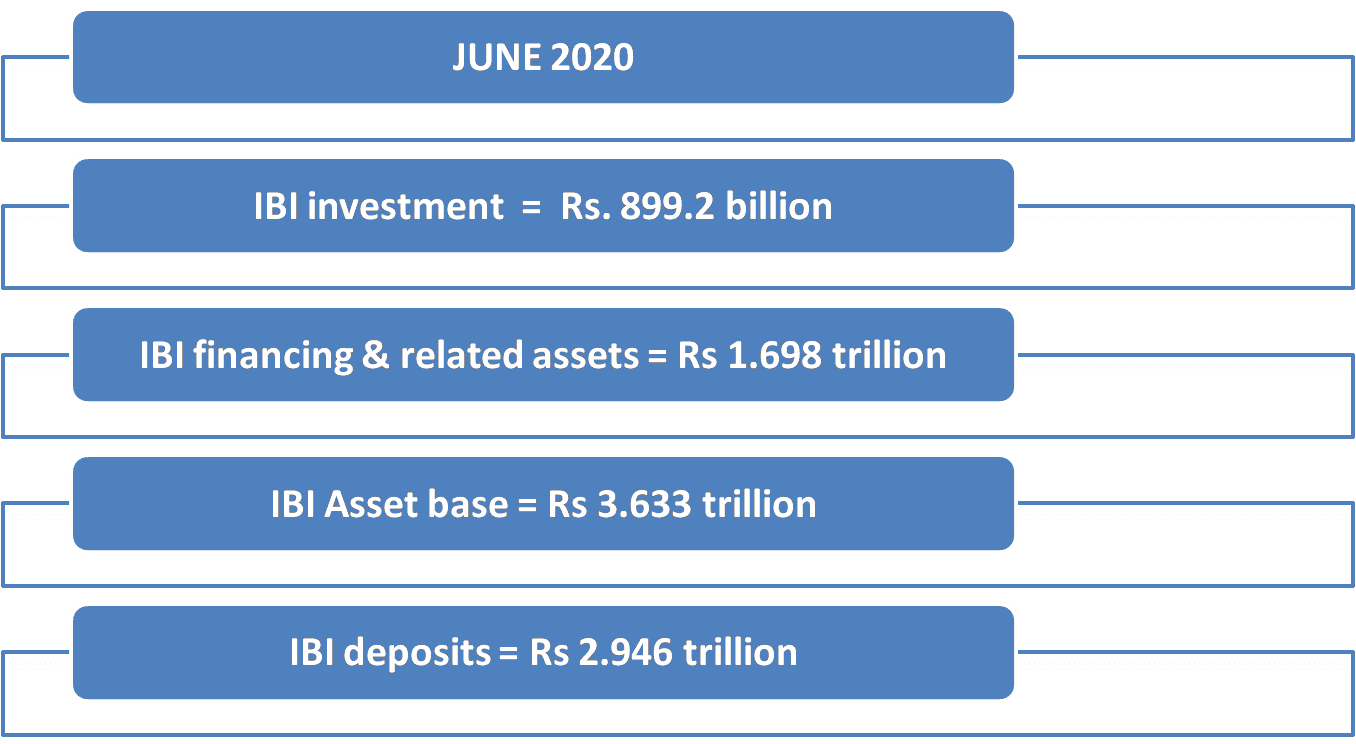

Overall, the investment of IBI surged to Rs. 899.2 billion by the end of June 2020, whereas the financing and related assets of IBIs increased to Rs 1.698 trillion. The asset base of the Islamic banking industry (IBI) grew to Rs 3.633 trillion while deposits of IBI stood at Rs 2.946 trillion by the end of June 2020.

The incumbent government is keen to use the options of Islamic financing for debt retirement and for the development of government projects. It is likely that more Sukuk will be issued by the government, which will further strengthen the balance sheets of Islamic banks and Islamic banking divisions.