The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has demanded the government to repeal the tax law amendments binding firms to pay digitally instead of cross cheques.

The Tax Laws (Third Amendment) Ordinance, 2021 [Amendment Ordinance] was promulgated on September 15, 2021. The Amendment Ordinance aims to broaden the tax base, enforce tax compliance, and enhance documentation of the economy by moving away from the widely practiced mode of payments through cross cheques.

The ordinance further provides powers to National Database and Registration Authority (NADRA) to support the Federal Board of Revenue (FBR) in achieving these ends.

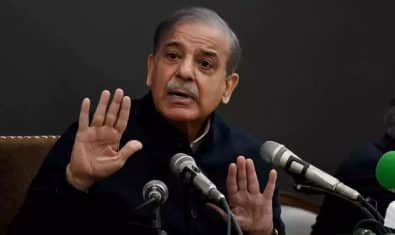

In a statement, FPCCI President, Nasser Hyatt Maggo, expressed shock at news reports “revealing” a serious conflict of interest underpinning the provision of coercing companies into making payments digitally.

Maggo said that it has been learned that this proposal was initiated by a committee of the FBR that includes an owner of a B2B FinTech company that provides software services for digital payments.

“It was that owner of the FinTech Company and a member of that FBR committee as well who proposed this idea and pushed it to be made part of the law, according to some other committee members,” the statement added.

Maggo further said that the ordinance threatens to disrupt business transactions because the majority of sales in the country were made on credit and this credit was secured through post-dated cheques issued by buyers in favor of the sellers.

The FPCCI further pointed out that, nowhere else in the world, bank cheques have been discontinued or businesses coerced to use digital modes of payment instead of bank cheques.

Digital payments are evolving in Pakistan and developed countries are way ahead in employing a digital mode of payments, but they too, have not coerced companies or anyone else to limit or discontinue the use of cheques, he added.

The Senate Standing Committee on Finance on Thursday also reviewed the Tax Laws (Third Amendment) Ordinance, 2021, and recommended several recommendations.

The recommendations include rejecting the suggestion to disconnect gas and electricity connections of those traders who failed to register for sales tax.

It is pertinent to mention here that the ordinance is already in force and the government has now presented it to parliament for getting permanent legal cover.