Small and medium businesses (SMBs) play an important role in the development of the local market and the global economy. Although the contributions of Pakistani SMBs are significantly less compared to other countries, however, they still play an important role nonetheless.

Facebook’s parent company, Meta, recently presented its ‘Global State of Business of Small Business‘ report for this year based on a survey of 23,840 small and medium business leaders from 30 countries and territories, including 5,324 business leaders from the United States. The study aims to provide helpful insights that can help facilitate support for the sector, stating:

Small businesses are a key engine of local markets and the global economy, so it is essential that policymakers and government leaders understand their perspectives, challenges, and opportunities.

Statistical Analysis

The survey was conducted in January 2022 when countries were still seeing a rise in COVID-19 cases due to the OMICRON variant. The reports are based on a minimum of 983 respondents from Pakistan.

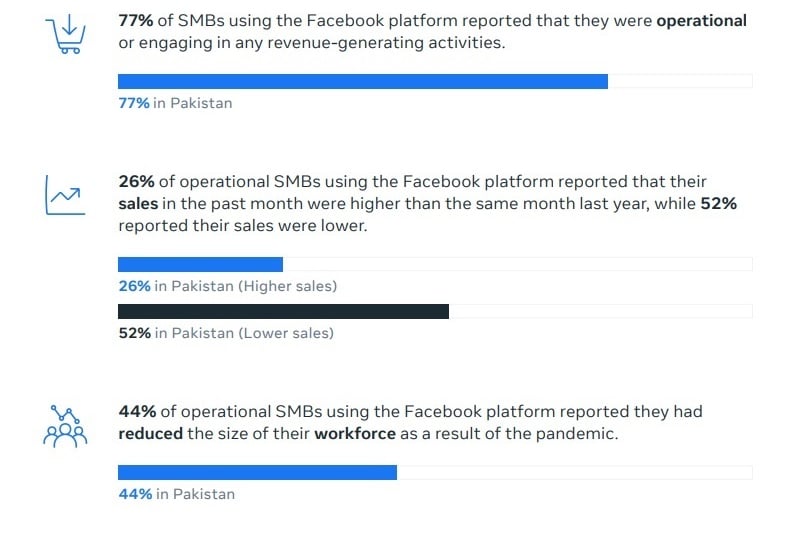

Almost 757 out of 983 (~77%) of SMBs in the country that use Facebook were operational or made use of the platform in one way or the other for business-related activities. While there were 67% in India, 86% in Indonesia, 78% in the Philippines, and 93% in Turkey who use the platform for revenue-generating activities.

26% of these SMBs reported that sales in the past month were significantly higher as compared to the same month last year. While 52% reported that the sales were comparatively lower.

Meta pointed out that the number of SMBs had increased employment rates internationally with a stable growth since July 2021 at 11%. In South Asia, 18% of SMBs increased employment as a consequence of the COVID-19 pandemic, the highest recorded during the survey. The increased employment growth rate was primarily driven by 26% in Pakistan and 9% in India.

In Pakistan, 44% of SMBs reported that they had to reduce the size of their workforce due to the pandemic.

Digital Resource Utilization

49% of SMBs reported having made at least 25% of their sales digitally in the past month, as compared to 46% in India, 47% in Indonesia, and only 24% in Turkey.

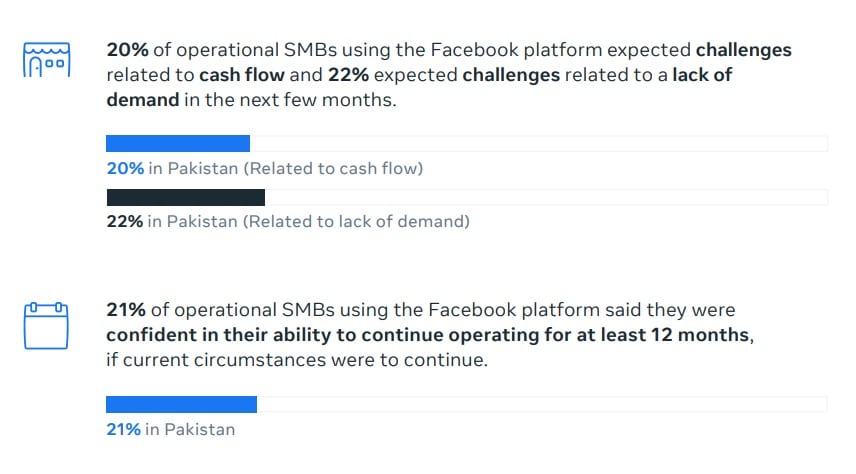

In Pakistan, 20% of operational SMBs stated they expected challenges related to cash flow. While 22% expected challenges related to the lack of demand over a few months.

SMBs operating in South Asia and Sub-Saharan Africa were also reported to have higher rates of pessimism in their ability to remain operational in the short term (~12 months). Pakistan was reported to have the lowest confidence (21%), with India (26%) following closely behind.

Financing

Government sources of financing were reported to be popular in some countries and territories, with the global average standing at 21%. However, Pakistani SMBs received only 10% financial assistance in the form of cash grants or loans from the government since the beginning of the pandemic.

On the other hand, Pakistan was reported to stand the highest in the category of non-government sources of financing at 32%. Meta reported that this percentage was high due to low government support, the absence of non-government cash grants, loans from a charity or non-profit organization.

Closure Rates

Small and medium businesses all around the world suffered throughout the pandemic. Meta’s yearly surveys since 2020 led many to believe recovery was possible. However, new variants of the virus have affected the supply chain. Meta reports that closure rates were reported to be higher in developing countries, while some developed countries also faced a huge increase. Pakistan, however, experienced a large drop (7 percentage points) in closure rates, falling to 23%.

Meta notes that a higher vaccination rate was associated with lower levels of SMB closures. For countries with faster vaccination rollouts, disparities were noted regarding economic recovery.

Closure rates were also dependent on sectors with the largest increases in closure noted in “agriculture, forestry, fishing and mining (22%), transportation and storage (21%), and wholesale and retail trade (22%).”

Closure rates were lowest in “the information and communications technology sector and the manufacturing, energy, water supply, and waste management sector.”

Final Verdict

More than 2 years after the COVID-19 pandemic, the state of small and medium businesses has considerably improved across various regions. Since Meta first began the survey in 2020, rates of closure have declined, the sales performance of operational SMBs have improved, and employment rates have become significantly better. Even though the pace of change has been sinusoidal, it may result in potential stability or new challenges for SMBs.

SMBs still face uncertainty and challenges with worries about cash flow and lack of demand being the primary concerns. However, SMBs continue to remain confident about the future as they continue to adapt to the ever-changing trends of the world.