The Pakistani Rupee (PKR) continued to drop further against the US Dollar (USD) and posted big losses during intraday trade today.

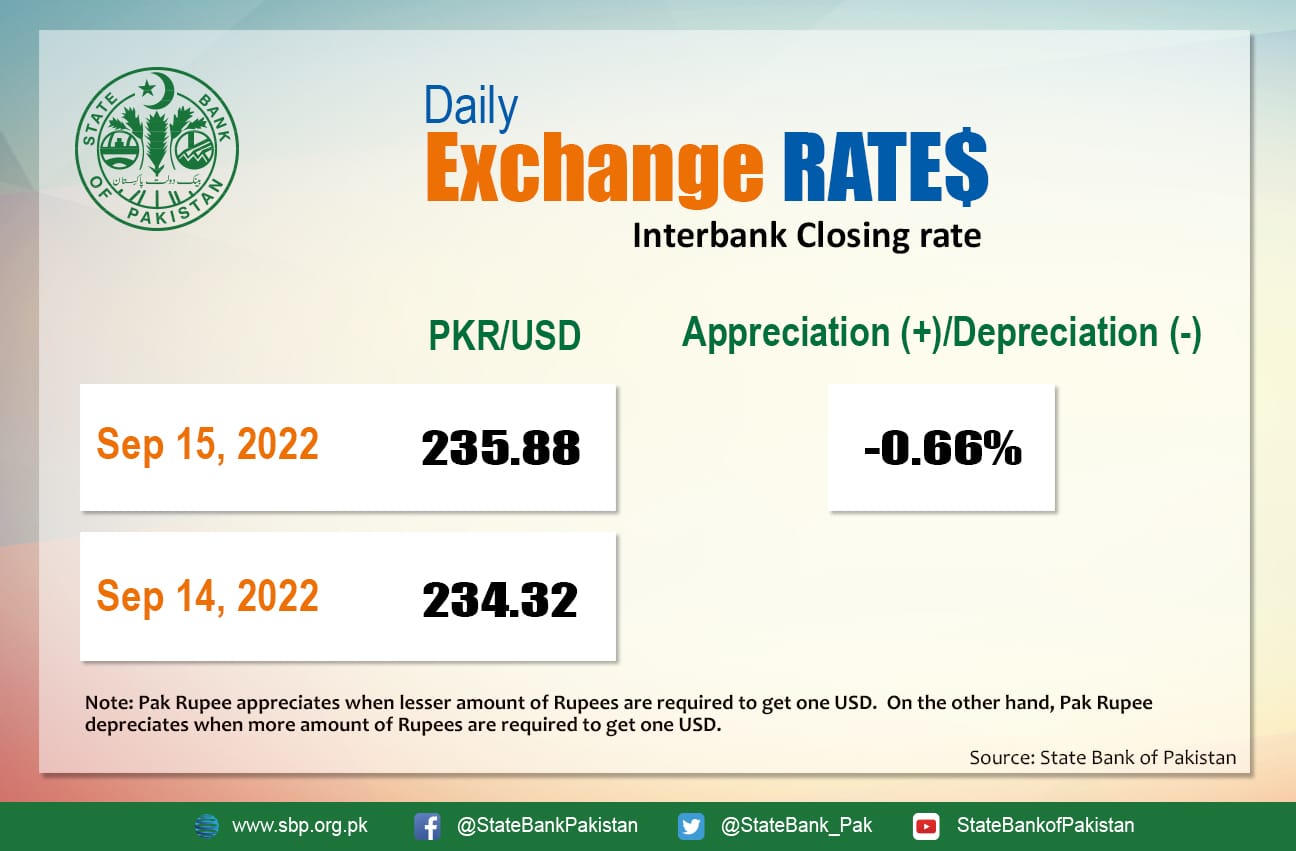

It depreciated by 0.66 percent against the USD and closed at Rs. 235.88 after losing Rs. 1.56 in the interbank market today. The local unit quoted an intra-day low of Rs. 235.98 against the USD during today’s open market session.

The local unit opened in red and was trading at 233.75 at 10:46 AM. By midday, the greenback went as low as 235.875 against the rupee. After 2 PM, the local unit stayed at the 235 level against the top foreign currency before the interbank close.

The rupee closed in red against the dollar for the tenth day in a row today despite news that Pakistan is expected to receive $2 billion from international financial institutions by the end of next month, which translates to $1.5 billion from ADB and an additional $500 million from the Asian Infrastructure Bank. The $500 million loan is subject to Asian Development Bank approval.

Foreign Direct Investments from multilateral and bilateral partners have been thwarted despite the International Monetary Fund’s (IMF) disbursal of $1.1 billion to Pakistan. Money changers of the view that the market wants additional dollar inflows from the billions that were promised by friendly countries after the IMF release, and anything concrete in that regard has yet to be undertaken by any party.

Still, there’s added pressure on the country’s import bill due to the floods, and as a result, dollar demand is rising. Cotton and wheat crops will be reduced this year, raising the import bill and disrupting the balance of payments.

Globally, oil prices fell on Thursday as projections of slower demand and a rampant dollar ahead of a potentially large interest rate increase overshadowed supply concerns.

Brent crude was down by 0.96 percent at $93.20 per barrel, while the US West Texas Intermediate (WTI) went down by 1.02 percent to settle at $87.58 per barrel.

The International Energy Agency predicted this week that oil demand growth would slow in the fourth quarter. The dollar remained near recent highs, supported by expectations that the Federal Reserve of the United States will continue to tighten policy.

Crude has dropped significantly since reaching near-all-time highs in March when Russia’s invasion of Ukraine exacerbated supply concerns, which were largely caused by the prospect of a recession and weaker demand.

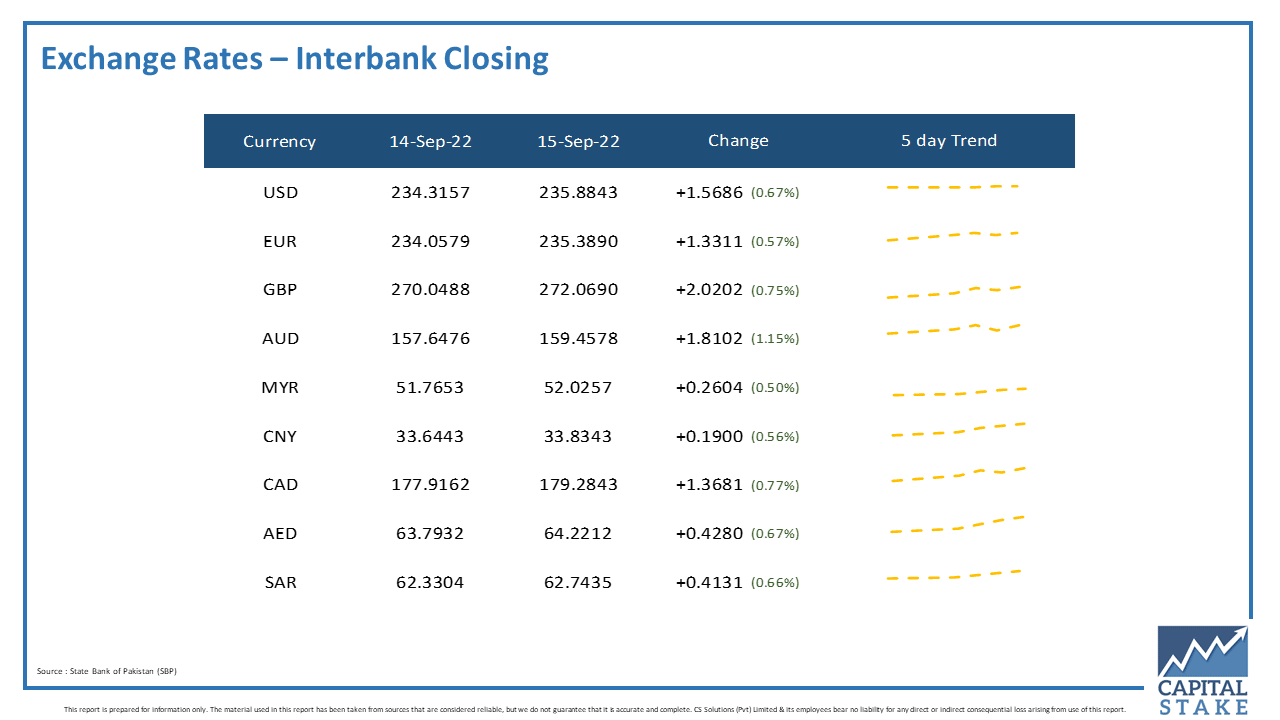

The PKR reversed gains against the other major currencies in the interbank market today. It lost Rs. 1.33 against the Euro (EUR), Rs. 1.36 against the Canadian Dollar (CAD), Rs. 1.81 against the Australian Dollar (AUD), and Rs. 2.02 against the Pound Sterling (GBP).

Moreover, it lost 41 paisas against the Saudi Riyal (SAR), and 42 paisas against the UAE Dirham (AED) in today’s interbank currency market.