The Pakistani Rupee (PKR) slid against the US Dollar (USD) and posted losses during intraday trade today.

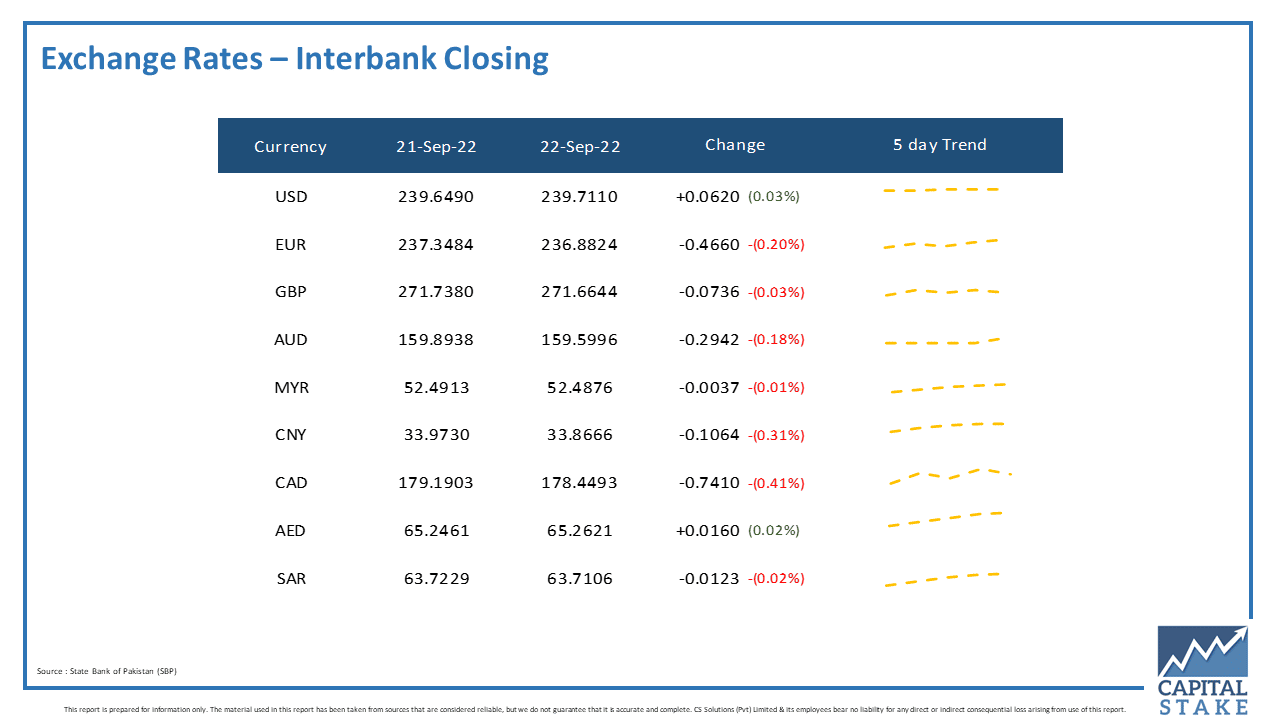

It depreciated by 0.03 percent against the USD and closed at Rs. 239.71 after losing six paisas in the interbank market today. The local unit quoted an intra-day low of Rs. 239.625 against the USD during today’s open market session.

The local unit was largely stable on the opening bell and was trading at 238.15 at 11 AM. By midday, the greenback went as low as 239.600 against the rupee. After 2 PM, the local unit stayed at the 239 level against the top foreign currency before the interbank close.

While largely stable, the rupee reported losses for the 15th consecutive day today and now is just Rs. 0.22 away from its all-time low of Rs. 239.94 against the greenback. The open market continues to experience a shortage of US currency.

Despite the release of a $1.16 billion tranche from the International Monetary Fund (IMF), the rupee has taken a complete 180-degree turn in less than two months, The drop can be attributed to a number of factors, including the ongoing surge in dollar demand from local importers, the country’s dwindling forex reserves, and rising import bills in the aftermath of the worst floods.

Overall, the dollar rose to a new two-decade high globally on Thursday after the Federal Reserve forecasted raising interest rates sooner and more aggressively than investors had anticipated in order to contain inflation and lifted target interest rate to 3.00-3.25 percent range.

The current account deficit in August reduced significantly to $0.703 billion in August as a result of the growth in exports and the substantial reduction in imports.

The month of August reflected the marked improvement in the balance of payment situation of the country. The impact of narrowing down CAD was recorded due to a series of measures taken by the government and the banking regulator particularly to curb the luxury imports which have taken a toll on the macroeconomic indicators including the outflow of foreign exchange reserves and widening of current account deficit.

Globally, oil soared again on Thursday after tumbling by almost 1 percent in the previous session on news of higher Chinese demand and geopolitical instability.

Brent crude was up by 0.53 percent at $90.31 per barrel, while the US West Texas Intermediate (WTI) went up by 0.59 percent to settle at $83.43 per barrel.

Crude oil demand in China, the world’s largest oil importer, is rebounding, having been dampened by strict COVID-19 restrictions.

At least three Chinese state oil refineries and a privately run mega refinery are considering increasing runs by up to 10% in October from September, anticipating higher demand and a possible surge in fourth-quarter fuel exports.

Meanwhile, Russia launched its largest conscription drive since World War II on Thursday, raising concerns that an escalation of the conflict in Ukraine could further crimp supply.

The PKR reversed losses against most of the other major currencies in the interbank market today. It gained one paisa against the Saudi Riyal (SAR), seven paisas against the Pound Sterling (GBP), 29 paisas against the Australian Dollar (AUD), 46 paisas against the Euro (EUR), and 74 paisas against the Canadian Dollar (CAD).

Conversely, it lost one paisa against the UAE Dirham (AED) in today’s interbank currency market.