Despite high tax rates being the highlight of a tumultuous start to the new financial year, the KSE-100 still managed to post a modest increase in profitability with Oil & Gas, Banks, and Technology Sectors leading the bourse.

According to Topline research, KSE-index companies’ after-tax earnings have grown by 4 percent YoY to Rs. 262 billion in 1QFY23, which is significantly lower than the compound annual growth rate (CAGR) in the last 5 years and 10 years of 16 percent and 11 percent, respectively.

Pre-tax earnings were up 19 percent YoY to Rs. 444 billion in 1QFY23 due to higher effective tax rates on (i) ADR-related tax on banks & super tax and (ii) OMCs due to turnover tax.

The increase in profitability has largely been led by Oil & Gas Exploration (E&Ps) (+55 percent YoY), Banks (+22 percent YoY), and Technology (+257 percent YoY) in 1QFY23.

Other sectors like Cement, Refinery, and Chemicals also gave major support during 1QFY23, with profitability growth of 27 percent YoY, 235 percent YoY and 23 percent YoY, respectively.

The power sector reported a loss of Rs. 9.8 billion in 1QFY23 compared to profits of Rs. 9.6 billion in 1QFY22. OMC’s earnings dropped by 94 percent YoY likely due to inventory and exchange loss. Fertilizer earnings dropped by 45 percent YoY due to a decline in Urea & DAP offtake and lower gross margins. Automobile earnings dropped by 100 percent YoY due to a decline in car sales and lower gross margins.

On a QoQ basis, after-tax earnings are up by 21 percent QoQ in 1QFY23. However pre-tax earnings were down by 18 percent QoQ due to an overall slowdown in the economy, higher interest rates, and floods.

Interestingly, in spite of low growth in profits, the dividend payout jumped 30 percent YoY to Rs. 82.4 billion in 1QFY23. This is primarily due to the one-time dividend announcement of Rs. 20 billion by Hub Power Company (HUBC). E&P dividends remain flat despite 55 percent earnings growth due to circular debt issues. However, dividends of Banks jumped 55 percent YoY led by a 22 percent YoY jump in profits and a surprise dividend announcement by Faysal Bank (FABL).

This report represents 98 percent of the KSE-100 market capitalization. Adding remaining companies would not materially impact the profitability growth trend.

KSE-100 index profitability growth was mainly led by improvements in E&Ps, Banks & Technology earnings.

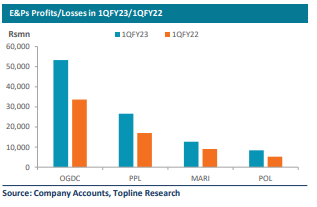

Oil and Gas Exploration (E&Ps)

E&Ps emerged as the best sector during 1QFY23 where profits increased to Rs. 101 billion, up 55 percent YoY. Oil & Gas Development Company (OGDC) contributed a major portion (53 percent) to the sector’s profitability growth followed by Pakistan Petroleum (26 percent), Mari Petroleum (13 percent), and Pakistan Oilfields (8 percent).

The sectoral profitability increased on account of an increase in net sales by 55 percent YoY, amidst an increase in international oil prices and rupee devaluation against the US dollar.

Commercial Banks

Banks emerged as the second-best sector during 1QFY23 where the sector reported an earnings jump of 22 percent YoY to Rs. 81 billion in 1QFY23, where one of the major reasons behind the increase in profitability was a sharp rise in interest rates and strong balance sheet growth.

Major players. which have witnessed significant growth are Standard Chartered Bank (+96 percent YoY to Rs. 6.1 billion), Meezan Bank (+65 percent YoY to Rs. 11.5 billion), Askari Bank (+65 percent YoY to Rs. 4.4 billion), Faysal Bank (+60 percent YoY to Rs. 3.3 billion), and Bank Alfalah (+52 percent YoY to Rs. 5.4 billion).

Technology

The sector displayed improved profitability during 1QFY23 due to higher revenue growth and the exchange gain effect from the devaluation of the Rupee.

Systems Limited (SYS) led the way with higher revenue growth due to business growth and TRG profitability improved partly due to better performance of its subsidiary IBEX on NASDAQ and revaluation on Affiniti.

Cement

During the period, Cement reported net profits of Rs. 11.6 billion during 1QFY23 as compared to Rs. 9.2 billion in 1QFY22. The major reason behind this increase in profitability was a 34 percent YoY increase in net sales led by strong cement prices. The better retention price also resulted in gross margins of 27 percent in 1QFY23 as compared to 25 percent in 1QFY22.

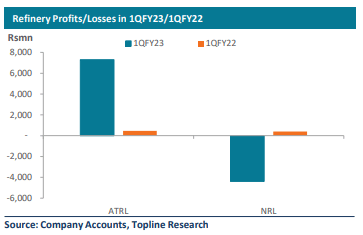

Refinery

The refinery Sector reported an earnings jump of 3.3x YoY to Rs. 2.9 billion in 1QFY23 vs. Rs. 0.9 billion in 1QFY22 primarily due to an uptick in refinery margins.

Product-wise average spreads for MOGAS and HSD were US$9.0/bbl and US$40.1/bbl respectively in 1QFY23 compared to US$9.7/bbl and US$7.7/bbl respectively in 1QFY22. However, the full effect of higher margins was dented due to inventory losses arising from Brent declining to US$88/bbl at the end of 1QFY23 compared to US$112/bbl at the start of the quarter.

Thus, the sector witnessed mixed trend where Attock Refinery (ATRL) recorded a profit of Rs. 7.3 billion in 1QFY23 compared to a profit of Rs. 464 million in 1QFY22 while National Refinery (NRL) recorded a loss of Rs. 4.4 billion in 1QFY23 compared to profit of Rs. 406mn in 1QFY22.

Chemical

Chemical sector profits increased by 23 percent YoY to Rs. 9.0 billion 1QFY23 from Rs. 7.3 billion in 1QFY22. Lotte Chemical (LOTCHEM) posted a 3.3x increase in profits followed by ICI Pakistan (ICI) profit growth of 24 percent YoY, and Engro Polymer (EPCL) growth of 15 percent YoY.

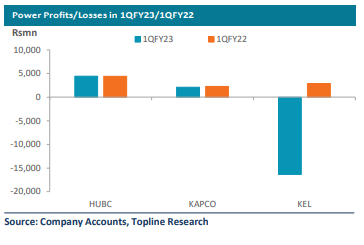

Power

The power sector’s performance remained dismal in 1QFY23 as the sector reported a loss of Rs. 9.8 billion primarily loss recorded by K-Electric (KEL) of Rs. 16.3 billion in 1QFY23. Kot Addu Power (KAPCO) witnessed a negative YoY change of 1 percent in profitability amidst lesser capacity purchase price revenue. However, Hub Power Company (HUBC) showed a slight profitability increase of 1 percent YoY.

OMCs

The sector’s profitability declined to Rs. 844 million in 1QFY23 as compared to Rs. 14.7 billion in 1QFY22. The significant decline in earnings is likely due to inventory and exchange loss. Attock Petroleum (APL) reported profitability of Rs. 4.3 billion in 1QFY23 vs. profit of Rs. 2.4 billion in 1QFY22.

This was followed by Pakistan State Oil (PSO) which reported earnings of Rs. 1.2 billion in 1QFY23 versus a profit of Rs. 12.0 billion in 1QFY22. Shell Pakistan (SHELL) recorded a loss of Rs. 4.6 billion in 1QFY23 vs. profit of Rs. 0.3 billion in 1QFY22.

Fertilizers

The Fertilizer sector also recorded a 45 percent YoY decline in profitability to Rs. 13.3 billion in 1QFY23 as compared to Rs. 24.2 billion in 1QFY22. The decline in profitability is due to the loss recorded by Fauji Fertilizer Bin Qasim (FFBL) which recorded a negative contribution of 13 percent to overall sector profitability.

Fauji Fertilizer (FFC) contributed 40 percent to overall sector profitability. This was followed by Fatima Fertilizer (FATIMA) at 31 percent, Engro Corporation (ENGRO) at 23 percent, and Engro Fertilizer (EFERT) at 19 percent.

Automobile Assembler

This segment also underperformed with profits of Rs. 35 million in 1QFY23 as compared to Rs. 8.9 billion in 1QFY22. The prime reasons behind this decline were

- 33 percent YoY decline in net sales led by lower car sales and

- lower gross margins of 2 percent in 1QFY23 vs 9 percent in 1QFY22 amid rupee devaluation against the US dollar

Payouts Better Than Last Year

KSE-100 index companies announced a cash dividend of Rs. 82 billion in 1QFY23 up 30 percent YoY compared to Rs. 63 billion in 1QFY22. This translates into a 32 percent dividend payout in 1QFY23 versus 25 percent last year.

The banking sector remained the largest contributor with a dividend announced of Rs. 27 billion in 1QFY23 followed by Power (Rs. 20 billion) and Fertilizer (Rs. 14 billion). Other sectors like E&Ps, Food, and Chemicals sector also announced a healthy payout of Rs. 7.5 billion, Rs. 4.0 billion, and Rs. 3.0 billion in 1QFY23.

In terms of dividend payout ratio, the payout from Banks was up by 700 basis points to 34 percent in 1QFY23 likely due to higher profits. The power sector announced a one-time dividend during 1QFY23 amid payment received from the government. Similarly, the dividend payout of the Fertilizer sector increased to 104 percent in 1QFY23 versus 51 percent in 1QFY22.

Banks: Faysal Bank (FABL) remained the largest dividend contributor in the baking sector with a contribution of Rs. 8.3 billion followed by MCB Bank (MCB) of Rs. 5.9 billion and United Bank (UBL) of Rs. 4.9 billion.

Power: In the Power sector, Hub Power Company (HUBC) announced a one-time bumper cash dividend of Rs. 20.1 billion during 1QFY23.

Fertilizer: In the Fertilizer space, Engro Corporation (ENGRO) remained the largest contributor of Rs. 5.8 billion followed by Fauji Fertilizer (FFC) of Rs. 4.0 billion, and Engro Fertilizer (EFERT) of Rs. 4.0 billion.

E&Ps: Within E&Ps sectors, only Oil & Gas Development Company (OGDC) announced a cash dividend of Rs. 7.5 billion during 1QFY23.

Food & Personal Care: Nestle Pakistan (NESTLE) declared a dividend of Rs. 3.85 billion in 1QFY23 which accounts for 97 percent of the total dividend in the sector.

Chemical: In the Chemical sector, Engro Polymer remained the largest contributor of Rs. 2.3 billion followed by Archroma Pakistan (ARPL) of Rs. 682 million.