The Pakistani Rupee (PKR) resumed losses against the US Dollar (USD) and dropped further during intraday trade today.

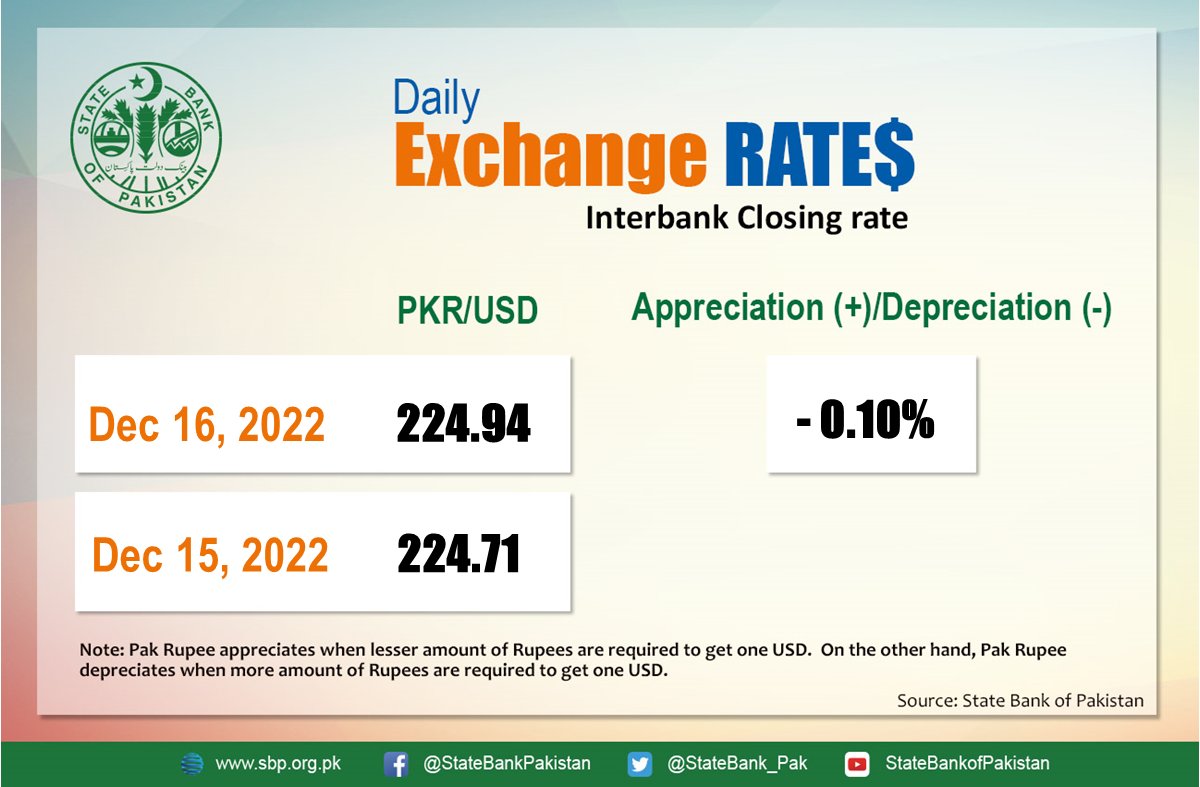

It depreciated by 0.10 percent and closed at Rs. 224.93 after quoting an intraday low of 225.125 against the greenback before close.

The local unit was initially bullish against the greenback and opened trade in the 224 range in the open market. By midday, the greenback moved lower against the rupee. After 1 PM, the local unit dropped and stayed on the 224 level against the top foreign currency the interbank close.

The rupee resumed losses against the US Dollar today with informal rates still hovering around 251-260 against the greenback. Money changers say the markets halted movements today because the greenback tumbled in global markets after the US Federal Reserve upped rates.

On December 8, the foreign currency reserves held by the SBP were recorded at $6.7 billion, down $15 million compared to $6.715 billion on December 02. Overall liquid foreign currency reserves held by the country, including net reserves held by banks other than the SBP, stood at $12.57 billion. The country’s overall liquid foreign exchange reserves are at their lowest level since 2014.

Money changers attribute today’s drop to rising political uncertainty as anything the coalition does for economic stability results in a spiraling effect that worsens the situation even further. While neutral participants are encouraging negotiations, consultations, and deliberations to achieve consensus on issues confronted by the nation and reduce political polarization, traders say that the public, including market players, want much more than just idle chatter.

Globally, oil prices fell on Friday as the market assessed the impact of central bank interest rate hikes, but it was on track for its biggest weekly gain in ten weeks due to supply disruption concerns and hopes for a recovery in Chinese demand.

At 3:50 PM, Brent crude was down by $2.04 or 2.51 percent to reach $79.17 per barrel, while the US West Texas Intermediate (WTI) was also red at $74.13 per barrel. Both benchmarks fell 2% the day before as the dollar shored up and European central banks raised interest rates.

Despite the big drop, both benchmarks are on track for their biggest weekly gains since early October, with market sentiment buoyed by potential supply tightness after major international merchants cut supply in the past few days.

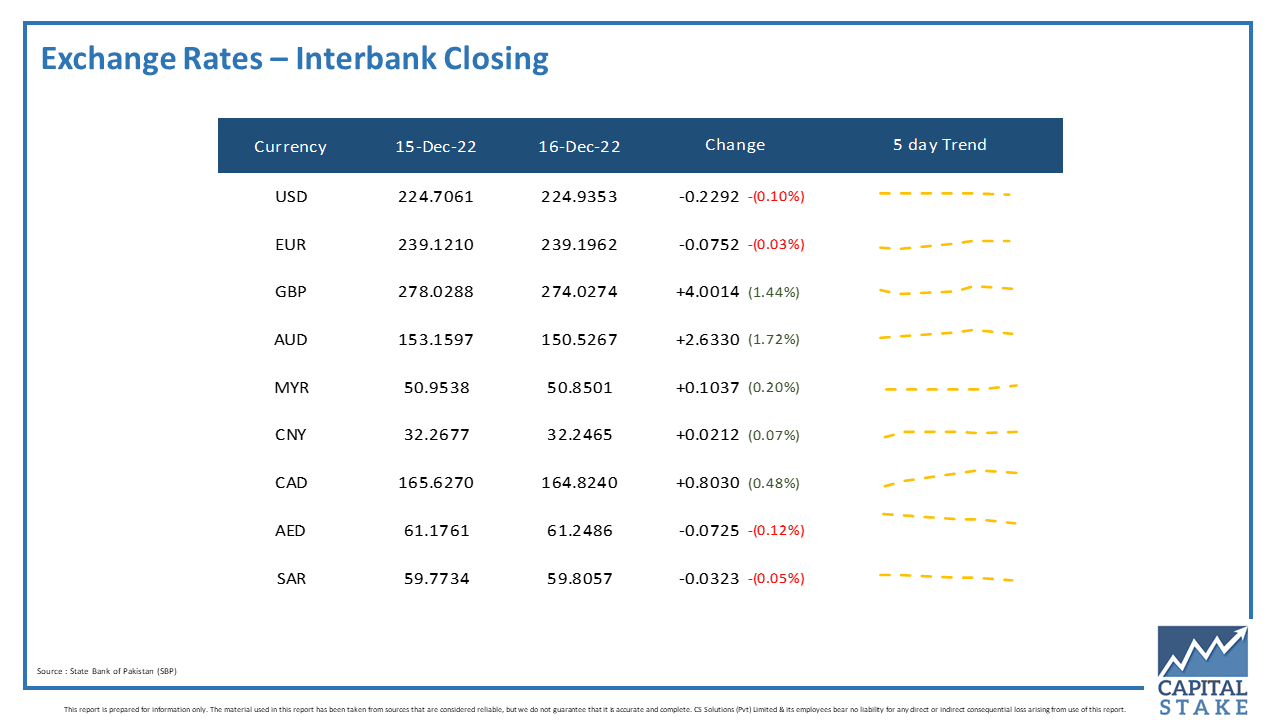

The PKR was bearish against most of the other major currencies in the interbank market today. It lost three paisas against the Saudi Riyal (SAR), seven paisas against both the UAE Dirham (AED) and seven paisas against the Euro (EUR).

Conversely, it gained 80 paisas against the Canadian Dollar (CAD), Rs. 2.63 against the Australian Dollar (AUD), and Rs. 4 against the Pound Sterling (GBP) in today’s interbank currency market.