The Pakistani Rupee (PKR) continued its mini resurgence against the US Dollar (USD) on Friday and reported gains in the interbank market. The local currency gained Rs. 0.23 against the greenback at the close of today’s session.

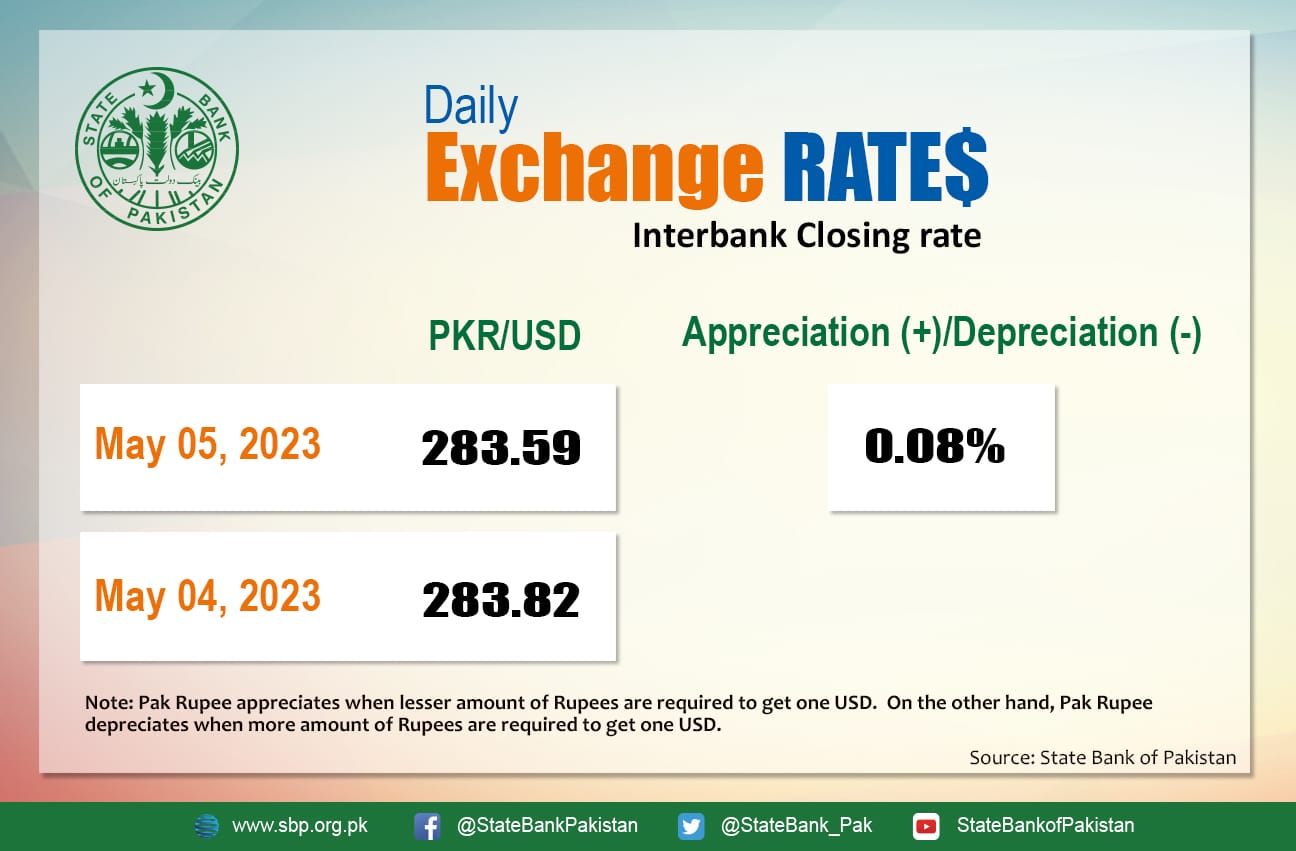

The PKR appreciated by 0.08 percent against the USD and closed at Rs. 283.59 today. The PKR had gained 6 paisas against the greenback at the close of yesterday’s session, closing at Rs. 283.82.

The rupee has been largely stable since the start of March. However, the PKR has lost Rs. 57.16 against the USD in the current calendar year while the losses in the current fiscal year stand at Rs. 78.74.

Despite the staff-level agreement with the International Monetary Fund (IMF) remaining elusive, Bloomberg said Friday that Pakistan’s sovereign bonds will probably rise in the near term as the country is expected to avert a default in the event of a debt rollover.

Quoting Avanti Save, a strategist at credit research firm Barclays, Bloomberg said that recent bilateral funding and rollovers have relieved some of the pressure on foreign reserves.

The reserves held by the State Bank of Pakistan (SBP) currently stand at $4.457 billion, after plunging below $3 billion in early February. The country faces $3.7 billion of debt payments starting this month, according to Fitch Ratings. An amount of $700 million is due in May while another $3 billion will mature in June. Fitch anticipates that $2.4 billion in Chinese deposits and loans will be rolled over.

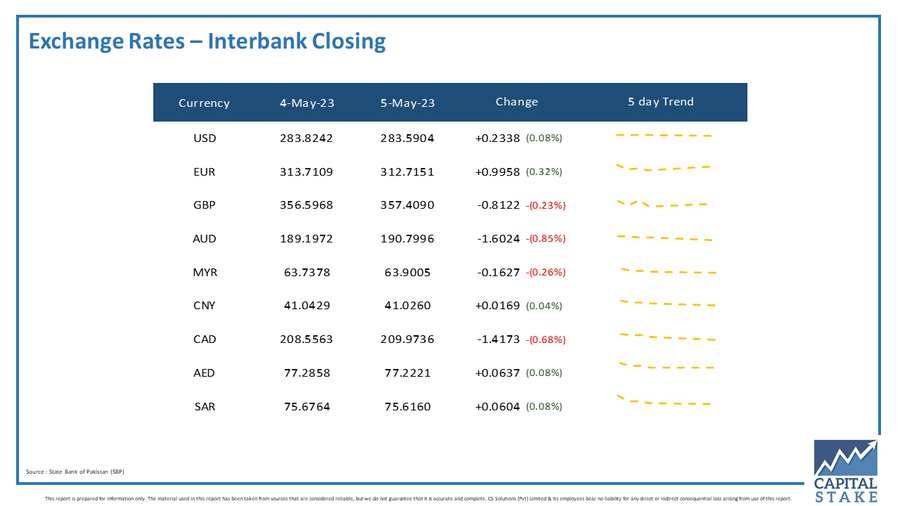

The PKR had a mixed showing against other major currencies in the interbank market today. It gained Rs. 0.99 against the Euro (EUR), and posted minor gains against the UAE Dirham (AED), and the Saudi Riyal (SAR).

However, it lost Rs. 0.81 against the Pound Sterling (GBP), Rs. 1.6 against the Australian Dollar (AUD), and Rs. 1.41 against the Canadian Dollar (CAD).