Moody’s Investor Service (Moody’s) says Pakistan may default if it does not receive a bailout from the International Monetary Fund (IMF) as its financing options beyond June remain uncertain, reported Bloomberg.

The credit rating agency’s analyst in Singapore said, “We consider that Pakistan will meet its external payments for the remainder of this fiscal year ending in June. However, Pakistan’s financing options beyond June are highly uncertain. Without an IMF program, Pakistan could default given its very weak reserves”.

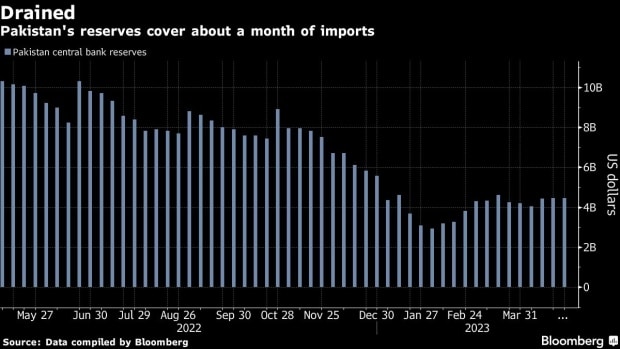

The analyst noted that Pakistan’s foreign-exchange reserves, which stand at $4.5 billion, remain extremely low, covering only about one month’s worth of imports. She said an extension of the IMF engagement beyond June 2023 would allow for additional financing from other multilateral and bilateral partners, potentially reducing default risk.

Pakistan is attempting to restart a $6.5 billion bailout program with the IMF’s blessings, which has been stalled due to Islamabad’s failure to meet certain conditions. Arguably, political tensions ahead of this year’s elections have added to the risk of a loan delay.

On Tuesday, the yield on 2031 dollar bonds was indicated at 34.58 cents on the dollar, the lowest since November. Meanwhile, the Pakistani rupee is trading near all-time low levels.

According to S&P Global Ratings, Pakistan’s gross external financing needs as a percentage of current-account receipts plus usable reserves are expected to rise to 139.5 percent in the fiscal year 2023-24 from 133 percent in the fiscal year ending on June 30, 2023.

Andrew Wood, a sovereign analyst at S&P in Singapore, said the agency sees the IMF program as laying the groundwork for significant fiscal policy reforms. He was of the view that an agreement on the current review cycle could also instill more trust in other bilateral and multilateral lenders to Pakistan.