The liquidity conditions in Pakistan’s inter-bank money market remained relatively strained during July-March FY23 as compared to the same period last year, with the State Bank of Pakistan (SBP) pumping a lot of cash into banks.

The Economic Advisor’s Wing of the Finance Division noted in the Economic Survey 2022-23 that the average outstanding Open Market Operations (OMOs) almost doubled and soared to the highest level of Rs. 6,520.5 billion during the review period as compared to Rs. 2,641.8 billion in the same period last year.

“The government’s increased reliance on scheduled banks for its financing needs in the absence of central bank borrowing affected the liquidity conditions of commercial banks,” the survey stated.

T-Bills

During July-March FY2023, the market offered a total amount of Rs. 28,808.9 billion in primary auction for T-Bills, slightly higher than Rs. 26,426.5 billion offered amount during the same period last year.

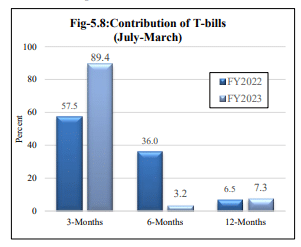

Within the offered amount, the Government has raised Rs. 15,514.6 billion (54 percent of the offered amount) in the T-Bill’s auction as compared to last year’s accepted amount of Rs. 12,959.5 billion (49.0 percent of the offered amount). The acceptance for the tenors under T-Bills mainly generated within 3 months.

During July-March FY2023, around 89.4 percent of outstanding T Bills acceptance for 3 months, followed by 7.3 percent for 12- months and 3.2 percent under 6 months, indicating the market’s expectations of further tightening of monetary policy stance in the near future because the market offered a significant amount at higher rates.

Pakistan Investment Bonds (PIBs)

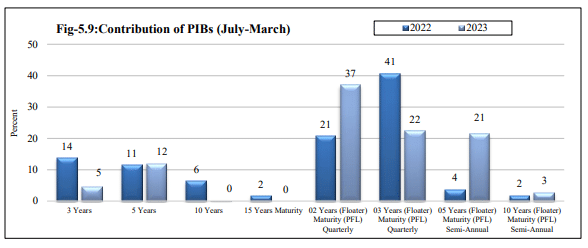

During July-March FY2023, Government remained inclined towards a floating rate long-term debt instrument which is Pakistan Investment Bonds (PIBs). The market offers Rs. 3,587.6 billion under fixed rate PIBS which is around 33.0 percent of the offered amount, while for floaters, the market offered Rs. 7,179.8 billion, 67.0 percent of the offered amount.

Keeping in view the higher yields demanded by the market relative to prevailing cut-offs, the Government accepted only Rs. 968.9 billion from fixed coupon PIBs (16.6 percent of the accepted amount). Against this backdrop, floaters helped the Government to raise medium-to-long-term debt. Given these favorable traits of floaters, the Government was able to raise Rs. 4,861.4 billion via issuances of floating rate PIBs (83.4 percent of the accepted amount).

Moreover, 2Y quarterly coupon PIBs remained the market’s most favored instrument floaters which contribute around 44 percent of floaters accepted amount.

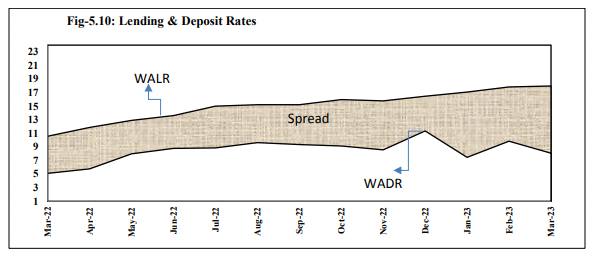

In the presence of persistent high inflationary pressures, an aggressive monetary tightening has been adopted and the policy rate increased by 8.8 percent to 21 percent during the last 12 months. The pass-through effect of the tight monetary policy stance on the Weighted Average Lending Rate (WALR) was increased from 10.6 percent on gross disbursement in March 2022 to 18.0 percent in March 2023.

Similarly, the Weighted Average Deposit Rate (WADR) offered on fresh deposits also increased from 5.1 percent in March 2022 to 8.1 percent in March 2023.

Accordingly, the banking spread (the difference between the lending and deposit rates and the cost of channeling funds through intermediaries) increased from 5.5 percent in March 2022 to 9.9 percent in March 2023.